© DNB

Data Science Hub

We have set up the Data Science Hub (DSH) to leverage data more smartly. This allows us to extract more value for our supervision, policies and research. In doing so, we value collaboration and partnership with financial institutions, and other central banks and supervisory authorities.

Data science

At DNB, we have a huge amount of data at our disposal. Often we can use those data much more smartly than we commonly do, and extract more value. The Data Science Hub helps us achieve our ambition of making our work more data-driven and digital, and thereby smarter. The Hub does so by providing guidance in data science projects and activities. For example, we use data science technologies such as machine learning to increase data quality or predict stress in certain markets or sectors.

Collaboration in data use

Data science is about data applications that make our processes more efficient or smarter, or both. We aim to work in collaborative settings and partnerships wherever we can, jointly developing applications that may also benefit other central banks and supervisory authorities. One of the collaborative tools we use is the DNB GitHub. Financial institutions are also working on smart data applications and we join forces in this area, for example through Iforum. Find out more about some of our smart data supervision projects: Dataloop, Know your Customer and Biodiversity.

Using data for research and advice

We also want to use data in a better and smarter way in our activities as a central bank. Higher-quality data analyses help us prepare better economic estimates, and they improve our understanding of the economy and inform our advice even better. We also use machine learning algorithms to optimise banknote sorting.

Economic sentiment indicator

A prime example of smart data use in research is the sentiment indicator. We created this indicator using complex algorithms based on almost one million news articles in the Dutch financial daily ‘Het Financieele Dagblad’. The indicator compares the newspaper’s sentiment with the state of the economy. This allows us to provide a more up-to-date picture of economic growth faster.

Data analysis of derivatives markets

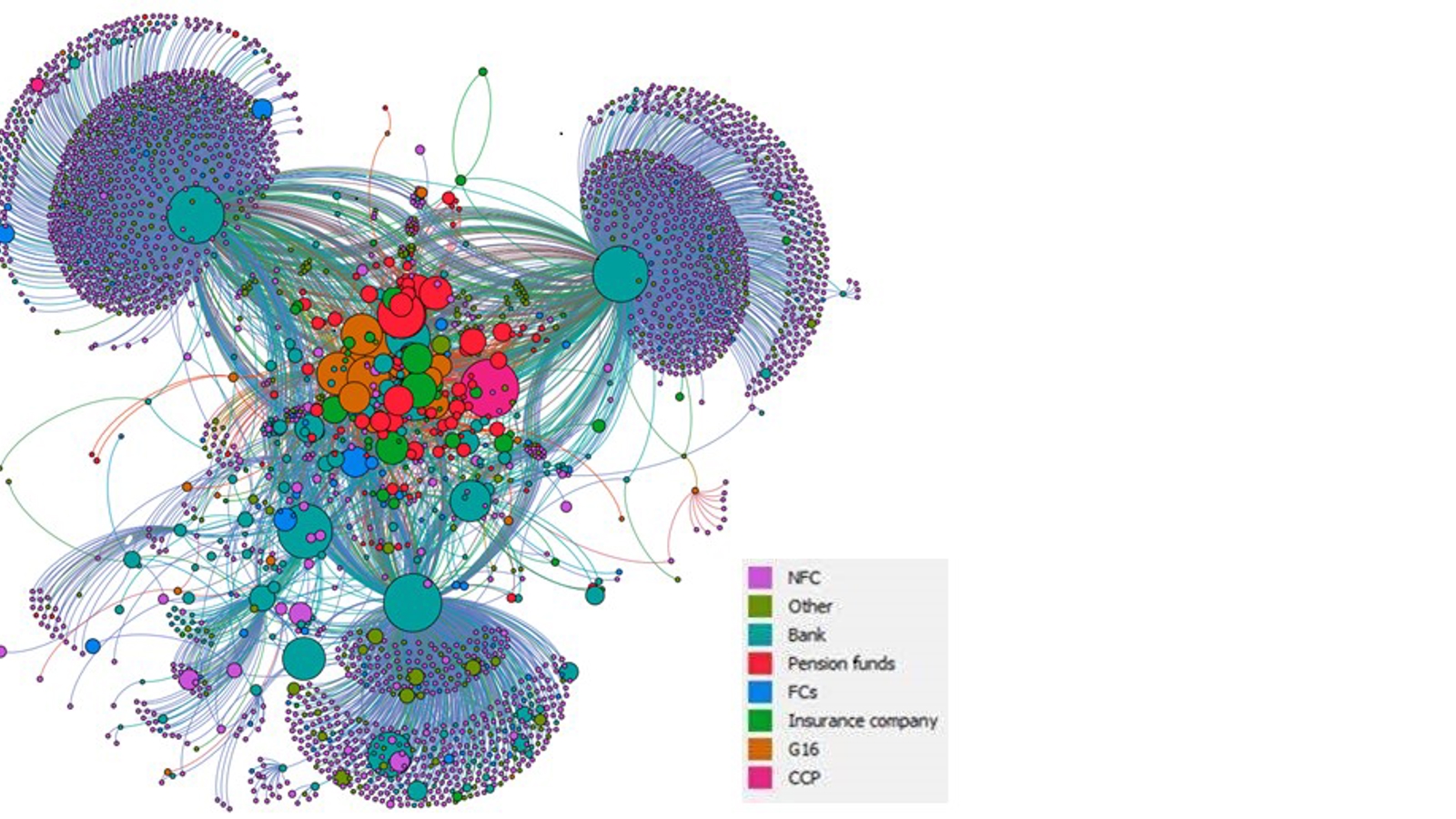

We also use data for market analysis and risk assessment, for example to collect data on the derivatives market. Market participants use derivatives for various purposes, such as hedging interest rate fluctuations. We collect granular data on all current derivatives contracts in the Netherlands to better assess interest rate and liquidity risks facing institutions and the market as a whole.

Netwerkvisualisatie van de Nederlandse derivatenmarkt gebaseerd op -data van European Market Infrastructure Regulation.

Banknote sorting algorithms

We check the quality of banknotes using large sorting machines. Banknotes that are still suitable for use are recirculated, while those that are contaminated or damaged are destroyed. We use machine learning algorithms to optimise these checks. This saves costs and reduces our ecological footprint. The cost of producing a single new banknote is a mere seven cents, but savings at the European level add up to millions of euros.

Using data in our supervision

We share large amounts of data with financial institutions. Collaboration projects help us leverage data in our supervision more smartly. Find out more about data science in our supervision.

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.