Fine for ABN AMRO Bank N.V. for non-compliance with bonus ban

On 10 June 2025, De Nederlandsche Bank (DNB) imposed a €15 million fine on ABN AMRO Bank N.V. (ABN AMRO) for non-compliance with the bonus ban.

Published: 19 June 2025

© DNB

Summary of the decision

- In 2012, banks that receive state aid were prohibited by law from awarding bonuses to their Executive Board. In 2015, this ban was extended to include the second-tier management of the institution.

- ABN AMRO, which is partly owned by the Dutch State, awarded bonuses to officials in seven second-tier management positions between 2016 and 2024, acting in contravention of this ban.

- ABN AMRO has been fined for awarding these bonuses.

State aid

During the financial crisis, several financial institutions received support from the Dutch State. A bonus ban was imposed on these institutions, which applies as long as the state aid is in place, as well as a ban on increasing fixed salaries beyond the annual collective wage increase. The aim was to prevent state aid, or income earned thanks to that state aid, from being paid out in the form of bonuses. The ban applies to the institutions’ top management levels. This includes the members of the Executive Board as well as officials whose activities could materially affect the institution’s risk profile, also referred to as second-tier management officials.

Non-compliance

Financial institutions receiving state aid are not allowed to award or pay out bonuses. ABN AMRO was nationalised in 2008 and received state aid in that capacity. Since 2015, the Dutch State has been gradually phasing out its shareholding.

DNB found that ABN AMRO awarded and paid bonuses to officials in seven second-tier management positions in the period from 2016 to 2024. The total amount of awarded bonuses exceeds €1.5 million. In awarding and paying out these bonuses, ABN AMRO has acted in contravention of the bonus ban. In addition, DNB's examination revealed that one official had received an increase in fixed salary in two consecutive years of 11.4% and 28.8% respectively, which was more than the permissible collective wage increase of 1.5% and 2.5% respectively.

Gravity of the non-compliance and degree to which blame can be attributed

This act of non-compliance damages society's confidence in financial institutions, especially given the fact that banks have an important societal role in ensuring a smoothly functioning economy and society. Given this societal role and the sensitivity of the subject of bonuses, DNB considers the non-compliance to be grave.

A professional market participant and licensed bank such as ABN AMRO may be expected to be aware of the relevant laws and regulations and to comply with them. It may also be expected not to let the non-compliance continue after it has been made aware of it, and to act promptly to restore compliance with the ban.

The supervisory authority specifically pointed out to ABN AMRO that awarding and paying bonuses to second-tier management officials is prohibited. ABN AMRO then initially halted the payment of bonuses. However, at a later date, ABN AMRO decided not only to resume paying out the bonuses, but also to award a new tranche of bonuses. In doing so, ABN AMRO deliberately allowed its non-compliance with the bonus ban to continue for an extended period of time and went against the supervisory authority's explicit instructions. DNB strongly condemns ABN AMRO’s course of action.

ABN AMRO has confirmed to DNB that it has now adjusted the scope of its application of the bonus ban, and no longer pays out bonuses to second-tier management officials.

Fine

The fine for ABN AMRO’s non-compliance has been set at €15 million, in accordance with the DNB General fine calculation policy (in Dutch). In determining the amount of the fine, DNB considered relevant that the non-compliance is severe and persistent, and that the degree of culpability is high. It was also taken into account that ABN AMRO is a large institution with considerable resources. On balance, and taking into account these circumstances, a fine of €15 million is appropriate and warranted.

Objection

ABN AMRO has six weeks from receipt of notification of the fine to lodge an objection. Read the full decision below (in Dutch), excluding confidential information.

Media representatives can contact press officers Ivo Bökkerink (i.j.w.bokkerink@dnb.nl or +31 6 11 40 52 02) and Ezra Malko (e.a.malko@dnb.nl or +31 6 50 01 26 91).

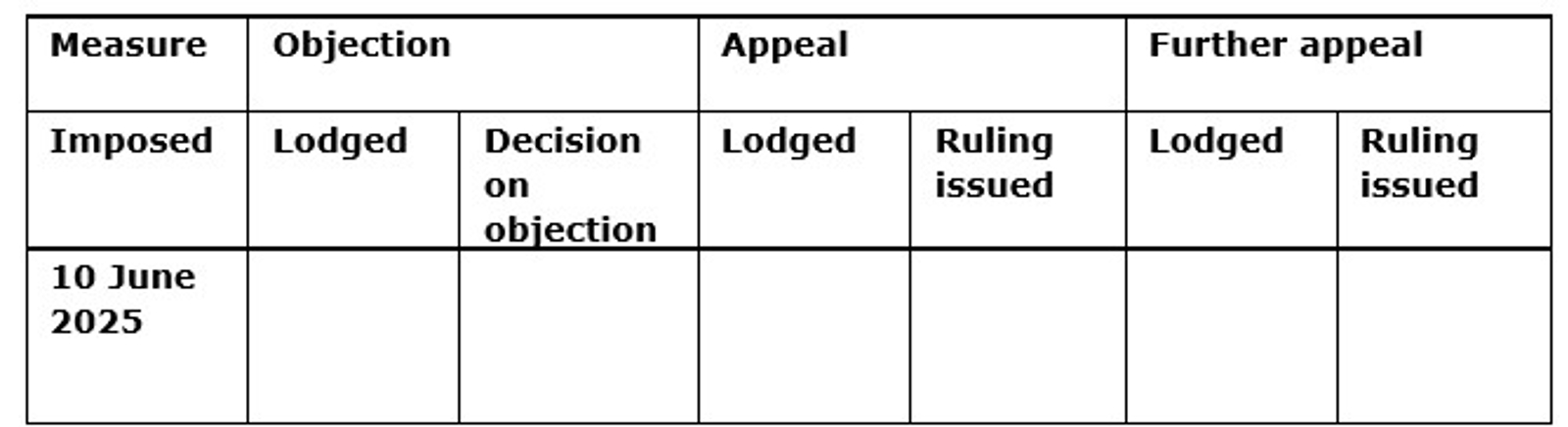

Current status (19 June 2025)

A decision becomes final if no legal remedy has been exercised against it. Any interested party may lodge an objection against the decision within six weeks of its date. The decision on the objection can be appealed in court within six weeks. Further appeal against the court ruling may be lodged with the Trade and Industry Appeals Tribunal (College van Beroep voor het bedrijfsleven – CBb). If no objection, appeal or further appeal is lodged, the decision becomes irrevocable. The table shows the current status of this decision.

© DNB

Boete voor ABN AMRO Bank N.V. wegens overtreden bonusverbod

Discover related articles

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.