Source: Payment diary data kept by DNB and the Dutch Payments Association and debit card data by the Dutch Payments Association.

Payments shifted from contact-based to electronic transactions

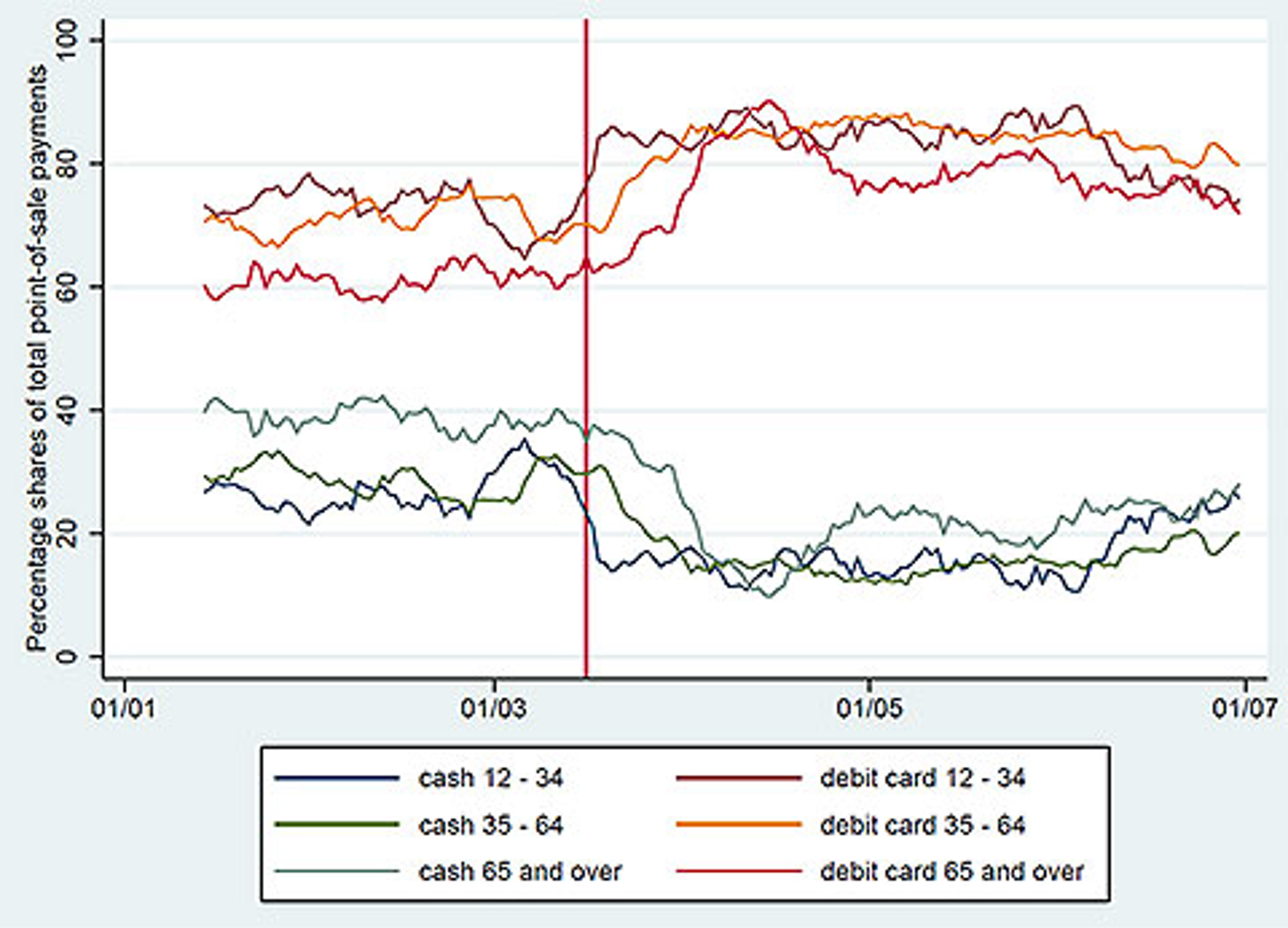

Consumers increasingly switched to contactless transactions using their debit cards or smartphones during the lockdown, at the expense of cash payments (see Figure 2). This was driven in part by measures which Dutch banks had taken to simplify contactless payments in order to prevent infection through manual contact. For example, they increased limits for contactless payments above which consumers were required to enter their PIN. At the start of 2020, the proportion of cash in the total number of cash and debit card payments at points of sale still stood at 30%. Bottoming out at 13% on 12 April, cash transactions rebounded to 23% at the end of June, still below pre-pandemic levels. While the decrease in cash use is seen across all age groups, it is more marked among those between 12 and 34 and those above 65 than among those between 35 and 64.

Figure 2 - Choice of means of payment at points of sale