Dutch banks' interest income under pressure as a result of low interest rates

Besides insurers and pension funds, banks are also sensitive to prolonged low interest rates. Declining bank lending rates and an effective lower limit to saving rates are putting a downward pressure on the interest rate margins of Dutch banks. If the interest margin is squeezed, this may slow down lending and thus obstruct monetary transmission. The ECB will need to evaluate this side-effect of accommodative monetary policy against its effectiveness in terms of achieving price stability.

Resolving non-performing loans of European banks to drive economic growth

European banks burdened with high levels of non-performing loans urgently need to resolve these loans, given that they undermine the banking system's resilience and hamper economic growth. Against this backdrop, faster and less costly legal procedures and further harmonisation of European insolvency laws are desirable. But improved solvency laws will only help resolving non-performing loans if other structural problems are addressed. It is important that the market for trading of non-performing loans is further developed.

Period of uncertainty surrounding Brexit must be as short as possible

Initial survey figures show a moderately adverse impact on the UK economy, but the uncertainties about the exact ramifications of the Brexit are great. The ultimate consequences will largely depend on the trade deals which the UK and the EU will conclude. Any substantial growth deceleration resulting from the Brexit may adversely affect financial stability, given that it may frustrate European economic recovery, the resolution of non-performing loans in the financial sector and the return to a normalisation of monetary policy. For the purpose of stability, the period of uncertainty must be kept as short as possible.

Dutch economy and housing market show upswing; recovery should serve to reform housing market

The Dutch economy is recovering, which, together with low interest rates and little new construction activity, fuels the resurgence of the housing market. House prices are increasing across almost all regions, but there are large differences. The recovery in the housing market should serve to further increase its resilience. Accelerating the curtailment of mortgage interest tax relief, further lowering of the maximum loan-to-value ratio after 2018, and increasing the supply of non-subsidised rented accommodation is needed.

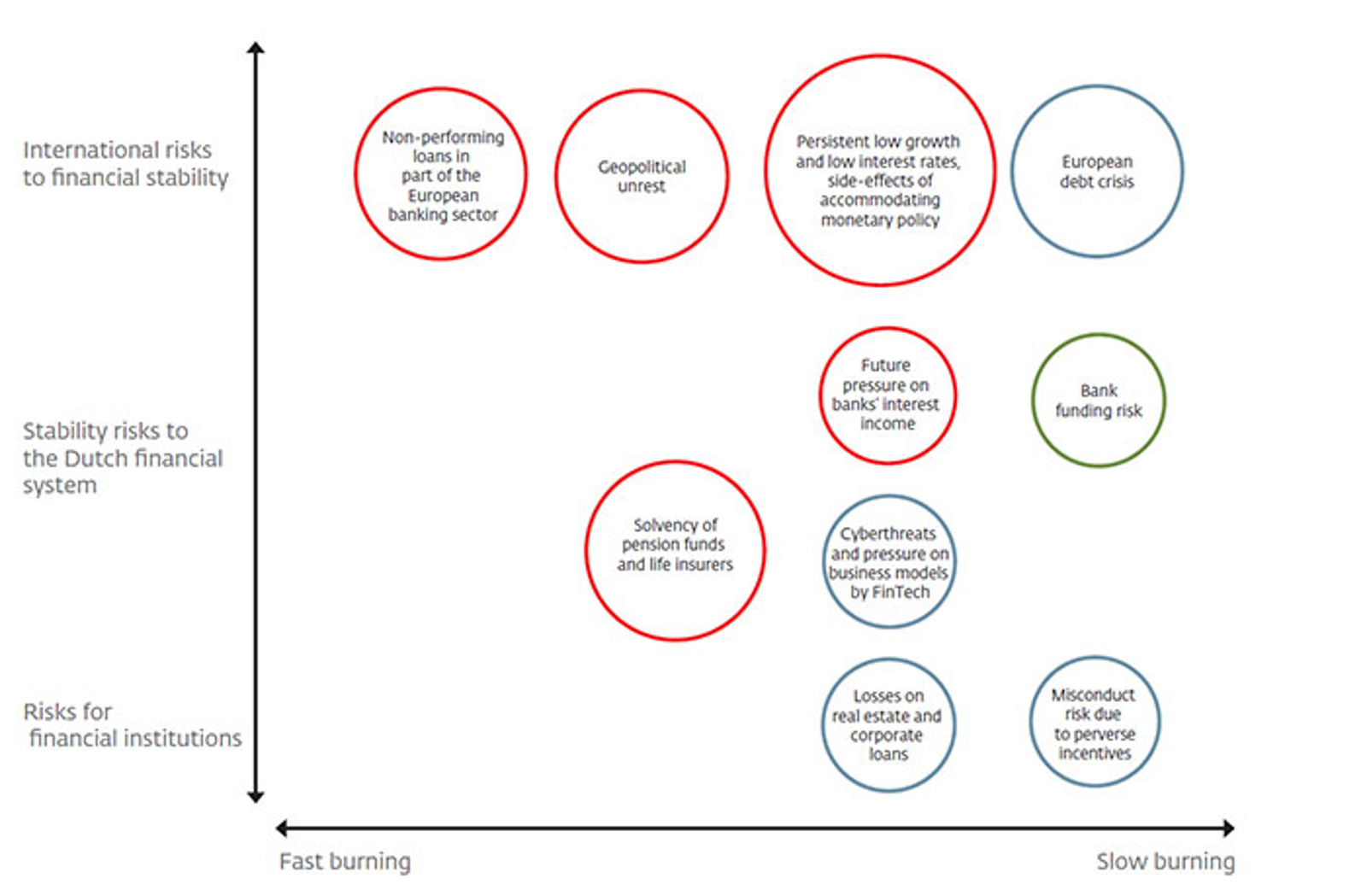

Risk map

The risk map below provides a schematic overview of the key risks to financial stability. The size of the circles reflects the magnitude of the risk. The colour of the circles reflects whether viewed over the medium term, a risk increases (red), decreases (green) or remains unchanged (grey).