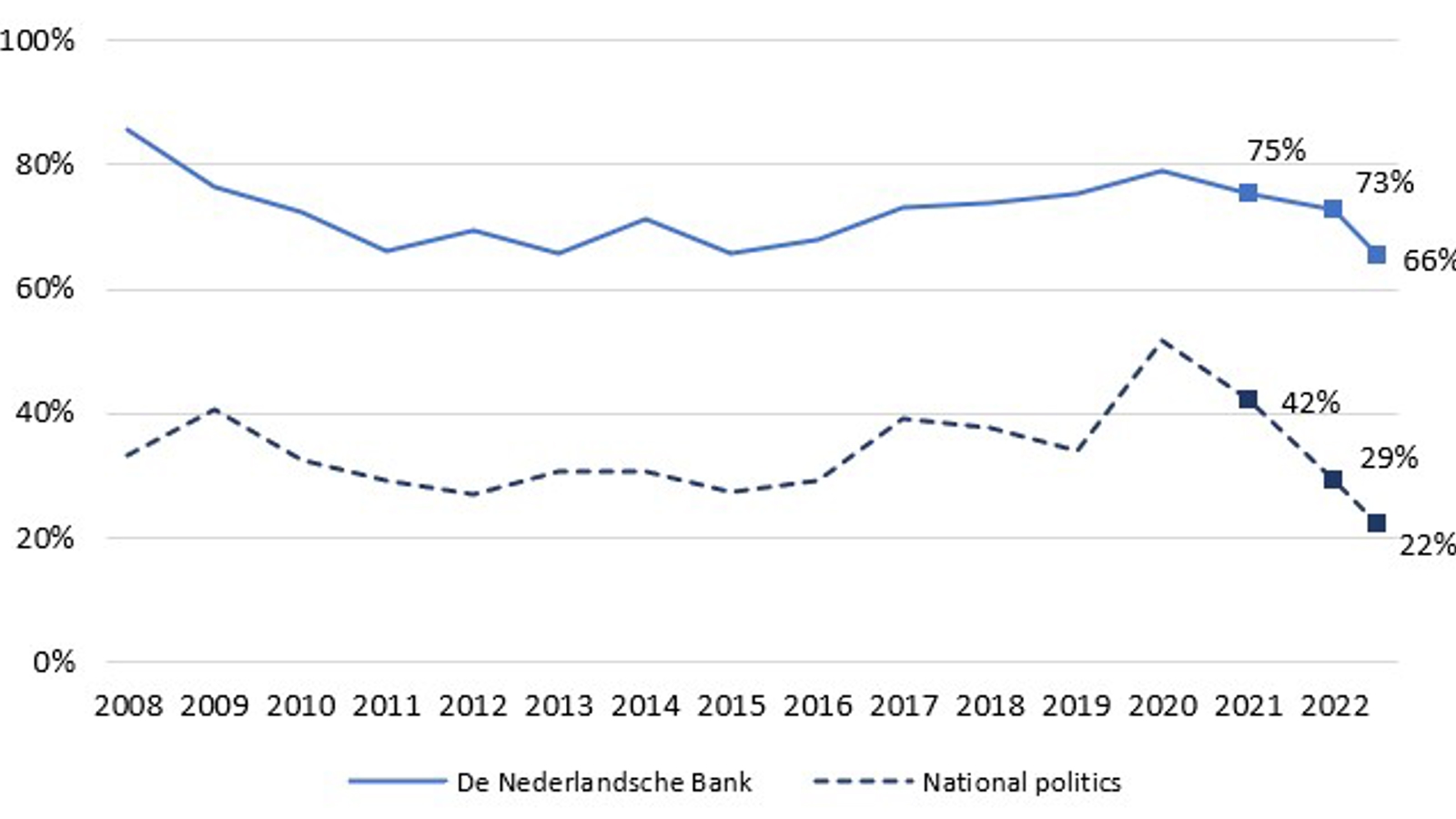

Source: DNB Trust Survey 2008-2022 and an additional survey held in September/October 2022.

Note: Trust in DNB and national politics is measured every spring. In autumn 2022, an additional survey was put out to the Centerpanel.

High price increases contribute to decline in trust

High inflation is associated with a decline in trust, a new study shows. Trust hinges on many factors, and a lot has happened in recent years that presumably affects Dutch people’s trust. Examples include Russia's invasion of Ukraine, the COVID-19 pandemic, sharply rising food prices and soaring energy bills. While the sharp price increases have been primarily caused by factors over which central banks and the national politics have little control, high inflation appears to damage trust in these authorities among a large group of people. Due to inflation, 66% of respondents have less trust in national politics and 46% trust DNB less.

Trust falls as perceived inflation rises

People directly feel the financial impact of price hikes. The survey measures inflation by asking respondents about the change they experience in the cost of groceries at the supermarket and their monthly energy bills. Trust is lowest among consumers who experience sharp price increases when doing their daily grocery shopping and those whose energy bills have risen steeply. In autumn 2022, almost three in 10 Dutch people experienced price increases in their groceries of more than 30% over a single year. Almost one in five experienced an increase in monthly energy bills of €150 or more. Also, many respondents say they are more careful with their money in response to high inflation and use less energy to save on energy costs.

Inflation leads to more stress

Sharp price increases can have more than just a financial impact. One in five Dutch people experience higher levels of stress due to inflation, and they have less trust in central banks and national politics. The same goes for people who are struggling to make ends meet, are tapping into their savings, or are running up debts.

More people believe fighting inflation is up to national politics than those who think this is up to central banks

While maintaining price stability is a primary responsibility of DNB and the other central banks that work together in the Eurosystem, controlling inflation also depends on national governments' fiscal policies and on wage negotiations between the social partners. Remarkably, though, more Dutch people consider curbing inflation to be a task of national politics (73%) than of DNB or the ECB (38% and 53%, respectively), while 18% believe trade unions also have a role to play and 12% cite retailers. These figures may well be linked to the high energy prices and the Dutch government's introduction of the gas and electricity price cap. In any case, Dutch citizens' trust in a given authority – be it national politics or DNB – is lower if they see it as its job to fight inflation.