Turnaround in the economy

According to the DNB business cycle indicator, the low point of the economic cycle has been reached, after which economic growth will pick up gradually and at a moderate pace this year.

Read more Turnaround in the economyYou are using an outdated browser. DNB.nl works best with:

Published: 18 February 2021

In a typical month, no more than 13% of prices for goods in the Netherlands are adjusted, according to research by De Nederlandsche Bank (DNB). This means that prices in the Netherlands do not change very frequently, with price stickiness being a significant rationale for central banks’ low-inflation policy. Price stickiness is an important reason why an adjustment of interest rates by a central bank is slow to be reflected in the general price level. This stickiness is also a reason why central banks strive for low inflation, because, particularly when inflation is high, the slowness of price adjustments produces undesirable economic effects.

The prices of most goods tend to be sticky. This means that producers do not adjust their prices every time their costs change, or when there is an increase or decrease in household demand for their products. Companies need time to set new prices and must incur costs to implement these price changes.

These sticky prices are relevant for central banks such as the European Central Bank, which sets interest rates in the euro area. After all, if prices are not frequently adjusted, monetary policy decisions take longer to pass through to the general price level than they would if prices were adjusted more frequently. Knowledge of how adjustments in policy interest rates affect the price level is therefore very important to central banks for implementing monetary policy aimed at achieving price stability.

Stickiness in prices also implies that it is important for central banks to attempt to keep inflation low. If prices remain rigid and are not adjusted all at the same time, a situation arises in which the price for the same product can vary greatly.

This is inefficient. For example, producers who charge relatively low prices for their goods will sell more, but will produce goods in an inefficient manner, for instance because their workers may for instance have to work overtime. Producers that sell goods at relatively high prices will sell less, but also produce less than they could. This inefficiency is exacerbated by higher inflation. Price rigidity therefore means that central banks should aim to keep inflation at a low level. Of course, price stickiness is only one of the factors influencing the inflation rate that central banks typically aim for.

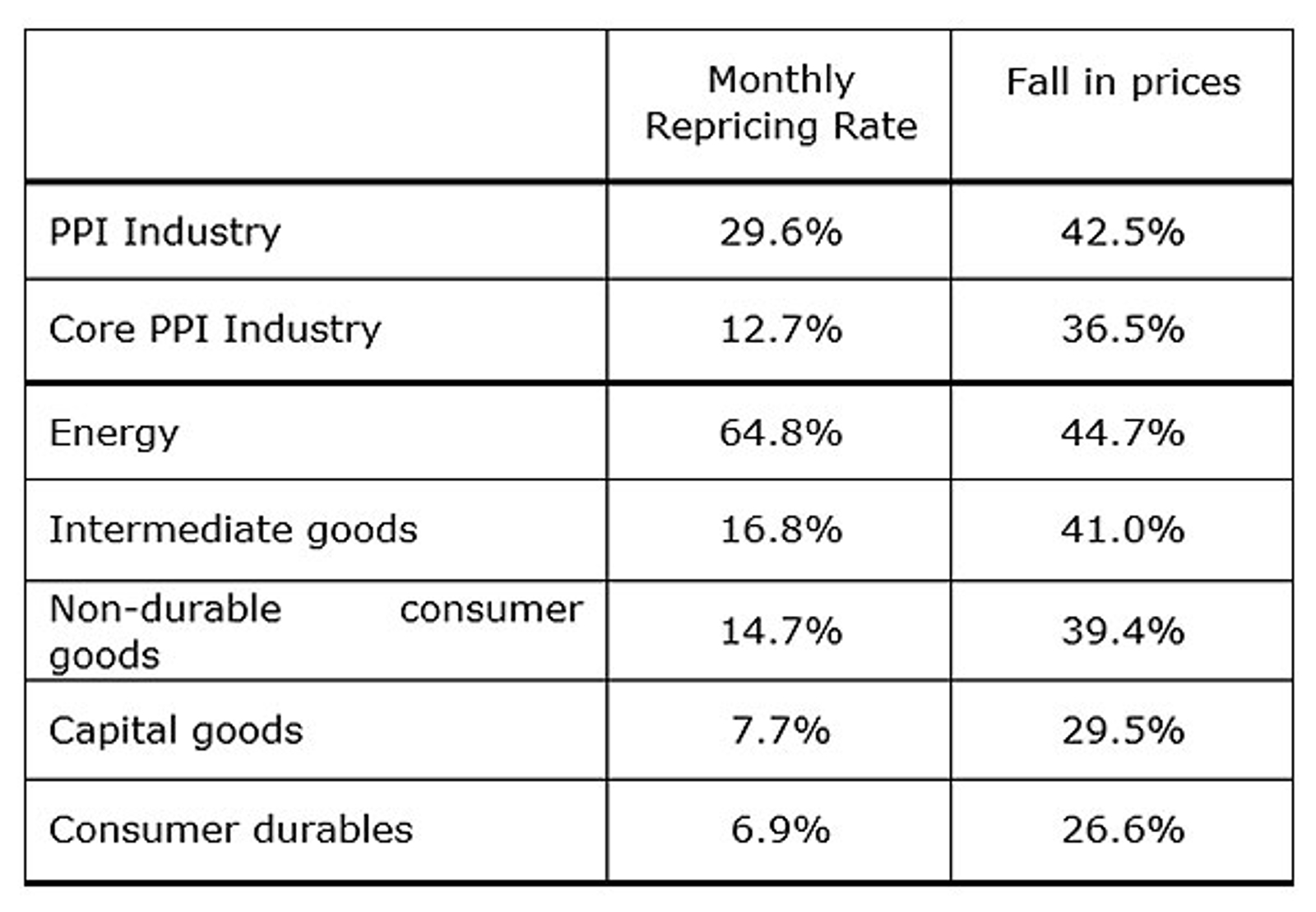

DNB research based on data underlying the Statistics Netherlands Producer Price Index (PPI) suggests that, like in other countries, Dutch prices do not change very frequently. Table 1 shows that in a typical month during the period 2000-2019, 29.6% of prices in the PPI Industry were adjusted. The PPI Industry includes manufacturing and a number of other sectors, such as mining, electricity and gas supply, and water collection and distribution. Table 1 also shows the percentage remaining if certain goods which are subject to particularly frequent price changes are excluded (Core PPI Industry). After omitting food, beverages, tobacco, and energy, only 12.7% of prices change in a given month.

Furthermore, about 40% of price changes were price declines. This holds even when inflation is positive, i.e., when the overall price level increases. One reason why different prices move in different directions at the same time is that the costs of some producers fall even when those of others increase.

When firms increase or decrease a price, on average they do so by about 4%.

Table 1: Price Adjustment in the Netherlands (PPI industries, 2000-2019)

Note: Core PPI Industry excludes food, beverages, tobacco and energy.

Table 1 also shows how often producers in different sectors adjust their prices. Prices are adjusted most frequently in the Energy sector, in about two out of every three months. These prices are likely rapidly adjusted in response to fluctuations in global oil prices.

The differences between individual sectors are large, however. Prices tend to be adjusted less frequently for goods that have undergone more processing. The cost of producing such goods typically depends on the prices of several inputs. A change in the price of any of these inputs has a smaller effect on the overall cost and is therefore less likely to trigger a price adjustment.

According to the DNB business cycle indicator, the low point of the economic cycle has been reached, after which economic growth will pick up gradually and at a moderate pace this year.

Read more Turnaround in the economy

In the fourth quarter of 2023, foreign multinationals transferred over €300 billion in conduit activities from the Netherlands abroad. These relocations indicate adjustments in business structures, and may be due to the introduction this year of a minimum tax for these international companies.

Read more Conduit activities in the Netherlands declined in fourth quarter of 2023

The Dutch economy is strong and resilient, but not everyone in the Netherlands experiences it that way. Many people are struggling financially or have concerns about their future. The Netherlands should therefore strive for a highly developed and finely tuned economy that works better for everyone.

Read more Towards an economy that works better for everyone

“We see that while the Dutch economy is doing quite well, it is not working well enough for some groups in society.” Klaas Knot said this at the presentation of DNB’s 2023 Annual Report.

Read more Introductory remarks upon the presentation of the 2023 annual reportWe use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.