In recent years, concerns have grown about unintended side effects of anti-money laundering efforts by banks, including unnecessary burdens on customers, restricted access to payment services, operational pressures and (indirect) discrimination. Especially in low-risk situations, it is not always clear whether banks’ efforts are proportionate. Complaints received by DNB and other indicators raise the question of whether current practices in such cases are proportionate to the actual money laundering risk.

We carried out an exploratory survey at five Dutch banks in 2025 on proportionate application of the Wwft to customers with a low risk of money laundering and terrorist financing. The survey was prompted by indications that some Wwft procedures are seen as excessive, particularly for low-risk customer groups.

The aim was to understand how banks are tailoring their Wwft procedures for customers with low-risk profiles. The survey follows up on our previously published report From recovery to balance, which highlights the importance of a risk-based approach.

Four specific customer groups were targeted in the survey: charities and religious organisations, homeowners’ associations, small SMEs/retail customers and politically exposed persons (PEPs).

Banks acknowledge importance of proportionality

The survey reveals that banks acknowledge the importance of proportionality and have already taken steps in this area. There is a clear willingness to better align procedures with customer risk profiles. At the same time, banks report facing constraints. This could lead banks to take measures that are more burdensome than necessary, placing disproportionate pressure on customers and causing inefficiencies in operations.

These constraints are closely related to the areas of tension inherent in a risk-based approach. A risk-based approach requires banks to exercise professional judgement about risks and to take appropriate measures. Exercising professional judgement may involve asking customers probing questions or assigning them a higher risk rating as a precaution, even when their risk profile is acceptable. This conflicts with the principle of proportionality.

In addition, sound risk assessment requires sufficient customer information to build a complete picture and comply with the Wwft. However, the pursuit of completeness can lead to administrative burdens and frequent customer queries, which may clash with customer-centric service and efficiency, especially when banks request more information than needed to compile a risk profile, perhaps even overstepping legal requirements.

Constraints in applying proportionality

- This tension shows why proportionality is not always easy to achieve in practice. Banks are sometimes hesitant to scale back measures, even when no significant risks are identified. The survey highlights several contributing factors:

- Risk aversion and procedural certainty Although the Wwft calls for a risk-based approach, in practice the focus often shifts toward strict compliance with rules and procedures. Analysts sometimes perceive their freedom to exercise independent professional judgement as limited, which may occasionally result in risk-averse behaviour.

- The dynamics of feedback We observe that, in practice, assigning higher risk ratings is typically considered the safest choice. Oversight and control functions tend to put more emphasis on high-risk cases and cases wrongly classified as low-risk than on those receiving an excessive risk classification. As a result, feedback from these functions appear to exert upward pressure on customer risk ratings.

- Impact of published risk indicators Various organisations publish risk indicators to support institutions in assessing financial crime risks. To avoid missing potentially relevant signals, banks often consider all of this available information. In practice, these indicators are sometimes interpreted as automatic triggers for action. The presence of a single risk indicator in a customer file may lead to additional measures, regardless of the broader customer profile and overall risk assessment.

- Knowledge and professionalism in risk assessment In practice, the knowledge and subject-matter expertise of employees are essential for appropriate customer handling – particularly when working with specific customer groups such as religious institutions and foundations. A solid understanding of the customer’s nature, context and activities is crucial for assessing risks carefully and proportionately. The degree of distance from the customer also plays a role. When bank staff operate mainly at a distance and have limited insight into the customer’s day-to-day operations, it becomes more difficult to make accurate risk assessments and apply suitable measures.

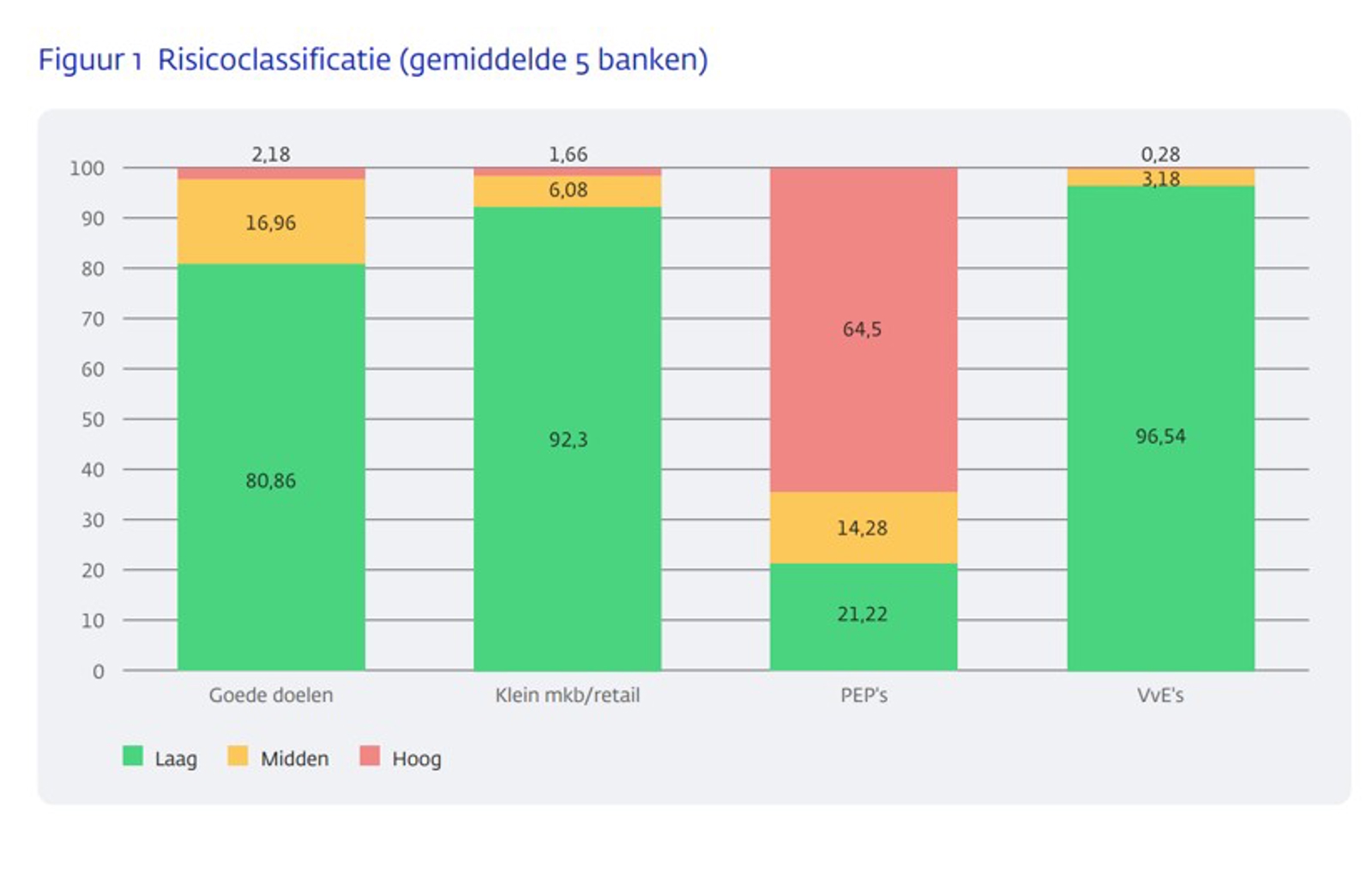

Results of risk classification by customer group

Banks classify their customers into risk categories, typically: low, medium and high. This classification determines the measures a bank applies when initiating and maintaining a customer relationship. The survey of the four customer groups reveals that customers in the homeowners’ associations and small SME/retail groups are predominantly classified as low risk. In contrast, greater variation is observed in the risk ratings for charities and, in particular, politically exposed persons (PEPs). Where customers are not classified as high-risk, additional burden does not stem solely from the risk rating. Other factors, such as internal procedures, interpretation of risk indicators, oversight procedures and differences in customer files, also play a role.