Turnaround in the economy

According to the DNB business cycle indicator, the low point of the economic cycle has been reached, after which economic growth will pick up gradually and at a moderate pace this year.

Read more Turnaround in the economyYou are using an outdated browser. DNB.nl works best with:

Published: 20 December 2021

© ANP

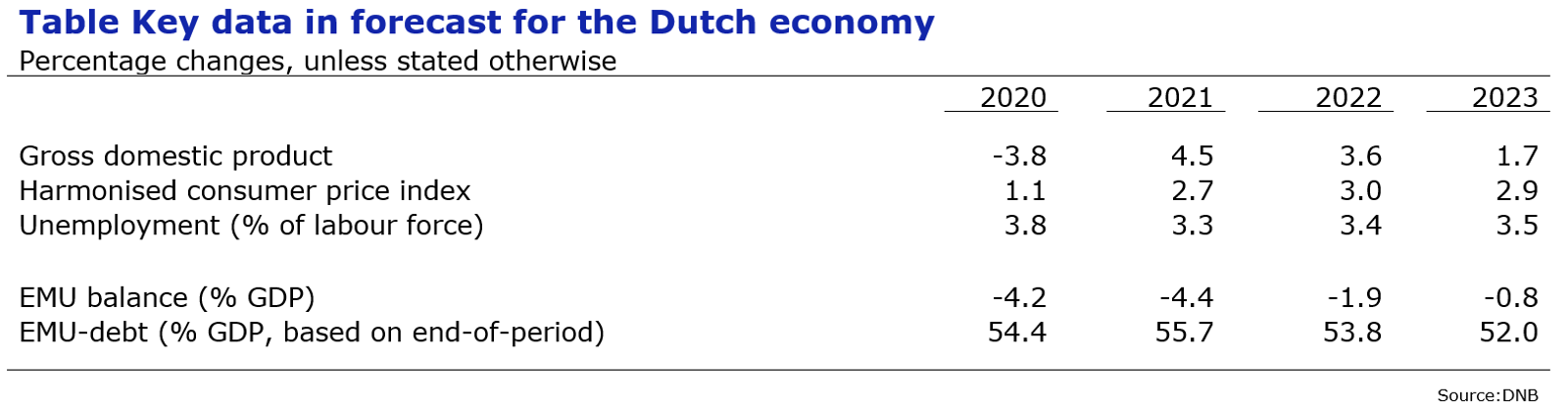

The Dutch economy has shown a rapid and strong recovery from the coronavirus recession of 2020. GDP is expected to grow by 4.5% this year. We have prepared the forecasts for the years ahead at a time of great uncertainty. In addition, we have not been able to take into account the recently announced lockdown, nor the new coalition agreement. Without having regard to these two developments and assuming that the growing spread of the COVID-19 virus this autumn is gradually brought back under control, economic recovery will continue in 2022, with GDP growth projected at 3.6%. The economy would then enter calmer waters in 2023, with growth of 1.7%. This is evident from the new half-yearly forecasts in the Economic Developments and Outlook, which De Nederlandsche Bank (DNB) published today. Given the uncertainty, we have also prepared two alternative scenarios. The first scenario analyses the impact on the economy of a protracted and more serious pandemic, including more stringent containment measures. The second scenario analyses the economic impact of higher inflation internationally. The recently announced lockdown will depress economic growth in the short term, but the new cabinet's proposed policies may actually drive growth in the medium term.

The lifting of the containment measures led to a strong rebound in household spending last spring. The global upturn in economic activity was so fast and convincing, however, that production chains have been unable to keep pace with the recovery in demand. From early 2021 goods production was increasingly constrained by shortages of materials and long delivery times. The Dutch economy consequently reached its capacity limits soon after the 2020 coronavirus recession. The extent to which the pandemic can be brought under control remains an uncertain and determining factor for the economic outlook. The same applies to the new coalition agreement, which has not been included in this projection.

To a far greater extent than usual, the macroeconomic figures in this projection conceal the underlying differences among businesses and institutions. Some businesses and workers are still being severely hit by the ongoing pandemic and the renewed measures, for example in the hospitality and cultural sectors, leaving them facing greater uncertainty and poorer prospects.

The labour market became very tight again soon after the coronavirus recession. Unemployment rose rapidly to 4.6% of the labour force in 2020 but has averaged 3.3% in 2021. The unemployment rate will rise slightly from next year but is set to remain low (3.4% in 2022 and 3.5% in 2023). Some businesses are still having to deal with substantial revenue losses, however, due to the containment measures, while in other sectors the economic recovery is leading to growing staff shortages and pressure for higher wage settlements. Negotiated wage growth in the private sector is expected to average 2.0% in 2021. The projection assumes that wage growth will rise slowly to 2.4% in 2022 and 2.6% in 2023.

Inflation has risen sharply during the year and will average 2.7% in 2021. This is due in particular to the unexpectedly rapid rise in energy prices. Inflation is set to remain high in the years ahead, averaging 3.0% in 2022 and 2.9% in 2023. Temporary government measures (cuts in energy taxes and tuition fees) will push projected inflation downwards in 2022 and upwards in 2023. Inflation is also being driven by the continued tight labour market, leading to higher wages and hence to rising unit labour costs. The transmission between wages and prices is not currently strong enough to trigger an undesirable wage-price spiral.

The economic outlook is more uncertain than usual. In an alternative scenario around the projection the pandemic develops in such a way that substantial containment measures are tightened and remain necessary until the end of 2022, after which they are gradually phased out. This could cut GDP growth next year by over two percentage points to 1.4%. In a second scenario, global commodity prices remain high over the long term, with persistent supply disruptions and a stronger wage-price spiral. Dutch inflation in that scenario rises to around 4% in 2022 and 2023, with GDP growth in those years on average one percentage point per year lower than in the baseline projection.

For more information, please contact Bouke Bergsma on +31 20 524 3797 or +31 6 53 25 84 00.

According to the DNB business cycle indicator, the low point of the economic cycle has been reached, after which economic growth will pick up gradually and at a moderate pace this year.

Read more Turnaround in the economy

In the fourth quarter of 2023, foreign multinationals transferred over €300 billion in conduit activities from the Netherlands abroad. These relocations indicate adjustments in business structures, and may be due to the introduction this year of a minimum tax for these international companies.

Read more Conduit activities in the Netherlands declined in fourth quarter of 2023

The Dutch economy is strong and resilient, but not everyone in the Netherlands experiences it that way. Many people are struggling financially or have concerns about their future. The Netherlands should therefore strive for a highly developed and finely tuned economy that works better for everyone.

Read more Towards an economy that works better for everyone

“We see that while the Dutch economy is doing quite well, it is not working well enough for some groups in society.” Klaas Knot said this at the presentation of DNB’s 2023 Annual Report.

Read more Introductory remarks upon the presentation of the 2023 annual reportWe use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.