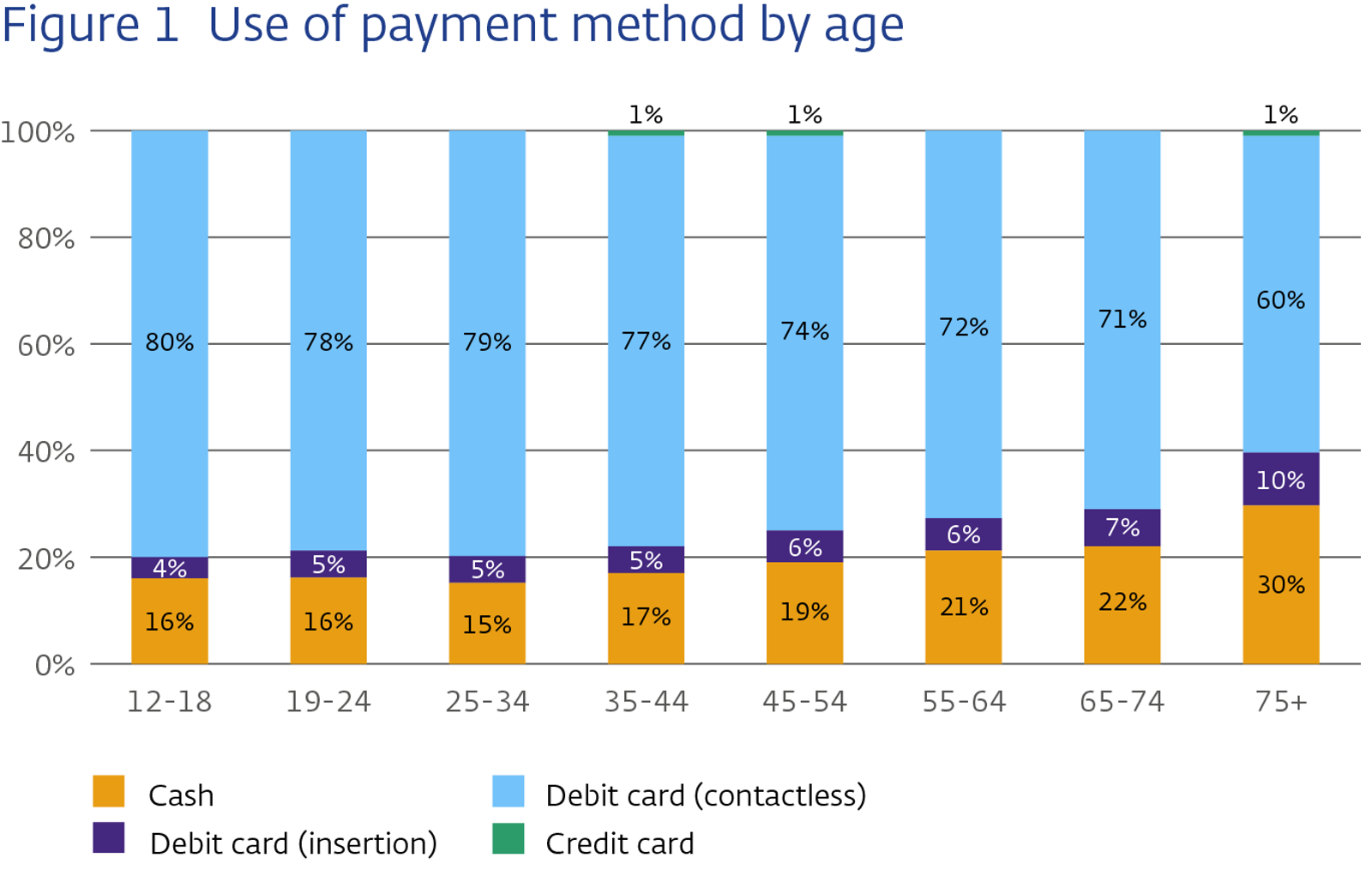

Younger and older people in particular are more likely to pay by debit transaction

The share of debit transactions in total payments at the checkout remained unchanged at 80% in 2024, but there are notable outliers among certain age groups. In particular, young people aged between 12 and 18 and older people aged between 65 and 74 were more likely to pay using a debit card, mobile phone or smartwatch than a year earlier, according to a joint study conducted by the Dutch Payments Association (Betaalvereniging Nederland) and De Nederlandsche Bank (DNB).

Published: 01 April 2025

© iStock

Young people aged between 12 and 18 made more debit payments last year than in 2023. The share of debit payments in this age group grew by 6 percentage points, from 78% in 2023 to 84% in 2024. Older people between 65 and 74 years also opted for debit payments more often, with the share of these payments increasing by 3 percentage points, from 75% to 78% (see Figure 1). For most other age groups, the share of debit payments decreased slightly or remained the same, leaving the total share of debit payments unchanged in 2024.

© DNB

Payment by mobile phone increasingly popular

The number of point of sale (POS) payments grew by 3% to 7.2 million in 2024. Of these, 19% were paid in cash and the rest with a debit card, mobile phone or smartwatch. Less than 1% of all payments were made by credit card. The value of all these payments rose 4%, to €178 billion. Strikingly, the value of all cash POS payments rose sharply (+11%), while the number of cash payments remained roughly stable.

Of all POS payments, 80% are debit payments; this share is unchanged from previous years. The share of POS payments made by mobile phone grew again in 2024, although this increase was less pronounced than in previous years (see Figure 2). With the rapid rise of debit cards on devices such as mobile phones or smartwatches, contactless payment options are now available anytime, anywhere at Dutch retail outlets.

More than 6% of POS payments are still made by inserting a debit card into a payment terminal. This was the case in 24% of payments five years ago. Consumers are more likely to insert their debit cards for higher amounts, despite also having the option of contactless payment. Entering a PIN is always required for debit payments of €50 or more.

© DNB

P2P payments more frequently electronic

Person-to-person (P2P) payments – to relatives, friends, colleagues and acquaintances and for school, sports and other informal activities – are also included in the survey. These payments are also being made electronically more and more often, in particular through payment request apps such as Tikkie.

The number of P2P payments grew by 5% in 2024 to 584 million. 64% of these payments were electronic, up 4 percentage points on the previous year. The total value of P2P payments rose 23% to €29.2 billion. Of this amount, €20.4 billion (70%) was paid electronically.

Electronic P2P payments saw the strongest growth among young people aged between 12 and 18 and among older people. The share of electronic payments among young people increased by 6 percentage points to 70%. Among people aged between 55 and 74, this rose even more sharply, by 8 to 9 percentage points.

Factsheet Point of Sale Payments in 2024

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.