An alias could be linked to an international bank account number (IBAN). When a consumer or firm switches banks, their alias remains unchanged, while the underlying bank account number changes. This would reduce the hassle involved in a switch. As this can only be achieved if everyone uses their alias, it must be enforced by law. We believe, however, that a system like this would not work properly if the Netherlands were alone in introducing it. It would be a good idea, however, to assess whether the cost-benefit ratio would be more favourable if the system were introduced at the European level and if its scope were extended beyond payments. At the same time, the Interbank Switch Support Service (Overstapservice) currently offered in the Netherlands can be further improved and promoted.

Developing robust aliases

Existing aliases are unsuitable for large-scale use in the payments system. For example, email addresses and telephone numbers are not "self-validating”. As a result, typing errors could result in incorrect payments. Self-validation means consumers and firms can verify whether aliases are valid. Furthermore, email addresses and telephone numbers are not stable enough. After all, consumers and firms can switch email addresses and telephone numbers. For this reason, we have assessed the costs and benefits to society of developing, issuing and using new, robust aliases that are suitable for large-scale use in the payments system.

Costs would significantly outstrip benefits

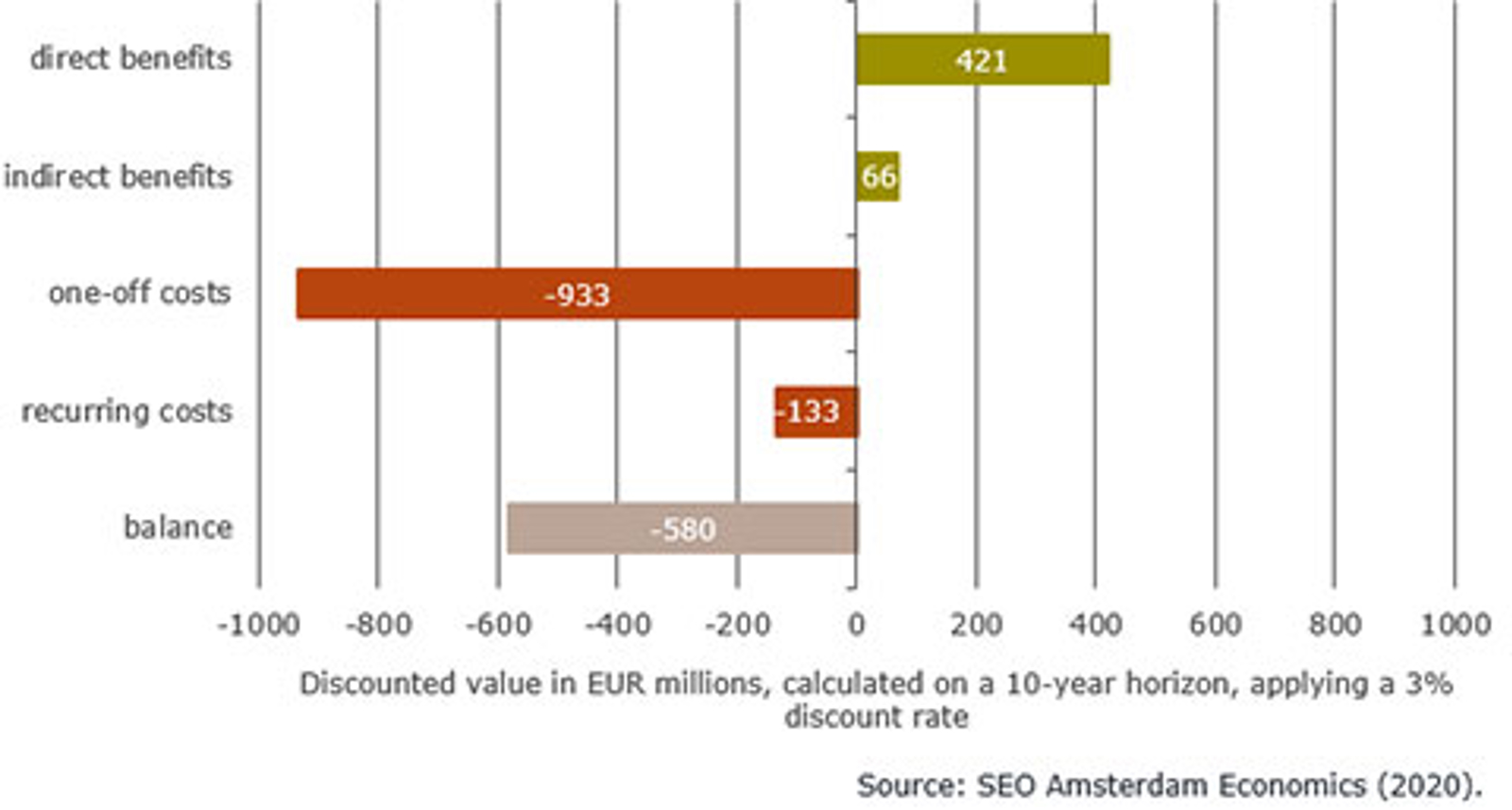

We have commissioned research agency SEO Amsterdam Economics to prepare a cost-benefit assessment. This shows that the costs of enforced alias use exclusively in the Netherlands would significantly exceed its benefits (see Figure 1). The net discounted value over a 10-year horizon would amount to EUR -580 million. This net amount represents the balance of almost EUR 0.5 billion in expected benefits and well over EUR 1 billion in expected costs. The 10-year horizon reflects the pace at which the payments landscape would change and IBANs would increasingly fade into the background. The outcome is surrounded by uncertainties, however. The most favourable scenario results in net benefits of EUR 5 million, whereas the most unfavourable scenario produces net costs of EUR 946 million.