DNB imposes instruction on trust office Intertrust for incomplete procedures manual and inadequate customer due diligence

De Nederlandsche Bank (DNB) imposed an instruction on trust office Intertrust (Netherlands) B.V. (Intertrust) on 31 March 2022 for non-compliance with the law regarding its procedures manual and customer due diligence. Intertrust did not comply with certain provisions regarding the procedures manual and customer due diligence pursuant to the Act on the Supervision of Trust Offices 2018 (Wet toezicht trustkantoren 2018 – Wtt 2018) and the Decree on the Supervision of Trust Offices 2018 (Besluit toezicht trustkantoren 2018 – Btt 2018).

Published: 13 October 2023

Gatekeeper role

The Wtt 2018 aims to promote the integrity of the financial system through regulation of the trust sector. Trust offices act as gatekeepers of the system. They play an important role in countering terrorist financing and criminal money laundering by having procedures in place to ensure compliance with the Wtt 2018 and by conducting ongoing customer due diligence. Intertrust failed to fulfil its obligation to prepare a thorough procedures manual and to conduct proper customer due diligence.

Procedures manual

The instruction also prescribes a course of action to end non-compliance with the law. The course of action requires Intertrust to revise or redraft its procedures manual (and if necessary its policies, procedures and measures) by 1 June 2022 to restore compliance with the relevant provisions of the Wtt 2018 and Btt 2018. For instance, the procedures manual does not contain procedures for establishing a risk-based work programme for the compliance function, nor does it provide sufficient procedures for handling and registering incidents.

Customer due diligence

In addition, the course of action requires Intertrust to ensure that all customer files are brought into verifiable compliance with the relevant provisions of the Wtt 2018 by 31 January 2023. This has been prescribed because DNB found that Intertrust did not carry out full customer due diligence in certain files examined. The deadline of 31 January 2023 as set in the instruction was extended to 31 December 2024 by decision to implement a change on 11 November 2022.

Objection

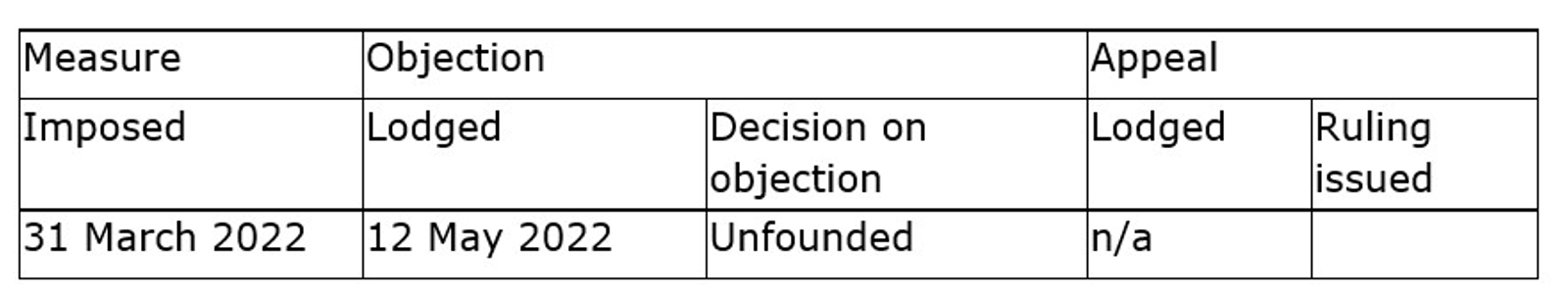

Intertrust lodged an objection to the instruction imposed by DNB. On 29 November 2022, DNB declared Intertrust’s objection unfounded. No appeal against the decision on objection was lodged within the six-week time limit. This means that the instruction, the decision to implement a change and the decision on the objection have become irrevocable.

See below for the instruction, the decision to implement a change and the decision on the objection, excluding confidential information. For further information, please contact DNB’s Information Desk on 0800 020 1068 (freephone in the Netherlands) or +31 20 524 91 11 if you call from abroad.

Aanwijzing Intertrust (Netherlands) B.V

Wijzigingsbesluit Intertrust (Netherlands) B.V

Beslissing op bezwaar Intertrust (Netherlands) B.V

Discover related articles

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.