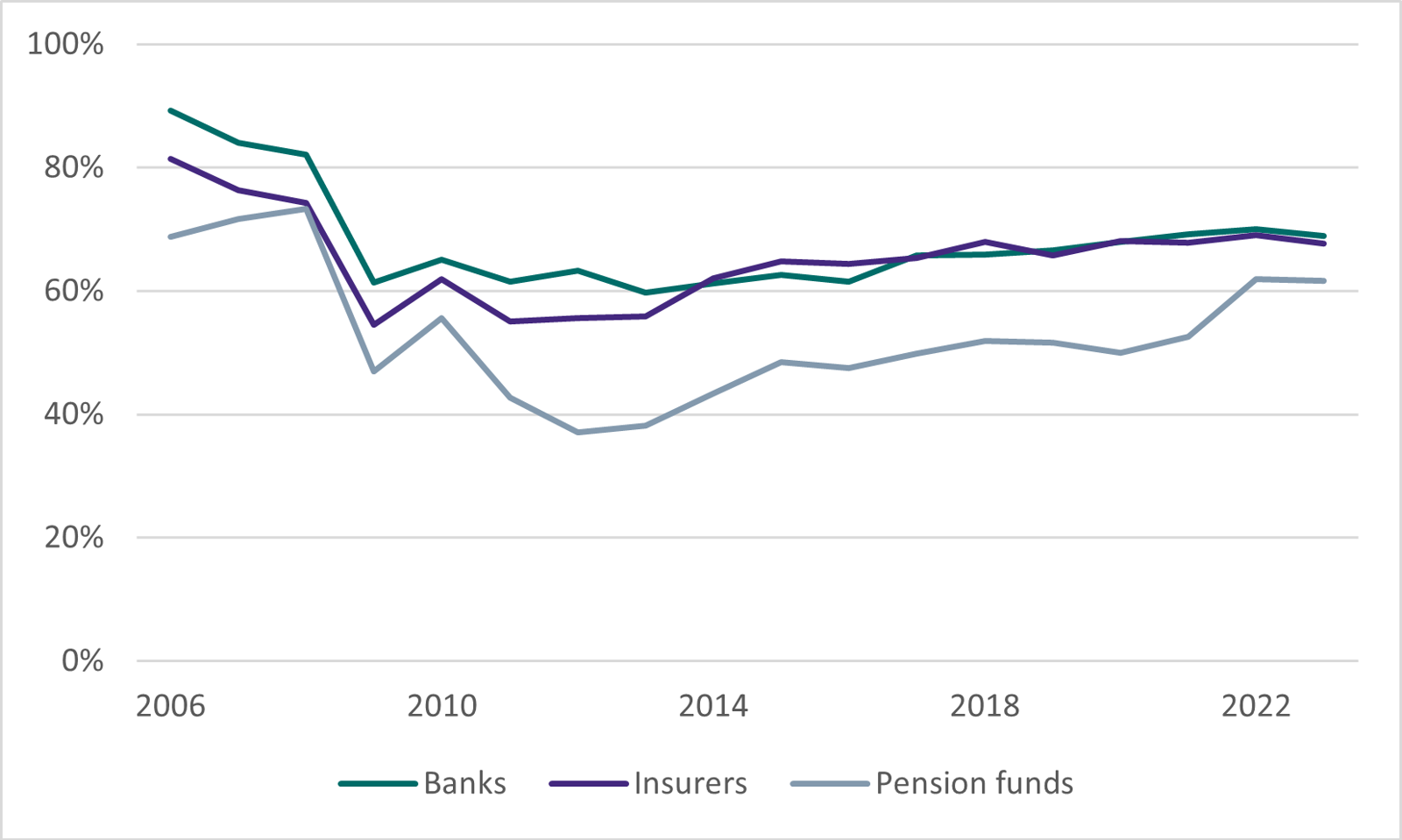

Public trust in the financial health of banks, insurers and pension funds remains unchanged

Furthermore, the survey shows that households have trust in the financial health of Dutch banks, insurers and pension funds. Figure 2 shows that in 2023, 62% of respondents have substantial or full confidence that pension funds will be able to fulfil their commitments to pensioners. Also, 68% of respondents are confident that insurers can meet their payment obligations to policyholders.

Confidence that Dutch banks will be able to repay the money entrusted to them at all times is at a similar level. Confidence that one's own bank is capable of doing so is even slightly higher at 75%. Closer inspection reveals that respondents who completed the questionnaire prior to the announcement of UBS's takeover of Credit Suisse were slightly more confident in their own bank's financial health than those who completed the survey after the announcement (77% against 73%). Over the past year, households have also thought slightly more often about the possibility that Dutch banks could fail. In 2023, 38% of those surveyed said they thought about this occasionally or very often in the past year, up from 34% in spring 2022.

Figure 2: Public trust in the financial health of banks, insurers and pension funds

Share of respondents that have substantial or full confidence