Working Group on Climate Adaptation

Risks from climate change pose major challenges. For the environment and therefore also financially. The Working Group on Climate Adaptation, made up of financial sector and government representatives, is examining how physical climate risks and climate adaptation affect the economy and the financial sector. It is also looking at how the financial sector can contribute to climate adaptation, working with or without government or the business community.

© Rijkswaterstaat

Financial risks of climate change

Companies, governments, banks, insurers and investors face financial risks due to climate change. Such risks include the consequences of rising sea levels, more frequent extreme weather, greater water discharge through the rivers, severe drought and soil subsidence. The business community, the financial sector and the government are therefore looking into how to adapt the economy to climate change to boost our overall resilience.

Financing and insurance solutions

The Working Group on Climate Adaptation is examining what scenarios, methods and data are needed to estimate the physical impact of climate change on the economy and is working on potential solutions. This may involve forms of insurance, risk sharing and guarantees, and public-private partnerships, with the aim of contributing to a greener, agreeable and, above all, future-proof living environment.

Opportunities for collaboration

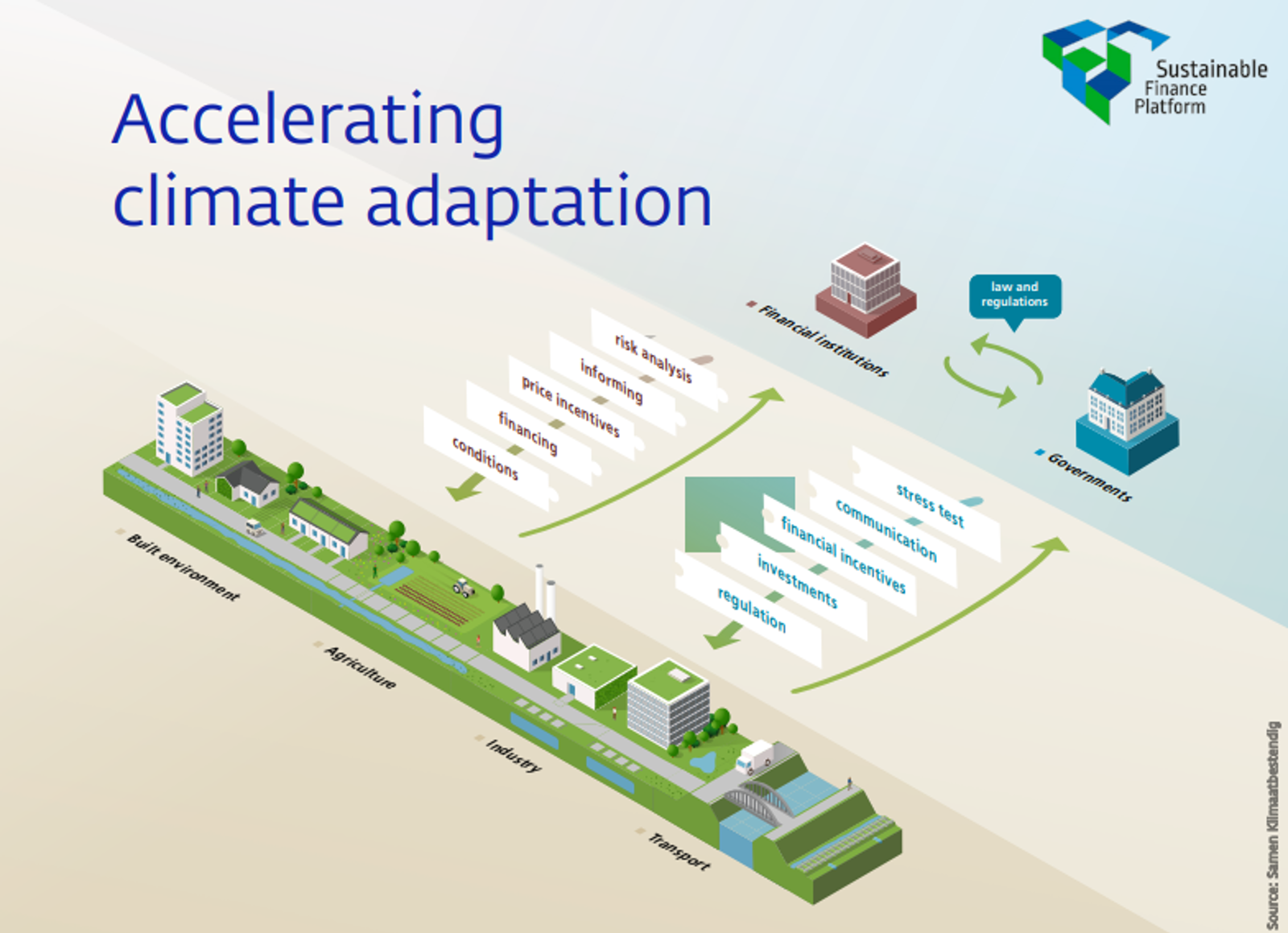

In 2022 and 2023, the Working Group on Climate Adaptation examined climate trends and conducted a number of impact analyses on various sectors. It identified sector-wide opportunities for public-private financing of adaptation measures, and made recommendations on how to resolve bottlenecks. The opportunities for collaboration are summarised in the figure below.

Opportunities for collaboration using the tools available to financial institutions and governments in each domain or sector. (© Samen Klimaatbestendig)

Pilot projects

Since 2024, the working group has been implementing the previous recommendations and building expertise and gaining practical experience with tools and collaborations in pilot projects. Two pilots were launched in late 2024: Foundation repair with the municipality of Rotterdam, and Climate-adaptive business parks with the municipality of Súdwest Fryslân. As part of these pilots, working group members contribute ideas on public-private solutions and share expertise and experience.

Initiatives aimed at enhancing cohesion that the working group collaborates with, such as Samen Klimaatbestendig, the Adaptatie Atelier foundation and NL AAA Klimaatbestendig, have been identified as necessary to build bridges and create a common understanding between public and private parties. The working group's collaboration with these initiatives also helps to build a broader understanding and commitment to climate adaptation in the financial sector.

Publications

The working group published its findings and recommendations in the 2023 report Accelerating climate adaptation. Interested parties both in the Netherlands and abroad have consulted the report. The working group also released a concise public version summarising the recommendations.

Activities in 2024, resulting from the recommendations of this report, are detailed in the Progress Report 2024.

About the working group

Since 2024, the working group has been composed of five clusters: Communications, Housing, Business, Data and Investments.

It comprises 60 people from 29 financial institutions, governments and other organisations. Its members are representatives of ABN AMRO, Achmea, Agriver, Altera Vastgoed, APG, a.s.r., AXA XL, BPD, Bouwinvest, Donatus, ING, IVBN, Ministry of Economic Affairs, Ministry of Infrastructure and Water Management, Ministry of Agriculture, Fisheries, Food Security and Nature, Ministry of Housing and Spatial Planning, Nationale-Nederlanden, Nationale Hypotheek Garantie (NHG), Dutch Banking Association, NWB Bank, Pensioenfonds Rail & OV, Philips Pensioenfonds, PwC, Rabobank, Staf Deltacommissaris, Stimuleringsfonds Volkshuisvesting (SVn), TU Delft/Resilient Delta, Univé and Dutch Association of Insurers. It is chaired by Gijs Kloek from Achmea. NextGreen supports the working group with process supervision and guidance in setting up pilots.

History of the Working Group on Climate Adaptation and related initiatives

- 2020: Network organisation Samen Klimaatbestendig identifies opportunities for collaboration; the notion of a Working Group on Climate Adaptation takes shape.

- 2022: The Sustainable Finance Platform’s Working Group on Climate Adaptation is launched.

- 2023: Working Group on Climate Adaptation publishes the report 'Accelerating Climate Adaptation'.

- 2023: NL AAA-Klimaatbestendig, an initiative of the Delta Programme Commissioner, is launched, with the involvement of the Working Group on Climate Adaptation.

- 2024: The Working Group on Climate Adaptation set about implementing the report's recommendations

in five themed clusters. The clusters are exploring potential pilots. The Business cluster, together with the Ministry of Agriculture, Fisheries, Food Security and Nature, organised the working conference 'Working together towards resilient agriculture and nature’. - 2024: The Adaptatie Atelier foundation is working with the working group to prepare fact sheets on financing climate adaptation at business parks and housing corporations.

- 2024 - NL AAA-Klimaatbestendig is taking further shape as six ambassadors are appointed. Gijs Kloek, chair of the working group, is part of the support team.

- 2025 - Full steam ahead. See the working group’s ambitions in the ‘Progress Report 2024'.

Contact

For information on the working group's activities, presentation requests etc., please contact Gijs Kloek of Achmea at gijs.kloek@achmea.com.

The information and publications on this page reflect the considerations and efforts of the relevant working group established under the umbrella of the Sustainable Finance Platform. As a member of the platform, DNB supports the efforts, but it is not the author. It includes private-sector initiatives and does not contain regulatory requirements or government standpoints.

Downloads

- Progress Report 2024, Working Group on Climate Adaptation (January 2025) (06 February 2025 | 1.6MB PDF)

- Accelerating climate adaptation - An alliance between the financial sector and government (18 January 2024 | 2.9MB PDF)

- Accelerating climate adaptation - 2-pager (21 December 2023 | 2.5MB PDF)

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.