New contract, new investment policy

Pension funds have announced their intention to adjust their investment policies as part of the transition to the new pension contract. For younger members, most funds will reduce allocations to government bonds and interest rate swaps – low-risk instruments offering fixed returns – and increase exposure to higher-risk assets such as equities, aiming for long-term growth. For older workers and pensioners, pension funds will maintain a strong focus on government bonds and interest rate swaps to ensure stable benefit payments. The older the member, the shorter the maturity of these investments. On balance, this suggests a likely reduction in investments in long-term (≥25 years) government bonds and interest rate swaps under the new pension contract.

Investment policy changes remain uncertain

Based on market analyst expectations, we estimate that funds will reduce their holdings in government bonds and interest rate swaps with a maturity of 25 years and longer by roughly €100-150 billion. By comparison, €900 billion is outstanding in (semi-)government bonds with such maturities, and the net position of interest rate swaps is over €300 billion. The expected reduction therefore concerns a small but significant part of the market. However, there are uncertainties surrounding the ultimate decline in demand for long-term interest rate instruments. Many pension funds only provide an indicative overview of their planned investments, and some funds have yet to finalise their strategies. Developments in financial markets also play a role. The funding ratio on the transition date will influence how assets are allocated across member groups, shaping the aggregate investment policy. In addition, the scale of required adjustments may grow if funds choose to increase interest rate hedging to protect their funding ratios prior to the transition. These factors make it difficult to predict the final impact on investment allocations.

Dispersion of transactions reduces market pressure

The timing and dispersion of transactions will also influence market dynamics. The estimated trade volume associated with the entire transition is equivalent to more than a month’s worth of typical swap market trading, raising concerns about potential market stress if many funds trade simultaneously. However, several factors will help smooth the transition. First, a proposed regulatory change allows pension funds up to 12 months to adjust their portfolios after transitioning to the new contract, enabling them to wait for favourable market conditions before executing their trades. Second, the transition will be staggered, with most funds transitioning in almost equal measure on either 1 January 2026 or 1 January 2027. Third, the new pension contract has been years in the making, and investors have long anticipated these changes, so the likelihood of surprises is low. Speculators (including hedge funds) have already positioned themselves to profit from the expected trades. While this may create additional costs in the form of a lower price when pension funds sell their interest rate instruments, it also contributes to liquidity and demand for these products. In short, although a major shift is underway at the long end of the interest rate market, effective preparation will help mitigate its impact.

Long-term interest rates may rise

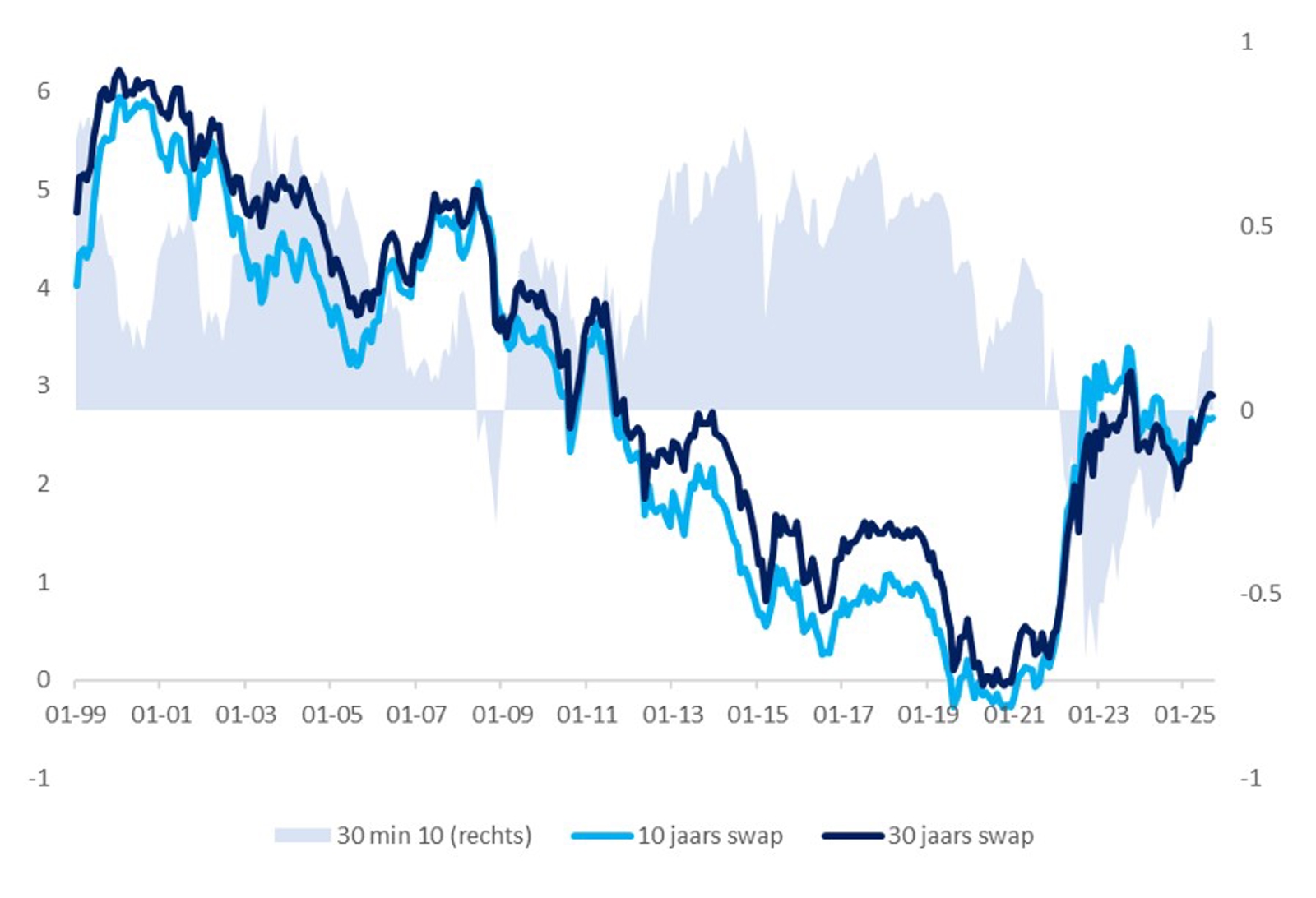

In the first part of 2025, 30-year rates rose more sharply than 10-year rates. Investor anticipation of the pension transition likely contributed to this trend, alongside investor reactions to global factors such as increased government spending and rising debt levels. Market analysts expect the pension transition to push 30-year rates higher, with limited impact on 10-year rates, which are important for financial markets. However, a higher level of long-term rates is not unusual. As shown in Figure 1, the spread between 30-year and 10-year rates is currently relatively narrow by historical standards. And in the United Kingdom and Japan, for example, this spread is wider than in the euro area. If the spread widens further, market incentives will emerge to rebalance supply and demand. For example, governments may favour issuing shorter-term bonds, and the cost of 30-year fixed-rate mortgages could also rise relative to 10-year mortgages, making the former more expensive for consumers.

Figure 1 - Swap rates and interest rate spreads over time (%)