Circular Finance through the Circular Risk Scorecard

Circular businesses provide effective hedging of risks associated with linear economic thinking, such as operating under the false assumption of infinite availability and affordability of raw materials. These 'linear risks' threaten the future resilience of businesses and economies.

The financial sector largely determines the shape of our economy by deciding which parties and activities to finance. While circular businesses are more future-proof than traditional ones, banks still base their financing assessments on traditional considerations, without including, for example, the risks associated with high prices of materials, scarcity of critical raw materials and restricted access to raw materials due to geopolitical and climate change.

To achieve a more resilient economy, linear risks and circular opportunities must therefore be explicitly included in financing and investment decisions. At the same time, circular risk must be assessed more realistically by creating more future-oriented (risk) models and by looking for certainties in future cash flows, long-term stability and chain contracts.

The Risk project group, consisting of experts from Rabobank, ABN AMRO, ING, Triodos, ASN, NWB Bank and Invest-NL, started working on developing a method to assess the financing of circular entrepreneurs through a 'circular lens’. They have developed a generic, open source tool with which the opportunities and risks of circular businesses can be assessed more realistically: the Circular Risk Scorecard (CRS).

Purpose of the Circular Risk Scorecard

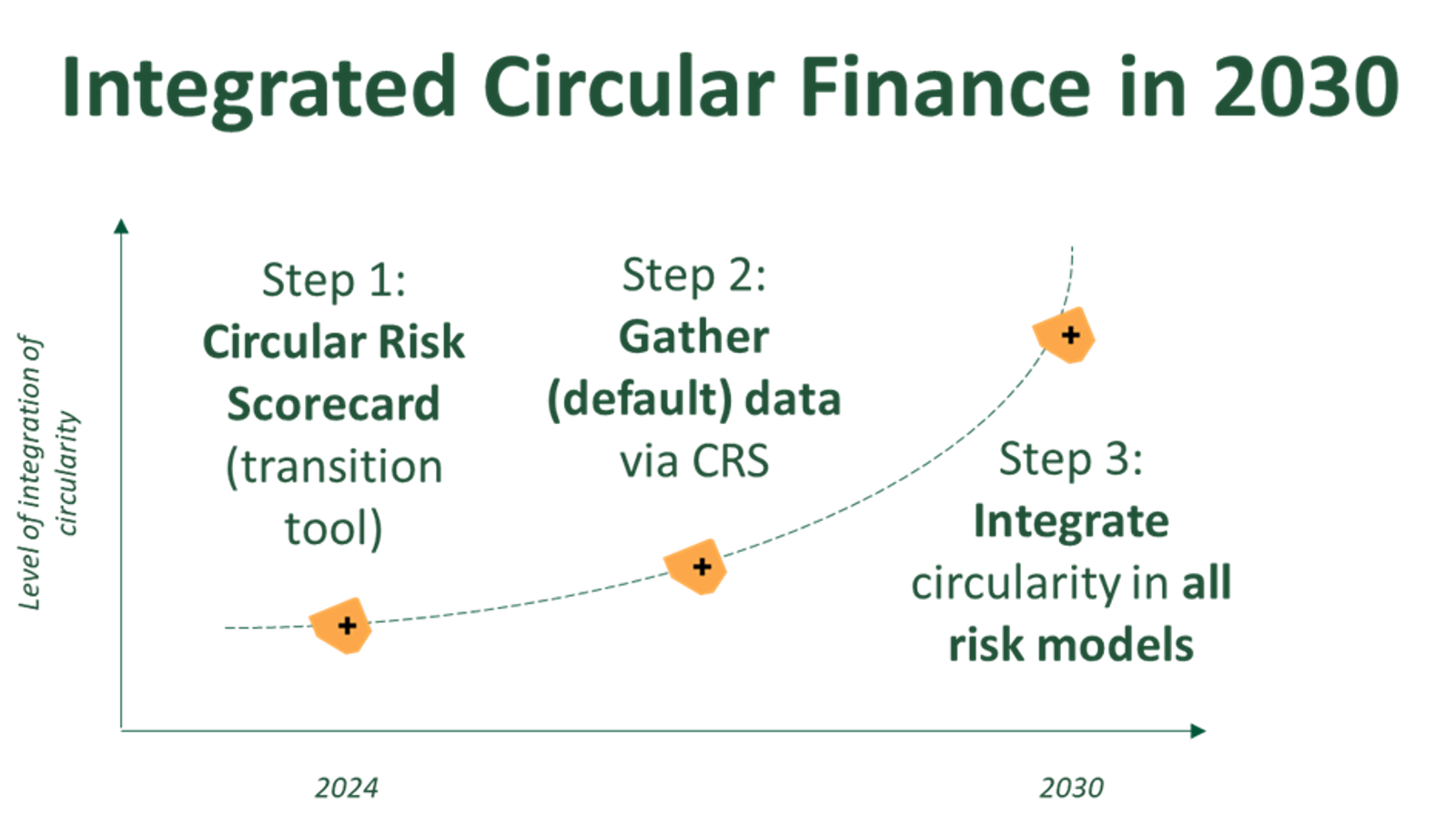

Primarily, the CRS is a tool that can be used to make a more realistic assessment of a company's long-term business risks (step 1). In addition, the CRS offers a way to collect (anonymised) data about (default) risks of circular (and non-circular) businesses (step 2). This (anonymised) data can be used to link circular risks and opportunities to the continuity of circular businesses. This is part of the transition towards a circular standard in financing in 2030 (step 3). This objective has been set in the: the Circular Financing Roadmap 2030 (Dutch).

Content of the Circular Risk Scorecard

The CRS calculates a risk score between 0-100, in which a low score corresponds to a low circular risk profile. The score is determined based on a total of six risk factors, three of which are not currently included in the existing risk models:

- the circularity of the product

- the suitability of the product for circularity

- the scarcity of the raw materials used

In addition, the score is determined by three risk factors that are currently included in the existing risk models, but which are viewed in the CRS through a 'circular lens' and are therefore assessed differently:

- the robustness of the contracts

- market competitiveness

- the experience of the management team

Application of the Circular Risk Scorecard

The CRS can be used/applied in several ways, namely as:

- Adjustment of risk perception and/or pricing via the existing risk models at banks (in addition to the existing risk models)

- Deal selection at financial institutions

- Training for financial institution employees

- Training for circular entrepreneurs

Access to the Circular Risk Scorecard

The CRS can be accessed via the following link: Streamlit (circularriskscorecard.streamlit.app

Guidance for the Circular Risk Scorecard

A manual for using the CRS is available.

Downloads

- Circular Risk Scorecard - a practical guide

- Circular Risk Scorecard - Executive Summary of analysis 100+ assessments

- Circular Risk Scorecard - Analysis 100+ assessments

Initial findings

In 2024, we assessed over 100 companies, both circular and traditional, linear companies, on the basis of the Circular Risk Scorecard. We found that circular companies have a significantly lower risk score than companies with linear business models. The following aspects largely explain this difference:

- Circular businesses have a management team that is more capable of leading an innovative and/or circular business, as well as being more diverse.

- Circular businesses are better at managing raw materials by creating cycles in their business models, avoiding raw material scarcity and price fluctuations.

- Circular businesses work better with their value chain partners, i.e. on a collaborative and strategic basis, rather than on a transactional basis.

- Linear businesses have potential to upgrade their products to circular designs, e.g. to modular, easily upgradable products.

- Circular businesses are better positioned to succeed in a future (circular) market and are better prepared for future sustainability-related laws and regulations.

See the above downloads for a two-page summary and a detailed analysis of our findings.

Training courses and workshops

We host regular training sessions and workshops on the Circular Risk Scorecard:

- Short sessions on results from the CRS collaboration

- 1-day Finance for Change course, addressing the broader transition to a circular economy

- 5-day Finance for Change course

If you are interested, register via the School for change website (Dutch).

Contact

For more information, contact Tessa Eerenberg (Tessa.Eerenberg@rabobank.nl) or Jeroen van Muiswinkel (jeroen@copper8.com). The Risk project group, part of the Circular Economy Working Group, is supervised by Copper8 and Zanders Group. Zanders Group developed the CRS.

The information and publications on this page reflect the considerations and efforts of the working group set up under the aegis of the Platform for Sustainable Finance. As a member, DNB supports the platform’s efforts, but the content does not necessarily represent DNB's official position.

Downloads

- Circular Risk Scorecard - a practical guide (06 February 2024 | 831KB PDF)

The information and publications on this page reflect the considerations and efforts of the Platform for Sustainable Finance. As a member, DNB supports the platform’s efforts, but the content does not necessarily represent DNB's official position.

© DNB

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.