The purpose of the CCyB is to increase banks' resilience as cyclical risks build up, and to release the buffer as soon as risks materialise. This gives banks additional headroom to absorb losses in bad times and supports lending to businesses and consumers, thus limiting the immediate impact of a crisis on the real economy. The CCyB applies to domestic exposures and has a mandatory reciprocity of up to 2.5%. Therefore, as of 31 May 2024, foreign banks with exposures in the Netherlands must also hold capital due to the 2% CCyB that applies here.

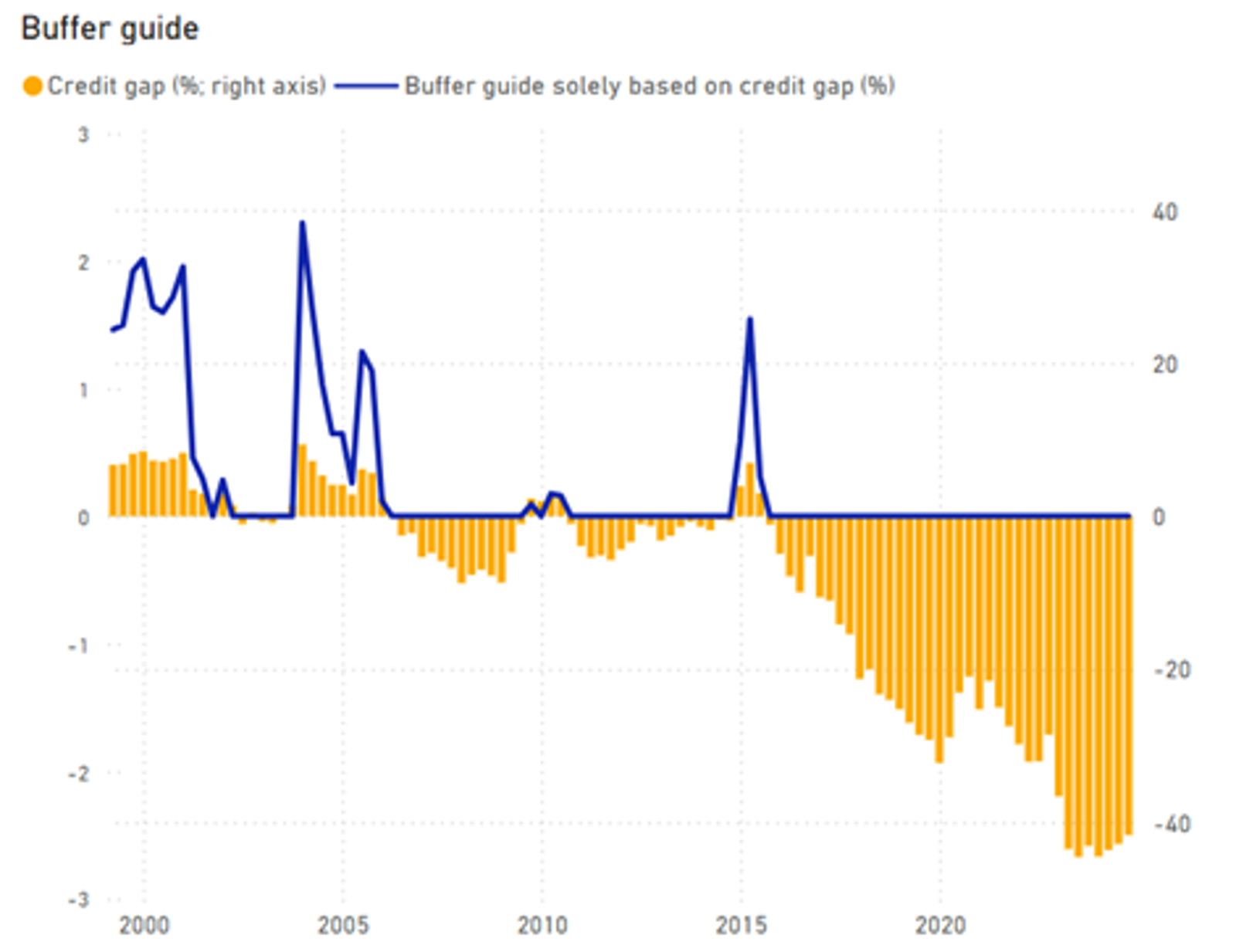

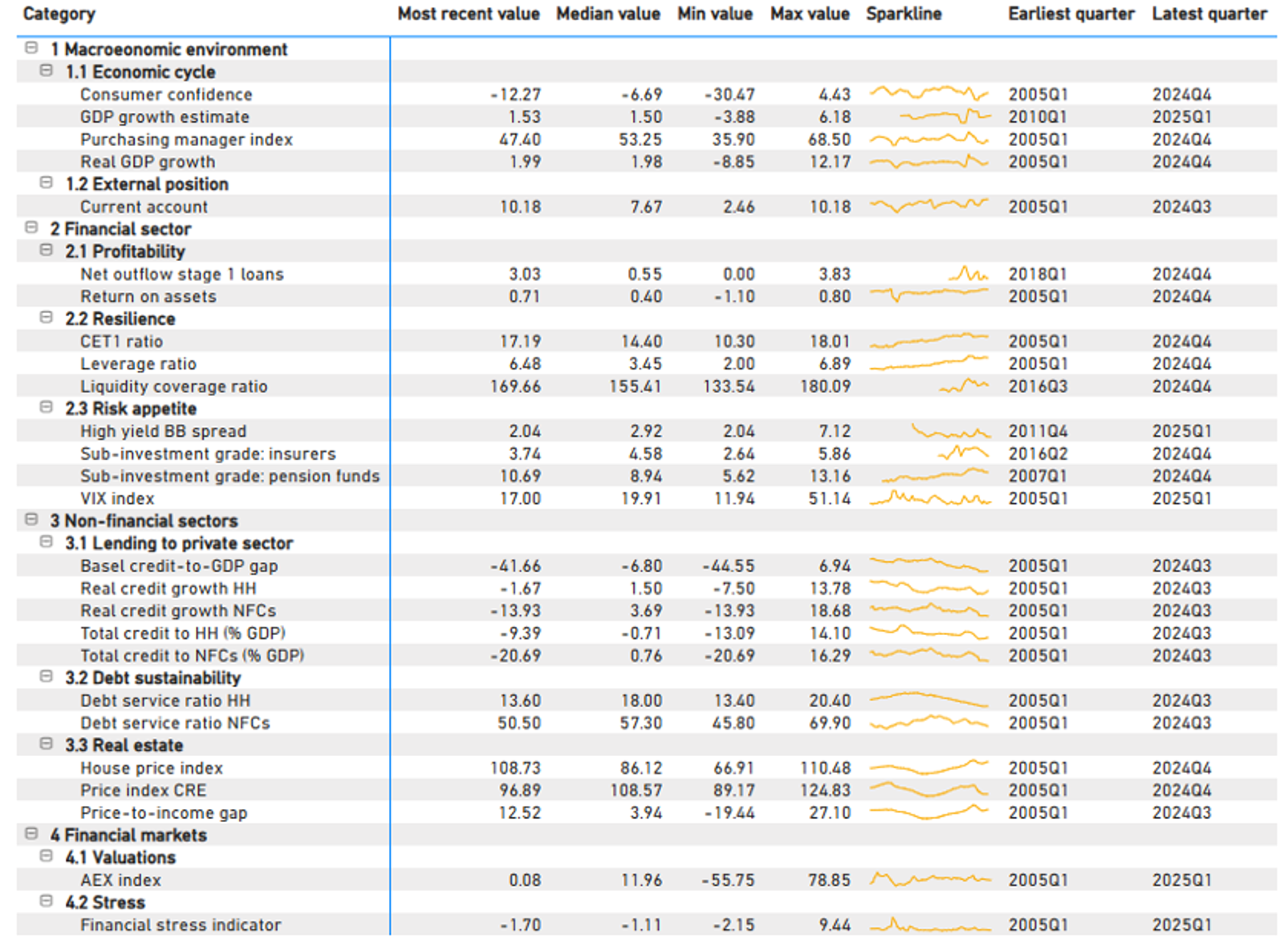

In accordance with DNB’s framework for setting the CCyB, we aim for a 2% CCyB in a standard risk environment, i.e. a situation where cyclical systemic risk is neither particularly high nor particularly low. In doing so, DNB seeks to take account of the inherent uncertainty involved in measuring (cyclical) systemic risks. DNB then determines the level of the CCyB on the basis of a varied set of indicators (including the credit gap shown in Chart 1, but primarily on the indicators in Table 1) that help to assess the phase of the cyclical systemic risk and compare it with a structural trend.

Our Spring 2023 Financial Stability Report contains a detailed description of why DNB thought it was suitable to raise the CCyB to 2%. Banks with loans outstanding in the Netherlands must comply with this requirement since 31 May 2024. DNB considers the current level of the CcyB remains suitable in light of the current risk environment. DNB therefore sees no reason at this stage to amend the level of the CCyB.