Innovation we can trust: the role of DNB in regulating FinTechs

‘A license from a respected regulator helps your business build trust with customers, investors, and partners.’, said Gita Salden at the conference ‘FinTech meets the regulators’ at DNB, Amsterdam, today. She spoke about the importance of innovation in the financial sector and the importance of regulation to underpin trust.

Published: 12 June 2025

© ANP

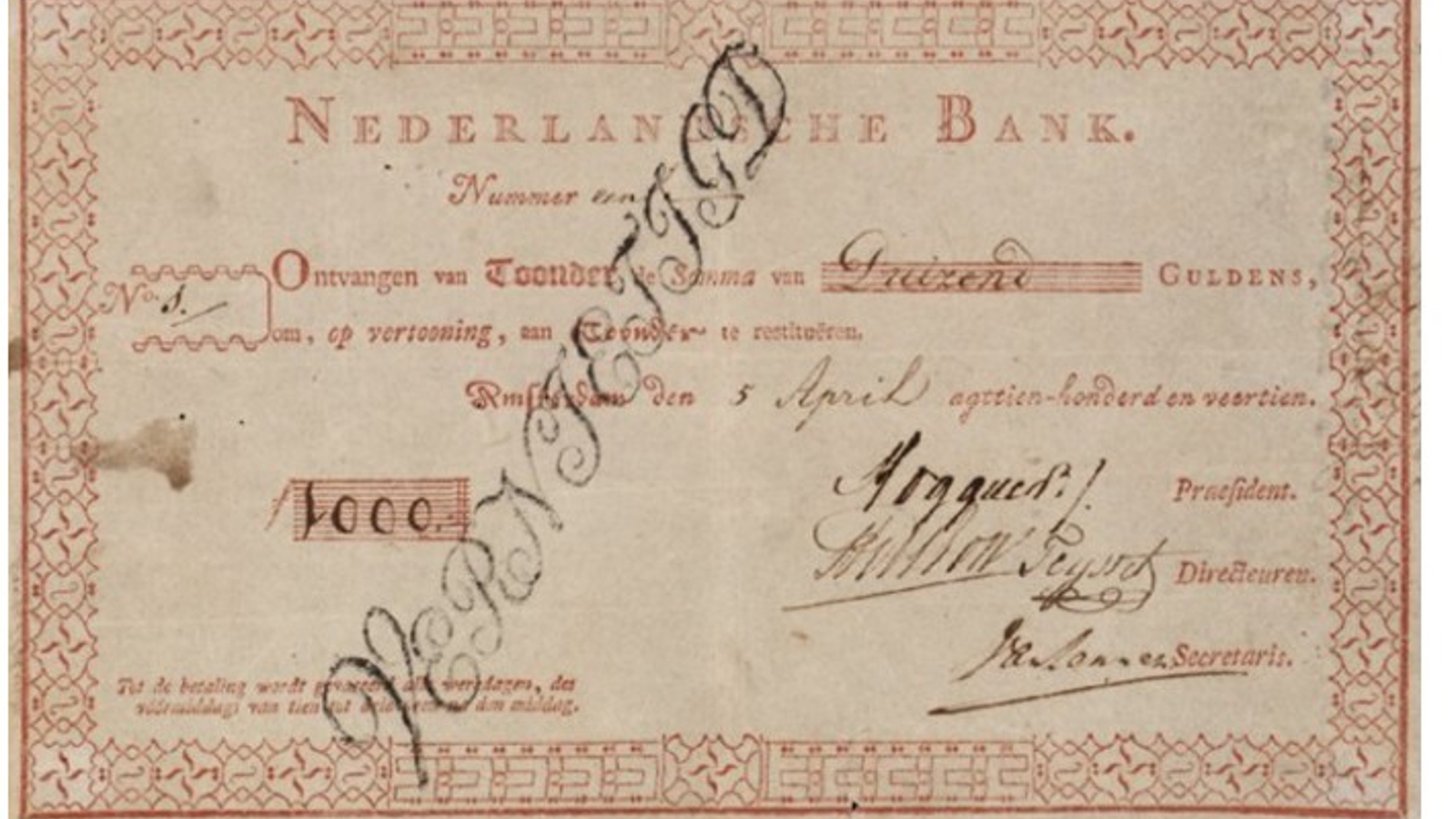

Do you know what this is?

© DNB

This is the reverse side of one of the first banknotes issued by DNB, two centuries ago.

Do you see all the names and dates written on it?

These are payment details: when people were paid with a DNB banknote, they wrote down the name of the payer and the date of payment.

If the banknote turned out to be worthless, at least they knew who to turn to for the ‘real’ payment.

Why did people think that was necessary?

Because money is about trust.

And the Dutch had some bad experiences with banknotes during the period of French rule of the Netherlands, when French notes were not backed by gold.

So from our founding in 1814, DNB did everything they could to win people’s trust:

the new banknotes contained a promise of payment in gold or silver coins and they were signed by no fewer than four people: DNB’s president, two directors and the secretary.

© DNB

These banknotes are part of our historical money collection.

You can see them next door, in our former gold vault.

Because when we renovated this building, we not only wanted it to be energy-efficient and sustainable, but also – quite unusual for a central bank – as open and transparent as possible.

Because trust is not only something you receive, but something you give.

Trust is not only about security, about guarantees, about stability, but also about openness, about letting the world in and looking towards the future.

So we opened our doors and our vault to visitors.

Don’t worry, all the gold bars, coins and banknotes have been safely rehoused in a secure facility in Zeist: our trust is not limitless….

I am proud to welcome you in our new headquarters where old meets new.

The perfect place to talk about opportunities and challenges, value and trust, digitalisation and the future of the financial sector.

The perfect place for new money to meet old money, for FinTech to meet the regulators.

Welcome!

We have a lot to talk about…

We all know that the financial sector is in the midst of a technological revolution.

New players, new business models, new technologies:

FinTech is transforming the way we pay, borrow, invest, and manage risk.

And we, as supervisors - DNB and the AFM - want to see this innovation thrive.

At DNB, we believe that a strong and innovative financial sector is essential to serving customers, supporting the economy, and building a future-proof financial system.

That’s why we’re open to new ideas, new technologies, and new ways of doing business.

But let me be clear: this openness comes with a responsibility.

Not only for DNB and AFM, but for every organisation that wants to offer financial products and services.

Because like I said: money is about trust.

In ‘The Ascent of Money: A Financial History of the World’, Niall Ferguson puts it beautifully: “Money is not metal. It is trust inscribed.” End of quote.

The moment that trust is broken, the entire system is at risk.

Let me give you an example.

You may have followed the case of Binance.

A major global crypto platform - operating without proper authorisation, facilitating billions in illicit transactions, and ultimately leaving Dutch customers unprotected. When DNB confronted Binance about its non-compliance with anti-money laundering regulations, they chose to exit the Dutch market rather than meet the standards we expect.

And then there is this case where we were notified by the Financial Intelligence Unit.

About a young man with a slick pitch about investments in tech stocks who managed to convince investors to hand over millions of euros.

He used the money to finance a lavish lifestyle: luxury hotels, designer clothing, and expensive cars.

The pattern – large sums coming in, nothing going into investments – was flagged because it resembled a classic pyramid scheme.

The case was referred to law enforcement, and the AFM was notified.

Why is a case like this important to follow up?

Indeed, there is no physical damage, nobody is left dead or bleeding.

But the damage to the financial market is devastating: trust has been betrayed.

That’s exactly why we hold the line: not to stifle innovation, but to guard, maintain and strengthen consumer trust in financial markets.

And to be fair, we are quite lenient nowadays…

When, way back in 1836, a young lady was suspected of counterfeiting DNB banknotes, the public prosecutor demanded the death penalty….

But today we still adhere to the rule we applied then: trust, but verify.

Because trust is not simply a nice-to-have in finance.

It’s the foundation.

Without it, nothing else works.

In his book, Ferguson describes money as a medium of exchange, a unit of account and a store of value, and states: ”To perform all these functions optimally, money has to be available, affordable, durable, fungible, portable and reliable.”

To make sure that money can perform all these functions, DNB and the AFM are the main regulators.

Who does what?

There’s an important difference between DNB and the AFM when it comes to supervising FinTechs.

DNB focuses on prudential supervision: we check if companies are financially stable and able to meet their obligations.

The AFM focuses on conduct supervision: they make sure companies treat customers fairly, provide clear information, and keep markets honest.

The supervision of many FinTechs is shared between DNB and the AFM.

Who takes the lead depends on what the company mainly does.

If it’s payments, savings, or lending, DNB is usually in charge.

If it’s investment services or financial advice, the AFM is the main supervisor. This way, FinTechs get the right kind of supervision based on their risks.

The latest FinTech Census in 2023 shows that FinTech companies in the Netherlands often have mixed experiences with supervision from DNB and the AFM. While they appreciate the openness and information provided by both regulators, they also find the process to be strict, risk-averse, and sometimes rigid.

Many FinTechs feel there’s little room for innovation and that licensing is slow and unpredictable.

They – you - would prefer a more solution-oriented approach, with clear feedback on obstacles to obtaining a license.

We have taken these comments to heart.

We understand that obtaining a license from DNB or the AFM is a rigorous process.

We understand that it can feel long, complex, and sometimes frustrating.

But we do not mean to be rigid, we mean to be fair.

We don’t want the process to be seen as a barrier to innovation, but as a mark of quality.

Not to be seen as an obstacle, but as a gateway to trust.

Because a license from a respected regulator helps your business build trust with customers, investors, and partners.

Believe me, we are not here to make life harder for you than it needs to be.

We work hard to make sure that our supervision is proportionate and risk-based.

In other words: we do not ask for more than is necessary.

So, if your business model carries limited risks, we won’t burden you with excessive conditions.

For instance: a small payment startup doesn’t face the same demands as a systemic bank.

A niche lending platform isn’t held to the same standards as a major insurer.

For early-stage innovators, we offer exemptions and sandbox-like approaches.

We’re open to exploring new business models

That’s why we have set up the Innovation Hub - a joint initiative of DNB, the AFM, and ACM, the Authority for Consumers and Markets.

It’s a space for open conversation, where you can pitch your ideas, ask your questions, and explore how regulations apply to your innovations.

Whether you’re building an AI-driven investment tool, experimenting with tokenised assets, or creating a cross-border lending app, we invite you to come and talk to us early.

The questions we receive in the Innovation Hub are very diverse.

They cover all topics that touch on innovation in the financial sector and the regulatory framework.

From a new AI tool at a large bank, to two technical university students who want to build an app to let people donate to street musicians, because no one carries cash anymore.

The Innovation Hub answers questions like:

- “I want to issue financial instruments via blockchain, but the regulations don’t account for this technology, so I can’t fully comply. How can I make sure that I don’t break the law in my specific case?” Or;

- “I want to issue electronic money or provide payment services. Do I always need a license for this activity?” Or;

- “I’ve come up with an app that makes it easier for groups of friends to pool money. If I want to launch this app, do I need a license?”

We do our very best to provide answers to these kinds of questions.

And let’s be honest: not every idea is going to fit within the rules.

Sometimes, we’ll have to say no.

But when we do, we’ll explain why, and together we’ll explore whether there’s a better way.

Because at the end of the day, we share the same goal:

A financial system that is safe, reliable, and innovative.

So please, don’t let today be the only time we connect.

Our door is open.

Literally.

We are here to listen, to help, and - when necessary - to push back.

Because as regulators, we have to balance two roles: enabling innovation and safeguarding trust.

The quote of Niall Ferguson I used before was not complete.

He wrote: “Money is not metal. It is trust inscribed. And it does not seem to matter much where it is inscribed: on silver, on clay, on paper, on a liquid crystal display.”

In other words: Money is money and money is trust, in every shape and form.

© DNB

So, let’s use this meeting to build trust. To build a thriving FinTech sector, but also a financial system that serves society as a whole.

Let’s get to work!

Discover related articles

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.