The revised Payment Services Directive (PSD2), implemented in 2019, aims to increase innovation, competition and security in the European payment market by encouraging both current and new service providers to develop and offer new types of services. A case in point is account information services. Payment service providers use the information they derive from the transaction data of a person’s payment account to offer such account information services. Think, for example, of an overview of income and expenses, which gives account holders a better understanding of their financial situation. Account holders must give a service provider their explicit consent to access payment data.

Little is known about the extent to which Dutch consumers share their payment data with third parties. The information is difficult to obtain, because also non-bank service providers in the Netherlands and abroad can provide these services. In August 2020 we therefore carried out a survey among members of the CentERpanel to collect more information about payment data sharing.

A quarter of respondents agree to use of their payment data

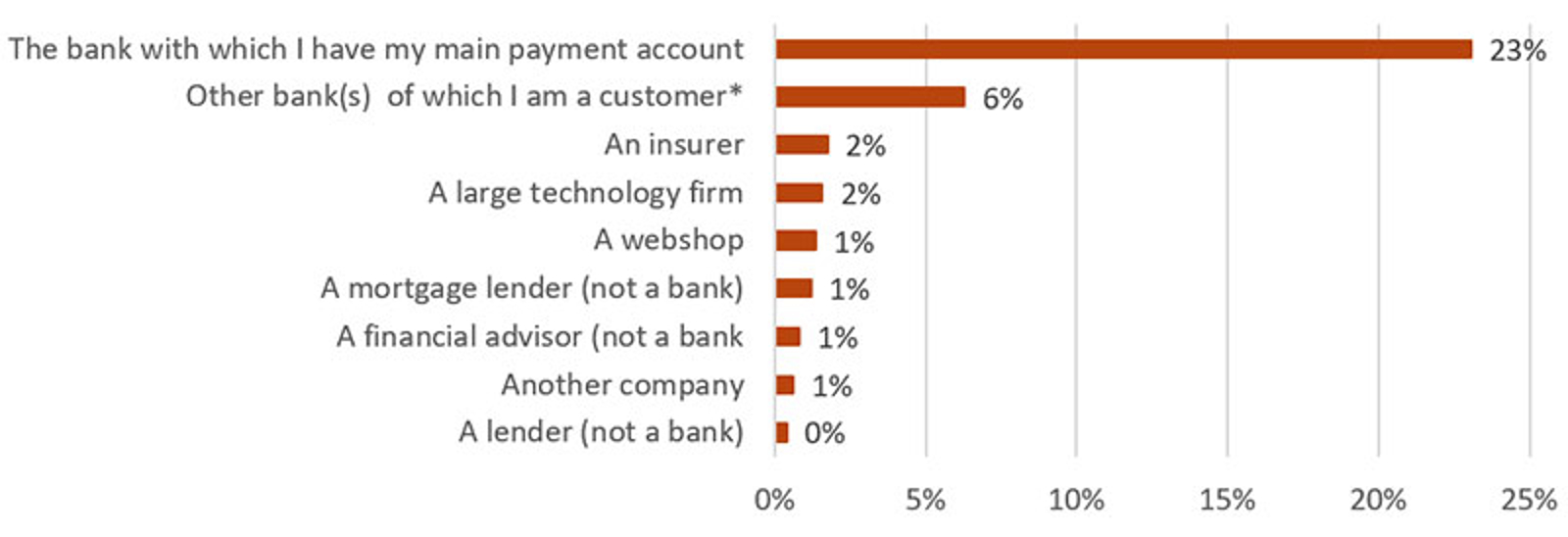

In the first year in which PSD2 was in force, a quarter of the Dutch respondents authorised the use of their payment data in exchange for new services. Young people are more inclined to give consent than older people. Consumers said they predominantly authorised the banks with which they have their main payment account (Figure 1). But a small part of them also granted access to other parties. For example, only 2% of respondents allowed large technology firms – such as Apple, Facebook and Google – access to their payment data. Banks therefore appear to have a strong competitive position in this new market.

Figure 1. Consumers predominantly authorise own bank to use payment data

Share of respondents giving consent for payment data use in the first PSD2 year