SEPA and IBAN discrimination

The Netherlands is part of SEPA. SEPA stands for Single Euro Payments Area: a single European payment market for non-cash euro payments. Anyone making cross-border euro payments within SEPA by bank transfer or direct debit can do so as quickly, easily and securely as in their own country, at no extra cost.

Some firms or other institutions may refuse to accept your bank account number issued in the Netherlands or in another European country for making transfers or direct debits. If this is the case, you could be the victim of IBAN discrimination.

SEPA

SEPA provides consumers, firms and institutions with a single efficient infrastructure for non-cash payments in euro. Within SEPA uniform standards apply to payment accounts (IBANs), European transfers - including instant transfers - and European direct debits in euro. This means you can pay within SEPA as quickly, easily, securely as at home, with no extra charges. Within SEPA there is no longer a distinction between domestic and cross-border non-cash euro payments. To get where we are now, the technical, legal and commercial differences between the typically domestic-oriented non-cash payment systems of participating countries have been eliminated since SEPA was launched in 2008. The European Central Bank (ECB), De Nederlandsche Bank (DNB) and other national central banks in Europe continue to promote the further integration of and competition in the European payment market. SEPA has been enshrined in law in the European SEPA Regulation for European Union (EU) Member States and European Economic Area (EEA) countries, including in the SEPA Regulation.

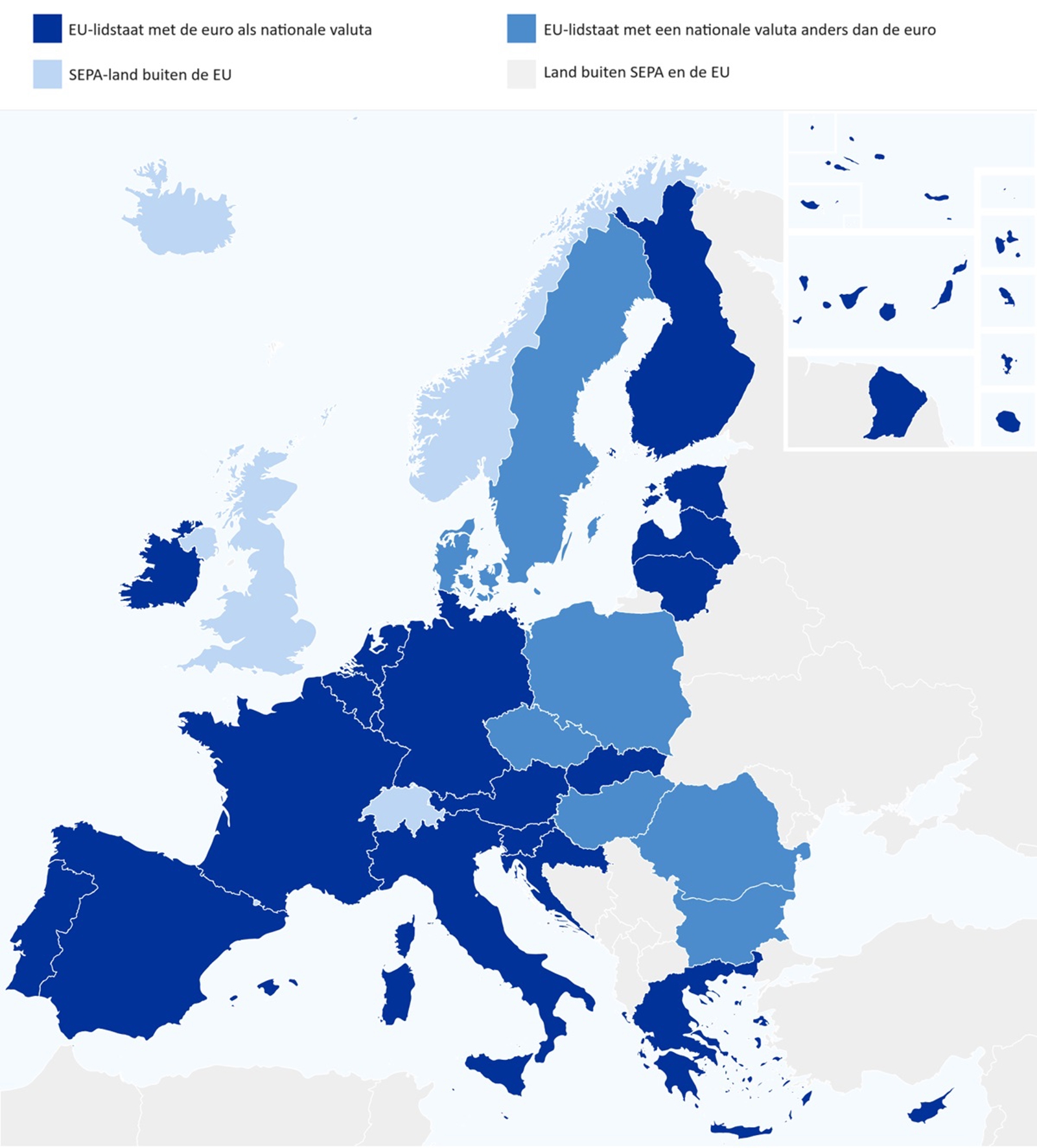

SEPA countries

Not only the countries that have adopted the euro are part of SEPA. There are 36 European countries participating in SEPA, including some countries that are not part of the euro area, the EU or the EEA, such as the United Kingdom and Norway.

IBAN discrimination

Thanks to SEPA, you can use a single payment account for your euro transfers and direct debits and do not need to open several payment accounts in different SEPA countries. Your payment account is identified using its International Bank Account Number (IBAN).

What is an IBAN?

The International Bank Account Number (IBAN) is an international standard for payment accounts. Your IBAN consists of a unique string of digits and letters that identifies your payment account in SEPA and beyond. Each IBAN starts with two letters denoting the country in which the payment account is held, e.g. 'NL' for the Netherlands, 'BE' for Belgium, 'DE' for Germany and 'FR' for France. The country code is followed by two check digits and then a country-specific account number. For example, a fictitious Dutch IBAN looks like this: NL 99 BANK 0123456789. Dutch IBANs always contain 18 characters and consist of a combination of 14 digits and 4 letters, with the letters denoting the payment account provider. The default length of the IBAN may vary from country to country and can be up to 34 characters. For example, a fictitious German IBAN is DE 89 370400440532013001, and a fictitious French IBAN is FR 14 20041010050500014M02606.

What is IBAN discrimination?

Within the EU/EEA, no distinction may be made based on the EU Member state of EEA country in which the euro payment account is held. If this does happen, however, it is considered IBAN discrimination.

IBAN discrimination is not allowed under the European SEPA Regulation (EU 260/2012). A payer or payee must not only accept a Dutch IBAN for transfers or direct debits, but also euro IBANs from all other countries in the EU/EEA. Sanctions may be imposed in the event of IBAN discrimination. In the case of IBAN discrimination, we may impose an order subject to penalty or a fine.

Some examples IBAN discrimination

You applied for a job in the Netherlands and were hired. To receive your salary, you provide your IBAN to your new employer. You hold your euro payment account at a bank in another EU/EEA country, e.g. Germany. However, your new employer refuses to use your payment account number because it only wants to pay salary amounts to Dutch IBANs, starting with the 'NL’ country code.

This constitutes IBAN discrimination. According to the SEPA Regulation, this is the case when an IBAN from another EU/EEA country is rejected for the transfer or direct debit of a euro amount between the payer's payment account and that of the payee. You provided your German IBAN, starting with the country code 'DE', to your employer to receive your salary. Your new employer is an institution, and we can hold it accountable for non-compliance with the SEPA Regulation.

A firm or institution in the EU/EEA can decide how it wants its customers to pay. For example, it may provide its customers with a direct debit (in euro) to pay for its product or service. If it chooses to do so, it must accept all IBANs issued in the EU/EEA as payment accounts from which to collect payment. If the firm or institution does not accept all IBANs, this is IBAN discrimination.

What is not covered by IBAN discrimination?

Under the SEPA Regulation, some situations are not considered IBAN discrimination. Below are some examples.

Under the SEPA Regulation, some situations are not considered IBAN discrimination

You have a payment account that you hold with a Belgian bank. Your IBAN therefore starts with the country code 'BE'. You would like to open a savings or investment account with a financial institution in the Netherlands. However, that institution refuses to open your account if your Belgian IBAN is to function as the contra account.

According to the SEPA Regulation, IBAN discrimination occurs if a firm or institution in the EU/EEA rejects an IBAN from another EU/EEA country for the transfer or direct debit of a euro amount between its own payment account and that of the payee.

You can make payments to and receive payments from others using your payment account. Normally speaking, you cannot do so using your savings or investment account. With these types of account you can only transfer money to a contra account you specify in advance. This means a savings or investment account is not a payment account. The ban on IBAN discrimination does not apply to transferring amounts to and from a savings or investment account.

An electronic payment request usually contains a payment link or QR code. By clicking on the link or scanning the QR code, the payer can usually transfer the amount using their own banking app in a convenient way. This is because the payee's account number and (often) the amount are given in the transfer order. However, the SEPA Regulation stipulates that payment requests are not covered by the ban on IBAN discrimination. This is because payment requests are not indispensable or mandatory for making and receiving transfers and/or paying by direct debit through a payment account.

Also, under the SEPA regulation, IBAN discrimination must involve a transfer or direct debit between a payer and a payee. A firm or institution operationally executing a payment request is not its payer or payee. The SEPA Regulation only covers euro transfers and direct debits that are made directly between the IBANs of the payer and the payee.

According to the SEPA Regulation, EU/EEA-based firms and institutions may not reject IBANs issued in other EU/EEA countries for making or receiving a euro transfer or direct debit.

It does not prescribe how IBANs issued in other EU/EEA countries must be provided and registered.

This means firms and institutions can specify how customers must provide an IBAN. They may opt to use online forms, but also use other channels, such as a telephone customer service or brick-and-mortar store or service point. Accordingly, an online may accept only IBANs starting with country code 'NL', while the firm or institution also accepts IBANs from other EU/EEA countries provided through its telephone customer service. If this is the case, the online form must clearly state this.

The SEPA Regulation and the ban on IBAN discrimination do not cover payments you make with your debit card or credit card for online and physical purchases, nor do they cover cash withdrawals from ATMs or bank branches.

What firms and institutions can do

Firms and institutions must set up their administrative ICT systems so that they can also process IBANs from other EU/EEA countries, such as in online forms, apps and accounting and customer management systems. If their systems are not yet set up for this they may process IBANs from other EU/EEA countries manually for the time being, for example through their customer service. In that case customer service staff must be aware that IBANs from other EU/EEA countries must be accepted, and inform their customers accordingly. Offering multiple payment methods may also help to prevent IBAN issues.

Reporting IBAN discrimination

If a firm or institution in the Netherlands rejects your euro payment account (IBAN) in another EU/EEA country, you may be a victim of IBAN discrimination. Use our online form to report this. But before you do, first read the information below.

- Read the following examples. The examples above will help you find out whether your case involves IBAN discrimination.

- First, file a complaint with the firm or institution involved. When considering your report, we will assume you have already filed a complaint with the firm or institution concerned. If your complaint is justified, the firm or institution must offer you a solution. If you feel you are not being offered an appropriate solution, you can report this to the registration centre for IBAN Discrimination. We will ask you to provide documentary evidence, such as emails or other correspondence with the firm or institution, showing that your IBAN from another EU/EEA country is rejected. The registration centre for IBAN discrimination will then investigate your report.

- Do you have a complaint about IBAN discrimination by a firm or institution based in another EU/EEA country? Then you can file your complaint with the supervisory authority in the country in which you experienced IBAN discrimination. The European Commission's webpage "IBAN discrimination” contains a list of the national supervisory authorities ensuring compliance with the ban on IBAN discrimination.

- We will inform you within three weeks whether your report will be considered. There need not always be IBAN discrimination, as you can see from the examples. We will inform you once we have completed our investigation. In handling your complaint, we observe the privacy rules of the General Data Protection Regulation (GDPR). Our statutory obligation of confidentiality prevents us from providing information about how we deal with your report or what its status is. Confidential information collected in the context of our supervisory task on compliance with the SEPA Regulation is subject to out statutory obligation of confidentiality under Section 1:89 of the Financial Supervision Act (Wet op het financieel toezicht – Wft).

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.