Why the ECB has lowered its policy rate

In July 2022, the ECB began raising its policy rate to curb persistent price rises. After the rate was raised to 4%, it is now being lowered again. Does this mean the era of inflation has come to an end? An update on the outlook for inflation.

Published: 10 June 2024

Euro area inflation rose sharply throughout 2021 and 2022, peaking at 10.6% in October 2022. To counter this trend, the ECB began rapidly raising its policy rate in the summer of 2022, up to 4% by September 2023. Although the interest rate has not risen further since then, its high level helped to slow inflation (read our explainer on how this works).

How the ECB's policy rate affects the economy

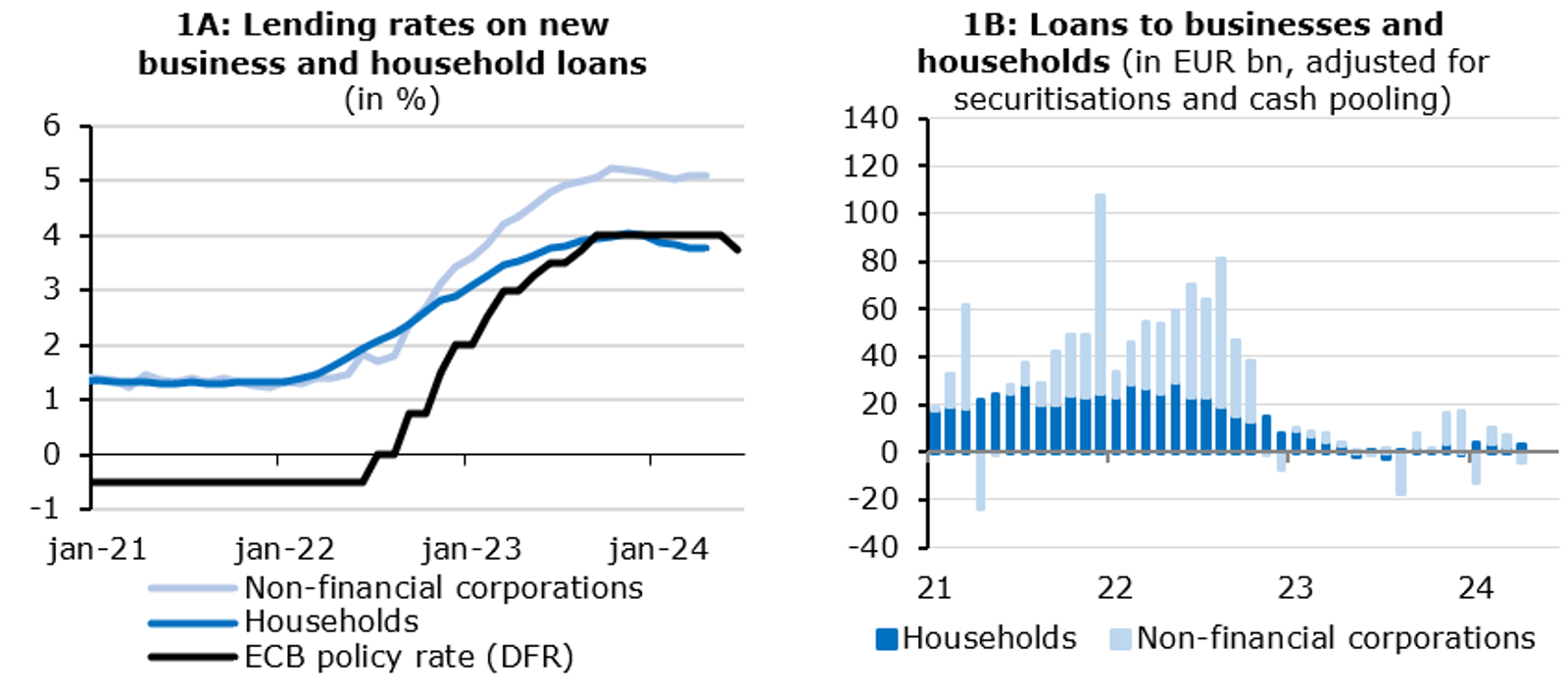

The impact of the ECB's interest rate policy is reflected in the development of lending rates and credit growth. Figure 1A (left) shows that lending rates for both businesses and households have risen sharply in line with the ECB's policy rate. This means that it has become more expensive for businesses to invest, while households have to consider higher mortgage interest rates when buying a home. Consequently, borrowing money has become less attractive. This can be seen in Figure 1B (right), which shows that lending declined sharply from the second half of 2022. Loan growth to both businesses and households has been close to zero for some time. This has put the economy in a lower gear, which is also reflected in euro area economic growth figures and has led to a fall in inflation.

Figure 1 - Development of lending rates and credit growth in the euro area

Inflation has fallen sharply

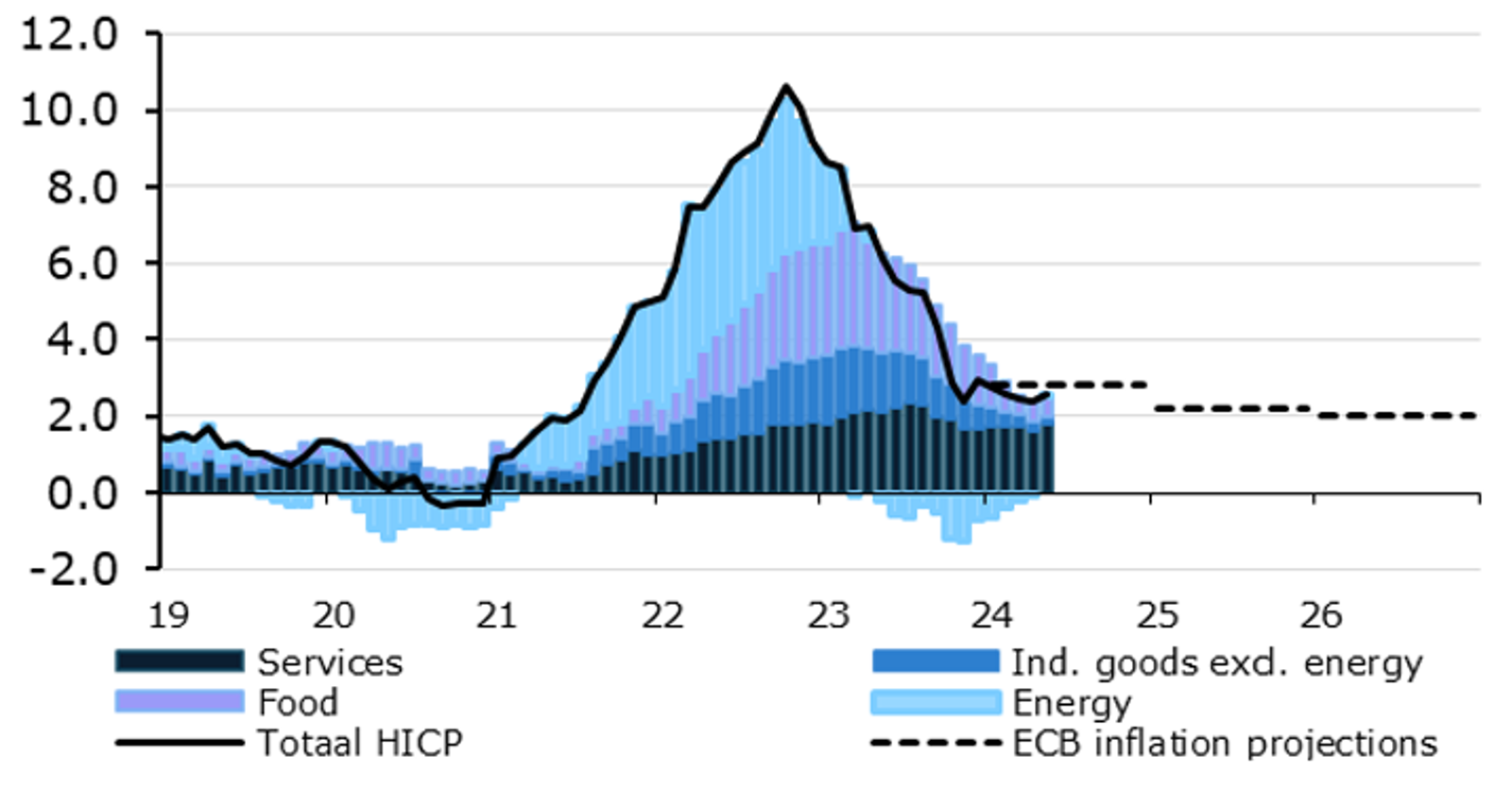

In the meantime, inflation has fallen sharply (see Figure 2). Inflation in the euro area averaged 5.4% in 2023, down significantly from the 8.4% average for 2022. The ECB's monetary tightening has contributed to this, but falling energy prices and decreasing bottlenecks in global supply chains have also helped to lower inflation.

In recent months, the drop in inflation has been a bit bumpy, but nevertheless, at 2.6% in May, it was significantly lower than in 2022 and 2023. As with the rise in inflation in 2021 and 2022, the fall in 2023 was first reflected in the energy component. The reason is obvious: energy prices in 2023 were a lot lower than the record highs of the summer of 2022. Gradually, most other components of inflation, such as food products and goods, also declined. Prices did remain at a higher level than before, however.

Figure 2 - Euro area inflation and component contributions

Annual inflation change in % and component contributions in percentage points

The services inflation component showed the smallest decline. In May, it stood at 4.1%. Services include prices for organised travel, restaurants and public transport, for example. Prices for services remain higher because they are largely driven by labour costs, and these are still rising relatively fast at the moment. In the first quarter of 2024 we see that wage growth (excluding one-off remuneration) in the euro area is no longer accelerating, and is even showing signs of moderation. Looking at recently concluded collective labour agreements, we can assume that this decline will become more evident after the summer.

Services inflation will remain somewhat higher for some time due to the significant rise in labour costs. However, to achieve an average inflation rate of 2% – the ECB's target – not all individual components need to be at or below 2%. Relatively low energy and goods inflation may offset somewhat higher services inflation.

Why is the ECB lowering its policy rates now?

In the most recent ECB projections, inflation in euro area countries is still expected to go up and down until the end of 2024, mainly due to fluctuating energy prices and temporary government measures. For 2025, the ECB projects inflation in euro area countries to fall to 2.2% in 2025, with a further decline to 1.9% in 2026. Because it takes time for policy rate cuts to work their way through to the economy, the ECB is already cautiously taking its foot off the brake.

Will inflation go up again when policy rates are lowered?

Although the ECB has lowered the interest rates, monetary policy is still having a cooling effect on the economy and inflation. This cooling effect is beneficial, because inflation – although it has fallen sharply – has not yet returned to its 2% target. The policy rate is currently still well above the estimated equilibrium interest rate. This is the neutral level of interest rates at which the economy is neither stimulated nor cooled, keeping inflation stable. As long as the interest rate is still above this level, the current monetary policy has a tightening effect, contributing to a decline in inflation.

The fact that the ECB lowered its policy rates on 6 June does not mean it will do so again during the next monetary policy meeting. That will depend on the extent to which the expected fall in inflation becomes a reality. The ECB will pay particular attention to wage growth and related service inflation in this context, assessing the economic situation on a meeting-by-meeting basis without speculating about future decisions.

Discover related articles

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.