Banks are shock-resistant and lending is holding steady

Banks are now better capitalised than before the credit crisis. Their average CET1 ratio is 17%, similar to the starting position in the pandemic stress test which DNB conducted in the spring of this year. They can therefore absorb the impact of the crisis without having to shut off the supply of lending to households and businesses.

Second wave brings renewed uncertainty

At the same time the economic impact of the coronavirus has largely yet to materialise and uncertainty is increasing again due to the second wave of infections. Banks may be hit by rising bankruptcies and credit losses when temporary government measures are wound down and bank payment holidays expire. Banks are already anticipating loan defaults by firms in hard-hit sectors and have raised their provisions for non-performing loans accordingly.

Financial crisis must be avoided

It remains of the utmost importance to prevent the economic crisis from spreading to the financial sector. The extensive support measures introduced by governments, central banks and supervisory authorities are curbing the impact of the coronavirus crisis on firms and households. In doing so, they are also helping the financial sector to dampen the impact rather than reinforce it. These measures remain important in the light of the current uncertainty. At the same time, in view of the longer-term risks, an appropriate exit strategy should be devised as soon as the acute phase of the crisis has passed.

DNB continues to give banks additional leeway

In March, DNB gave banks additional leeway in order to maintain lending levels and absorb any losses. In view of the current uncertainty DNB is keeping these crisis measures. At any rate, the floor for the risk weighting of mortgage loans and the countercyclical capital buffer will not come into force before the end of 2021.

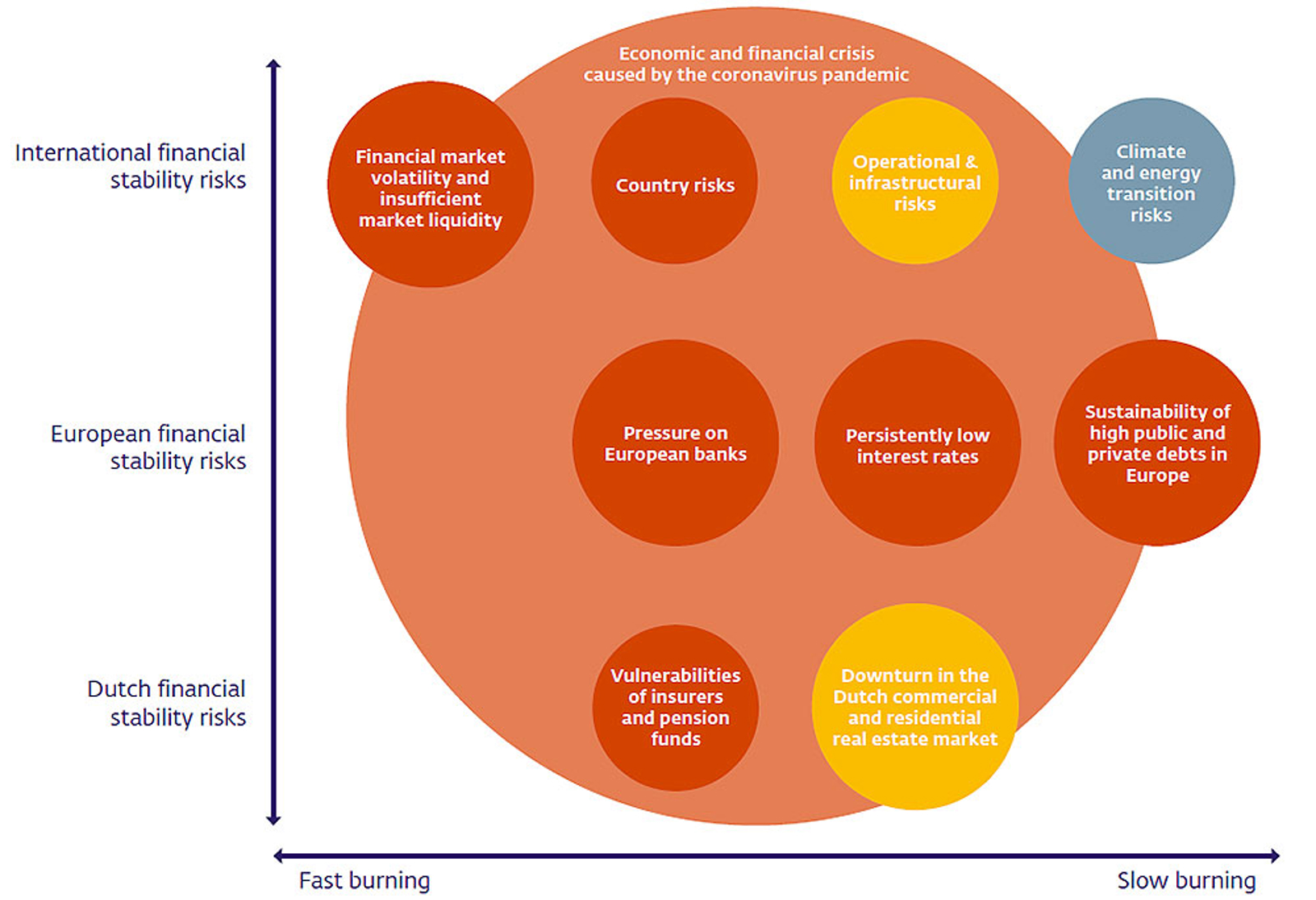

Persistently low interest rates, Brexit and cyberattacks are also significant risks

The FSR includes a risk map showing the principal risks to financial stability in the Netherlands. These are mostly associated with the coronavirus crisis. Private sector debt is rising and many countries are seeing their public finances deteriorate as a result of fiscal support packages. Concerns surrounding debt sustainability are consequently set to increase in the medium term. The coronavirus crisis is also leading to an increase in operational risks that may affect business continuity, including cyber risks. In addition, the first signs of a downturn in the commercial real estate market can now be seen. Brexit and other geopolitical tensions are also a major source of uncertainty. Finally, interest rates remain historically low, putting increasing pressure on the business models of banks, insurers and pension funds.