Protracted coronavirus crisis could severely hit the Dutch financial sector

Published: 08 June 2020

The economic crisis brought about by the coronavirus (COVID-19) pandemic is also affecting the financial sector. Risks to financial stability will grow as long as the crisis continues. Two key differences as compared to the 2008/2009 financial crisis are that this time the cause lies outside the financial sector and that the banks currently have significantly higher buffers. Consequently, they are better placed to maintain their lending to businesses and consumers.

Nederlandsche Bank (DNB) stresses this in its semi-annual Financial Stability Report (FSR). DNB notes that uncertainty about the economic impact of the pandemic is still exceptionally high. The longer social distancing measures have to remain in place, the greater the impact will be.

Financial markets have recovered after the initial sharp market correction, but financing conditions remain less benign than at the start of the year. Although market sentiment reversed following intervention by governments and central banks, nervousness still prevails in the markets. Even though sentiment is currently upbeat, renewed price drops cannot be ruled out.

Banks are being hit, but thanks to higher buffers they are better able to maintain their lending to healthy businesses. Nevertheless, banks’ profitability – already under pressure from low interest rates – is being further eroded by rising loan losses, higher funding costs and falling incomes.

Insurers and pension funds are also being affected by developments in financial markets, particularly as they see the prices of their assets drop. Most notably, the pension funds’ already vulnerable financial position has deteriorated further.

Pandemic stress test

A pandemic stress test conducted by DNB shows that the longer it takes for the economy to recover from the coronavirus crisis, the more serious the ramifications for Dutch banks will be. The stress test is intended to identify potential vulnerabilities in the Dutch banking sector in the event that severe economic scenarios materialise.

In a “severe” scenario, which assumes a lengthy lockdown period with strict social distancing rules, the Dutch economy contracts by almost 12% in 2020. Dutch banks’ capital ratios could drop by one-third, with the average CET1 ratio sliding from 16.5% at year-end 2019 to 11% at end-2022. Loan losses could reach EUR 23 billion. On the positive side, their relatively high capital ratios enable banks to absorb these losses without significant impact on lending levels.

The banks’ absorption capacity is not unlimited, however. To illustrate this, the FSR also contains a “perfect storm” scenario, in which exceptional developments are mutually reinforcing. In this scenario, the Dutch economy also contracts substantially in 2021, only to pick up tentatively in 2022. The banks’ loan losses could rise to around EUR 40 billion. Before this point is reached, however, banks will want to scale back lending to businesses and households to limit their losses and prevent their capital ratios from getting uncomfortably close to the minimum requirements. This will hamper the banks in playing their role in economic recovery, which will amplify the blow dealt to the economy.

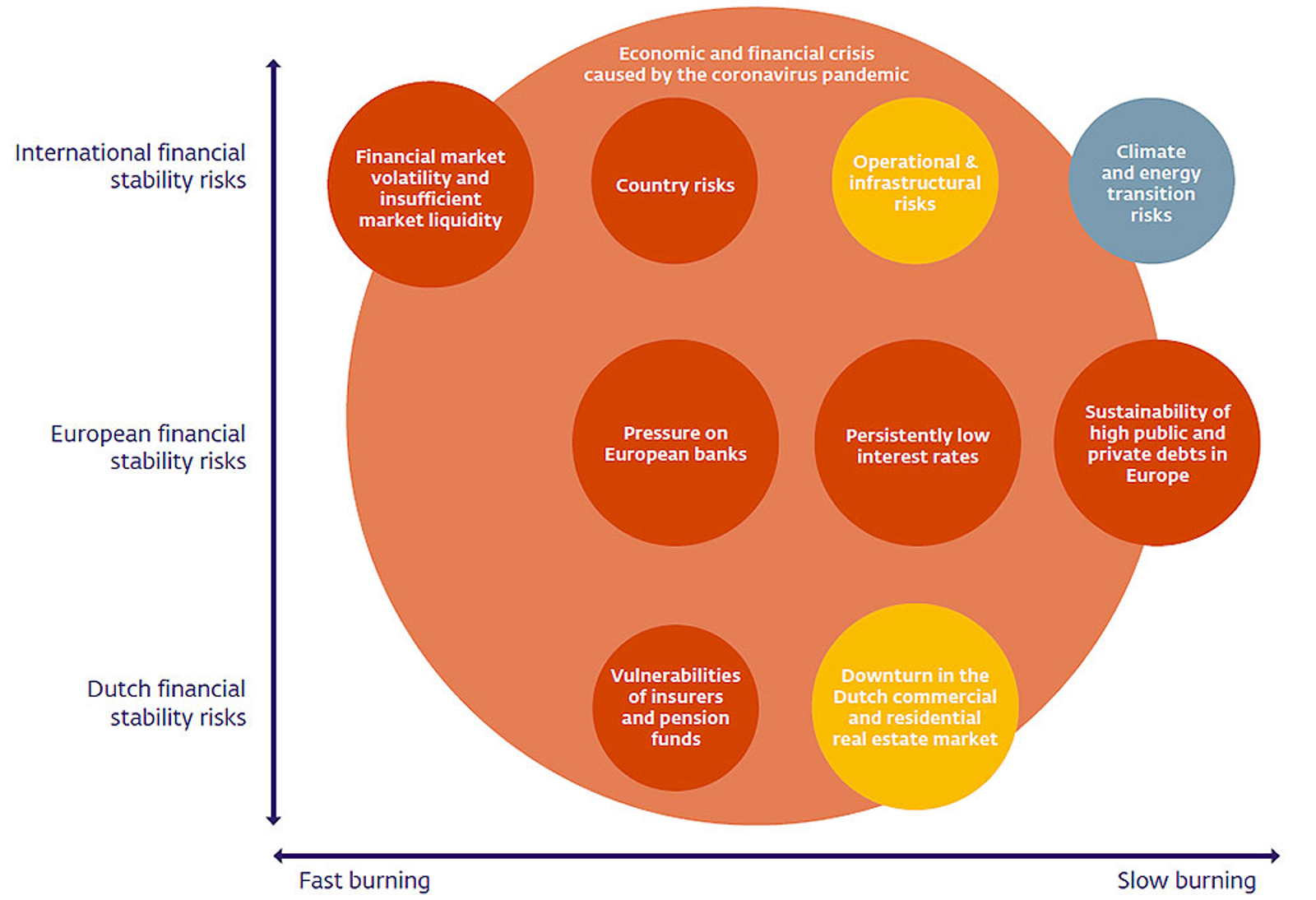

Risk map

The FSR includes a risk map showing the principal risks to financial stability. The biggest risk shown is that of an economic and financial crisis due to the coronavirus pandemic. Other risks to financial stability are mostly related to the coronavirus crisis: financial market volatility and insufficient market liquidity, pressure on banks, sustainability of public sector and private sector debt, vulnerabilities of insurers and pension funds, and risks in the commercial real estate market.

Discover related articles

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.