Source: Statistics Netherlands and DNB.

Note: The scenario without the coronavirus pandemic assumes the same turnover, profits and costs for 2020 as for 2019. Only sectors with >150 companies in 2019. Share of illiquid companies = 100 * number of illiquid companies (liquid resources) <0)/total number of companies.

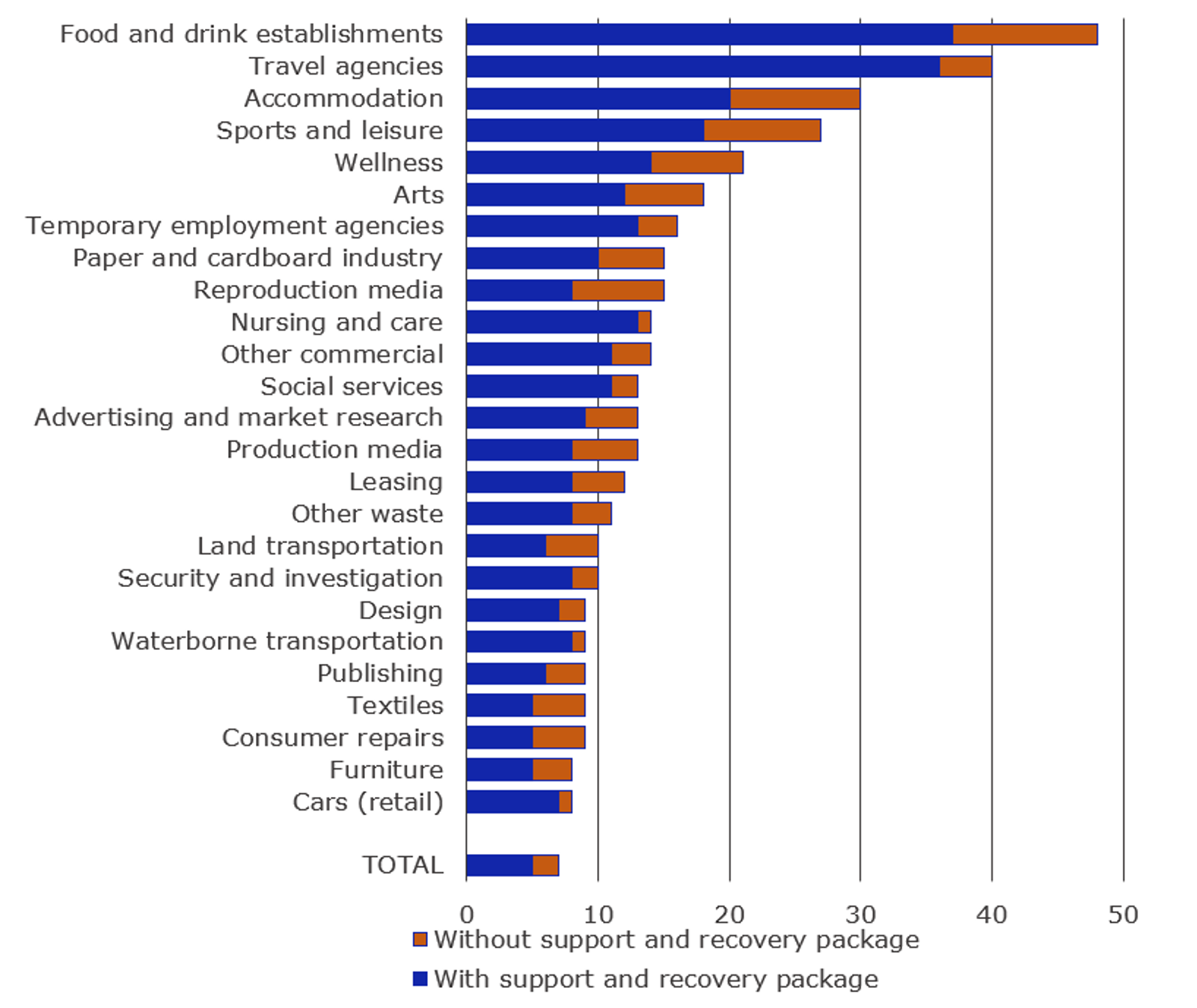

The increase in the number of SMEs with liquidity shortages is strongly concentrated in sectors directly affected by the social distancing measures, such as food and drink establishments (37 percentage points), travel agencies (36 percentage points), accommodation (20 percentage points), wellness (14 percentage points), sports and leisure (18 percentage points) and the arts (12 percentage points). However, their limited share in the economy reduces the overall impact. Within the retail sector, the impact varies greatly. Whereas the percentage of companies with liquidity shortages decreased slightly in the DIY and audio and video equipment subsectors as a result of the coronavirus pandemic, the subsectors of clothing and fashion articles and shoes and leather goods experienced a relatively sharp shortage increases.

Solvency, expressed as equity/loan capital, has worsened considerably in SMEs in sectors directly affected by social distancing measures. The impact of the coronavirus pandemic on solvency is significantly smaller in other sectors. This is because for many companies, estimated operating losses for full 2020 were relatively small compared to the equity on their balance sheets. The increase in the share of SMEs whose equity turned negative is therefore relatively limited at 2 percentage points (approximately 3,700 companies). Here, too, there is a greater increase in the sectors which have been relatively heavily affected by the coronavirus pandemic. The support and recovery package has had a relatively large beneficial impact in these sectors.

All in all, the coronavirus pandemic has had a particularly severe impact on the sectors most affected by the social distancing measures. The impact on the financial position of Dutch SMEs as a whole seems to be less significant, in part thanks to the support and recovery package. This is consistent with the development of the number of bankruptcies seen in the Netherlands so far.

We have based this estimate of the impact of the coronavirus pandemic on the financial position of Dutch SMEs on data from all Dutch private limited companies in the SME sector for 2020. These data include the 2019 financial statements, turnover, workforce and amounts received under the support and recovery package (NOW, TOGS, TVL).