Dutch economy is sensitive to fragmentation of the international trading system

The Netherlands is sensitive to worldwide economic fragmentation. If trade and financial flows between countries are disrupted, Dutch trade and GDP will be hit relatively hard. In turn, this may affect financial stability. Policymakers must carefully weigh these costs against the aim of achieving strategic autonomy.

Published: 08 December 2023

© ANP

This is according to a DNB Analysis, in which we use scenarios to illustrate the possible consequences of a world economic order that gradually disintegrates into blocs.

Countries increasingly strive for strategic autonomy

Since the global financial crisis in 2008, there has been a reversal of international financial and economic integration. Governments around the world are seeking to reduce their strategic and economic dependence on other countries through policies aimed at strategic autonomy (Figure 1). However, such policies exacerbate geo-economic fragmentation. Our DNB Analysis shows that the Dutch economy is more sensitive to such fragmentation than other European countries. It also reveals that the European single market can mitigate these adverse effects by reducing the Netherlands’ dependence on other world regions.

Figure 1 - Industrial policy interventions on the rise globally

© DNB

Note: This includes trade tariffs and non-tariff measures such as subsidies and export incentives. Source: Juhász et al. (2023).

As a small, open economy that is highly integrated in the global financial system, the Netherlands is particularly sensitive to a worldwide increase in geo-economic fragmentation. A measure of trade openness is the share of Dutch imports and exports of goods and services as a proportion of GDP. At 177%, this is one of the highest in the world. The bulk – 95% GDP – concerns trade with other EU member states. The high degree of openness means that the Dutch economy is sensitive to disruptions in global value chains. These chains have underpinned production and trade flows worldwide over the last decades, yielding greater wealth and lower inflation across the globe.

Disruption of global value chains hits Dutch trade and GDP hard

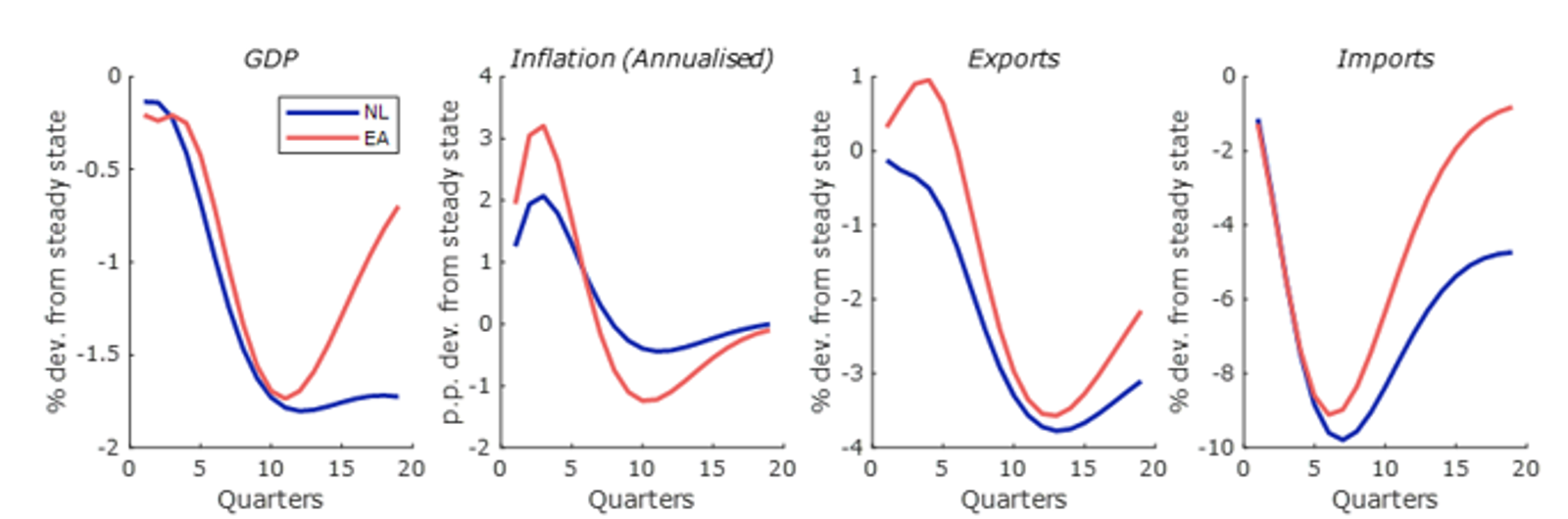

The DNB Analysis explores the impact of geo-economic fragmentation on the Dutch economy using a scenario in which global value chains are disrupted. Such disruption may result from policies that restrict trade and financial flows between world regions. In the scenario, this results in a negative shock in Dutch tradeable sectors. Dutch exports would fall by a maximum of almost 4% and imports by nearly 10%. GDP would decrease by about 1.7% in the medium-term (Figure 2), while inflation would go up, driven by higher trade and production costs. Figure 2 shows that the negative impact on the Dutch economy is more persistent than that on the euro area, due to the comparatively high openness of the Dutch economy.

Figure 2 - Dutch economy hit hard when global value chains are disrupted

© DNB

Impact of scenario on bank buffers seems manageable

Geo-economic fragmentation may also have implications for financial stability. Through economic channels, the financial sector may be affected by an increase in credit risk, reduced (international) diversification and a negative impact on banks' capital buffers. Nevertheless, stress tests show that in the fragmentation scenario the impact on Dutch banks appears manageable. Among the economic effects shown in Figure 2, the average CET1 ratio of Dutch banks, which is a key measure of a bank's financial health, falls by 2 percentage points. Vulnerabilities may be greater if geo-economic fragmentation also results in a tightening of financial conditions, for instance as risk premia in financial markets rise and financing costs increase.

The impact on financial stability may increase in case of more abrupt geopolitical fragmentation or if geopolitical risks suddenly materialise. Moreover, direct effects become greater in an international crisis, when fragmentation would hamper a swift multilateral policy response.

Awareness of trade-off between strategic autonomy and economic costs

Strategically important companies, sectors and technologies are being increasingly targeted by restrictive cross-border measures. The DNB Analysis emphasises that policymakers should carefully weigh the negative effects of such measures on the economy and financial stability against the benefits of reduced dependence. Pursuing policies to increase strategic autonomy will encourage other countries to adopt similar policies, thereby fuelling the trend of fragmentation of trade, foreign direct investment and bank financing. This could drive up costs in open economies like the Netherlands, as the scenario results show.

This means policies aimed at reducing economic dependencies must therefore be selective. At the very least, they must not undermine the European single market, and ideally strengthen it. The latter would give companies more opportunities to be internationally competitive while reducing the strategic dependence of the Netherlands and other EU member states on other world regions.

DNB Analysis - Geo-economic fragmentation: economic and financial stability implications

Discover related articles

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.