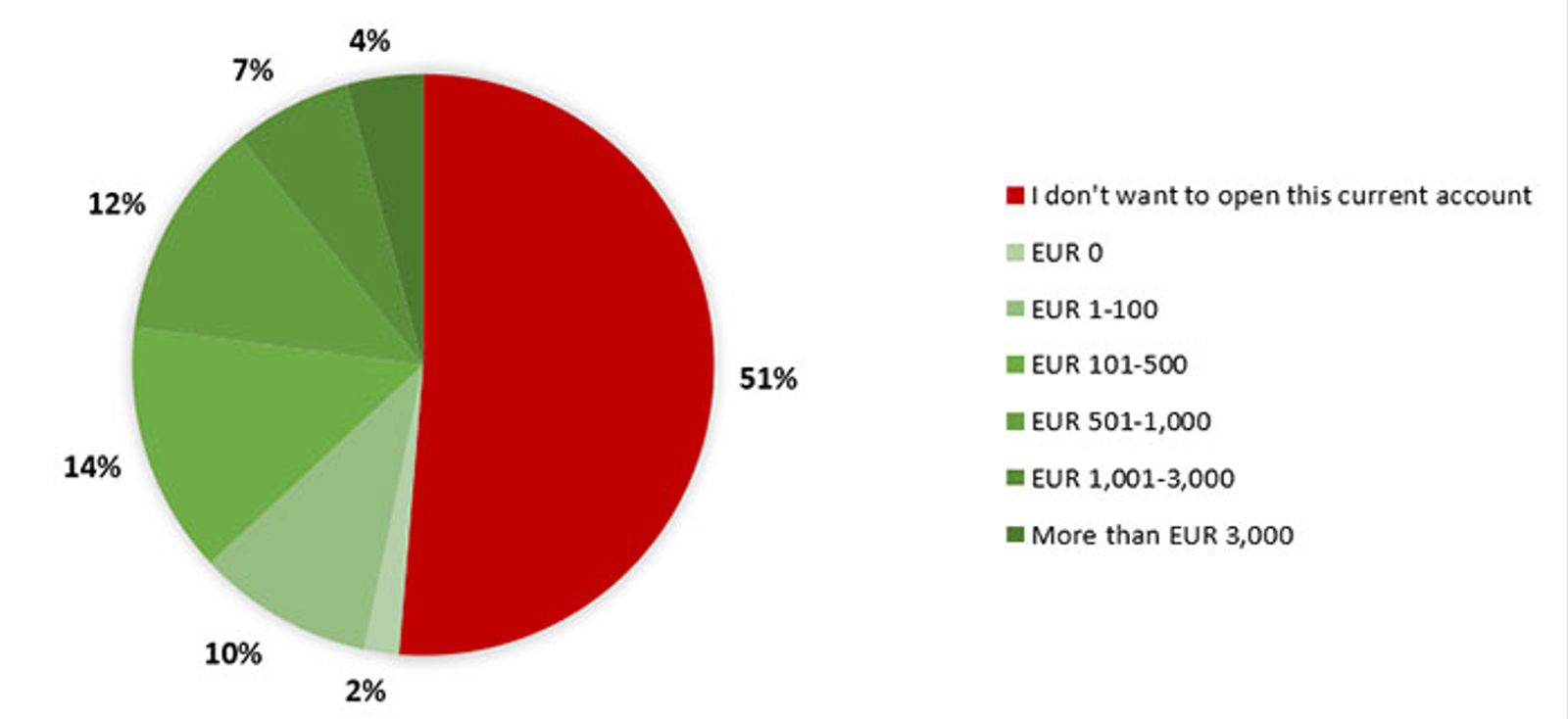

Source: CentERpanel 2021. Note: 2,523 respondents.

Familiarity with the concept of a digital euro increases people's willingness to use it as a means of payment. Almost half of Dutch citizens are familiar with the concept of digital central bank money, of which digital euros are a form, although most people indicated they did not know exactly what it entails. 53% indicated they had never heard of digital central bank money, 33% had heard about it but do not know what it means and 13% know exactly what it means. Dutch citizens are more familiar with other, existing forms of money such as cash (98%), electronic money (84%), and public and private money (53%).

Privacy and security are important

Dutch consumers are willing to hold a digital euro account provided their privacy is well-protected and the risk of theft and fraud of their assets is minimised. These findings are in line with those of the ECB's public consultation on the digital euro among citizens and professional parties, which was published on 14 April 2021. The most frequently cited reason why the Dutch public believe a digital euro would be useful is that central banks, unlike commercial banks, do not operate on a for-profit basis. This is why the digital euro could be a reliable complement to cash and existing electronic payment instruments, offering consumers more choice. While our research focused on Dutch citizens’ willingness to use the digital euro as a means of payment, we also looked at their willingness to savings options. We found that if the interest rate on a digital euro savings account would be equal to that offered on a regular savings account, about half of Dutch citizens would be willing to deposit money into such an account. Incidentally, the Eurosystem has no plans to offer digital euro savings accounts.

Next steps

We will continue to study the possibility for the digital euro in the period ahead, in line with the stages of the joint digital euro project of the ECB and the other national central banks in the Eurosystem. In the context of this project they will decide on further research into the requirements and design of a digital euro by mid-2021.