Turnaround in the economy

According to the DNB business cycle indicator, the low point of the economic cycle has been reached, after which economic growth will pick up gradually and at a moderate pace this year.

Read more Turnaround in the economyYou are using an outdated browser. DNB.nl works best with:

Published: 28 October 2021

Banks have not generally lowered their credit assessments of Dutch businesses compared to before the coronavirus crisis. In most of the hardest-hit sectors, non-performing loans have however increased markedly following the outbreak of the pandemic. Nonetheless, these sectors represent only a limited share of banks' total outstanding loans, so the average NPL ratio has not increased. As the number of bankruptcies may still rise due to the end of government support measures, it is important that banks and governments continue to closely monitor developments.

Since the outbreak of the pandemic, the historically low level of bankruptcies – which are at their lowest in over thirty years – defies initial expectations. In the Netherlands, the extensive support measures have played a key role . The government ended its generic support measures for businesses on 1 October 2021. The question is whether this will still lead to an increase in the number of bankruptcies.

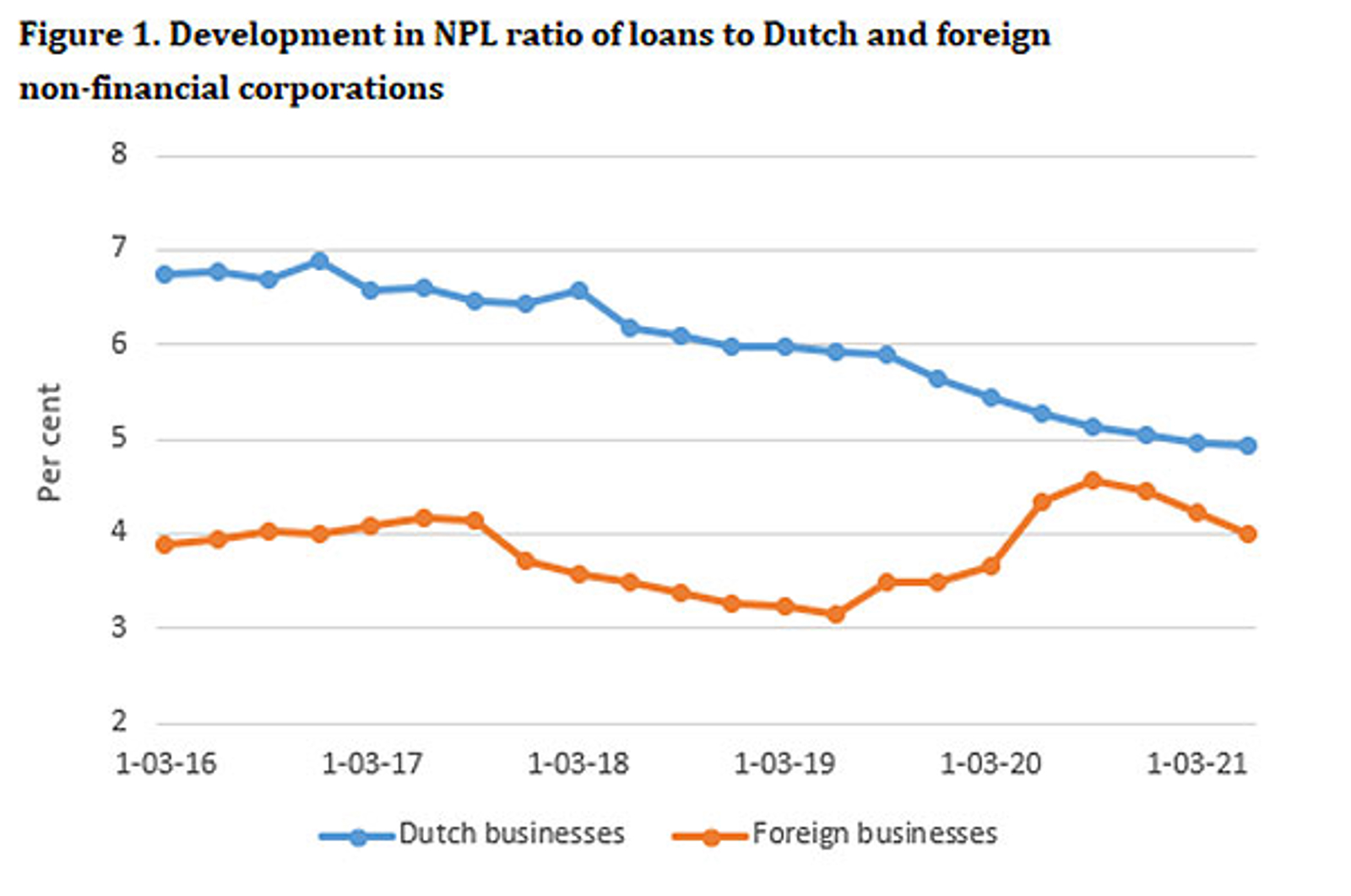

To answer this question we need to look at Dutch banks’ assessment of the creditworthiness of businesses. Figure 1 shows the proportion of non-performing loans in relation to the total loans of Dutch banks outstanding to Dutch and foreign non-financial corporations (NPL ratio). In the case of Dutch companies, there has been a downward trend since 2016. Despite the COVID-19 outbreak, this downward trend in the NPL ratio has continued, and has since dipped to below 5%, while in 2019Q4 it still stood at 5.6%. The coronavirus crisis has led to an increase in the NPL ratio for loans to foreign businesses, however: in the first two quarters of 2020, it increased by approximately 1 percentage point. Since then, there has been a downwards trend again. Also other banking data, such as the average probability of default and the volume of loans in arrears by less than 90 days, suggest to date a very limited deterioration in credit quality compared to pre-pandemic levels. However, since the outbreak of the pandemic banks have classified a higher proportion of their total loans as loans with an elevated credit risk, and must therefore maintain higher NPL provisions in order to absorb potential losses.

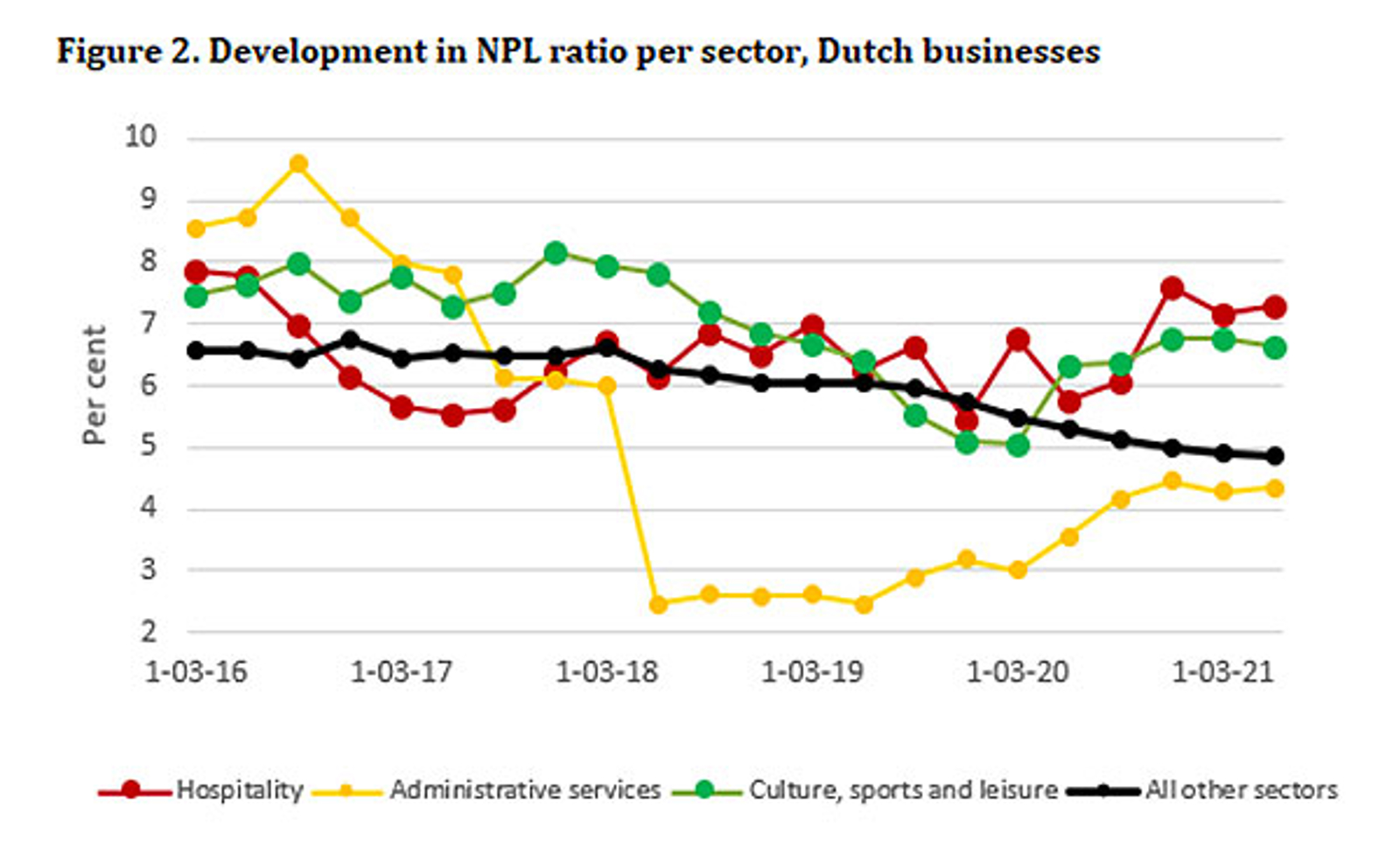

At sectoral level, the picture is somewhat more nuanced, as the crisis hit certain sectors particularly hard. Figure 2 shows the NPL ratio development for three of the hardest-hit sectors (Economic Developments and Outlook, 2021) together with the other sectors. In the “hospitality”; “administrative” (incl. leasing, employment agencies and travel agencies) and “culture, sport and recreation" sectors, there has been a clear rise in the NPL ratio compared to 2019Q4. In these sectors, the NPL ratio has increased by an average of 2 percentage points, a rise of roughly 30% to 40%. This increase has since stabilised. Nonetheless, this level of non-performing loans is not exceptionally high: for all three sectors the NPL ratios were higher in 2016.

The limited increase in the NPL ratio in Dutch banks’ loan portfolios does not preclude a future increase in NPLs or bankruptcies. Firstly, there is a delay in recording non-performing loans. It is also important to wait and see what happens now the government has definitively ended its support measures. This could also be the time when non-bank lenders demand resumption of regular debt repayment (with possibly higher repayments as a result of postponement). This might result in an increase in the number of bankruptcies. There is as yet no reason to assume that a large wave of bankruptcies will occur, although it is likely that the number of bankruptcies will return to its long-term average in some time.

It is therefore important for banks to pursue a prudent provisioning policy, to continue to monitor credit quality, promptly identify customers with debt repayment problems, and to effectively deal with any such problems. Due to the deferral of tax payments granted by the government, the government itself has also become a major creditor of the private sector (€19.7 billion in tax deferrals were outstanding at the end of September). The government's recent decision to set out its position (in Dutch) regarding the amicable settlement of debt is therefore a positive development in this regard.

According to the DNB business cycle indicator, the low point of the economic cycle has been reached, after which economic growth will pick up gradually and at a moderate pace this year.

Read more Turnaround in the economy

In the fourth quarter of 2023, foreign multinationals transferred over €300 billion in conduit activities from the Netherlands abroad. These relocations indicate adjustments in business structures, and may be due to the introduction this year of a minimum tax for these international companies.

Read more Conduit activities in the Netherlands declined in fourth quarter of 2023

The Dutch economy is strong and resilient, but not everyone in the Netherlands experiences it that way. Many people are struggling financially or have concerns about their future. The Netherlands should therefore strive for a highly developed and finely tuned economy that works better for everyone.

Read more Towards an economy that works better for everyone

“We see that while the Dutch economy is doing quite well, it is not working well enough for some groups in society.” Klaas Knot said this at the presentation of DNB’s 2023 Annual Report.

Read more Introductory remarks upon the presentation of the 2023 annual reportWe use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.