Inflation falls as economic growth stalls

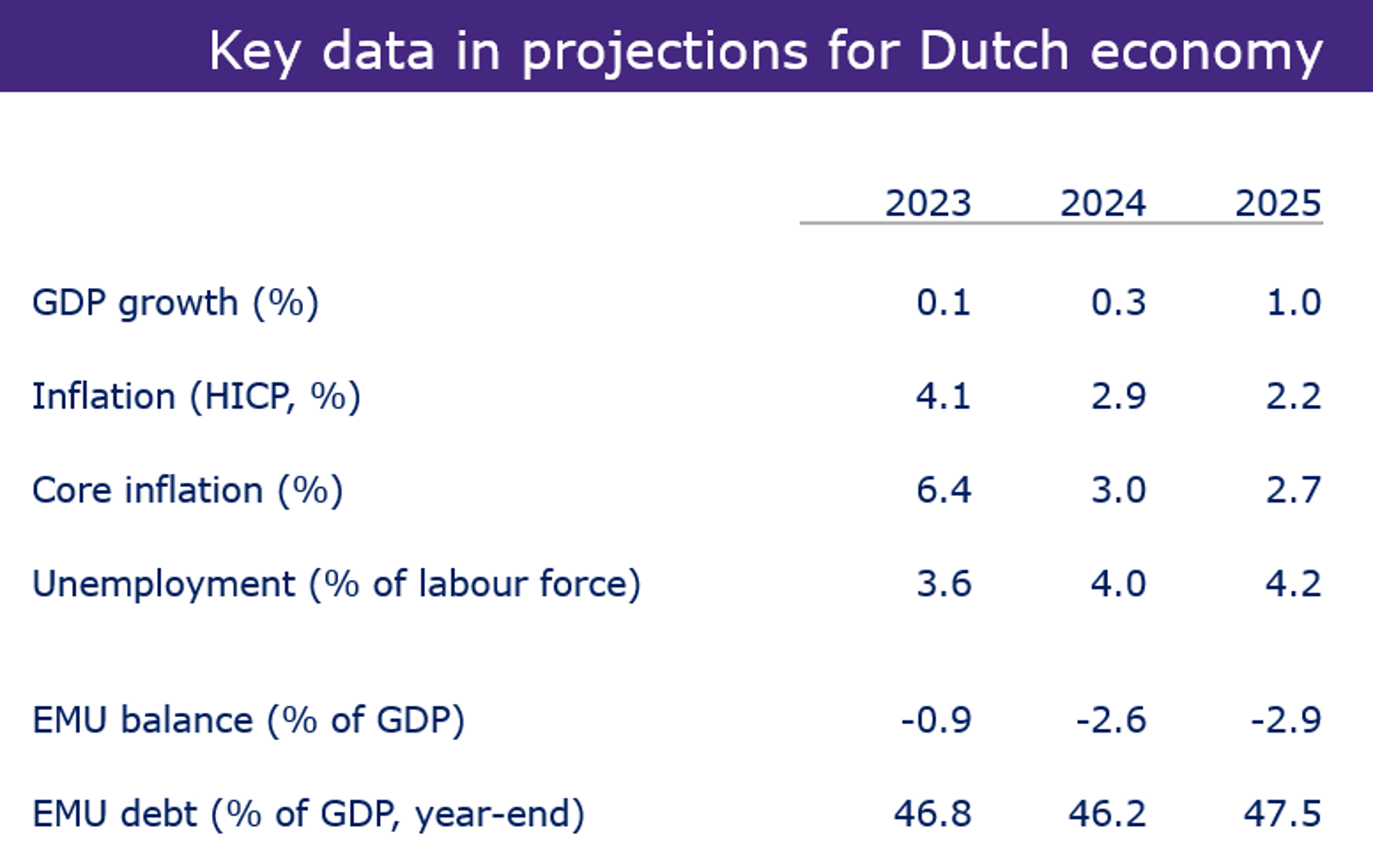

Inflation in the Netherlands is falling, owing in part to lower energy prices and a further cooling of the economy. Inflation will still be 4.1% this year; we expect inflation to fall to 2.9% next year and to decline further to 2.2% in 2025. The downside is that there is virtually no economic growth this year, also due to a drop in global trade. Gradual recovery in growth should follow over the next two years. These figures were revealed in the Autumn Forecasts released by De Nederlandsche Bank (DNB) today.

Published: 18 December 2023

© ANP

Inflation is falling slightly faster than we projected last June, mainly on the back of lower energy prices. In addition, the economy is cooling in response to the monetary policy of the European Central Bank and receding world trade. Economic growth this year is sharply lower than last year, when post-pandemic pent-up demand boosted growth. Gross domestic product (GDP) will increase by 0.1%, followed by 0.3% and 1.0% in 2024 and 2025.

Core inflation also falls

Economic growth is set to pick up in 2024 and 2025, mainly driven by domestic spending. Underlying core inflation – which does not reflect rises in energy and food prices – will still be 6.4% this year but then drop rapidly to 3.0% next year and 2.7% in 2025. This decline is also slightly faster than we projected previously.

© DNB

Growth to slump due to lower world trade and higher interest rates

The fact that almost no economic growth will remain this year is mainly due to slower growth in world trade and the recent rapid rise in interest rates. Central banks have raised interest rates around the world. This makes borrowing more expensive, stifles economic activity and thus depresses economic growth. Year-on-year growth in the Netherlands is barely positive, but the first three quarters of this year saw consistent contractions.

Higher government expenditure, particularly in the form of purchasing support, kept growth out of negative territory. This support boosts household consumption. Wage increases – which currently just outstrip inflation – also ensure people have more money to spend, which supports consumption as well.

Public sector deficit to rise sharply in the coming years

The general government budget deficit is still limited to 0.9 % of GDP this year. However, this situation will deteriorate rapidly in the years ahead, partly because more interest has to be paid on government debt. The deficit will then increase towards the EU threshold of 3%.

In 2024 (0.2%) and 2025 (0.2%), employment growth will almost come to a halt, while labour supply should show slightly stronger growth. As a result, unemployment will rise slightly in the coming years, to 4.2 % by 2025, The labour market is nevertheless set to remain tight.

Alternative scenario

Being a trading nation, the Netherlands will be hit hard if economic conditions deteriorate abroad, for example due to increasing uncertainties and geopolitical tensions. We have detailed this in an alternative scenario, in which growth is 0.7 percentage points worse next year than in the baseline scenario and 0.4 percentage points worse in 2025, resulting in growth of -0.4% and 0.6%.

Fiscal discipline is needed to absorb shocks

The likelihood of adverse economic risks materialising outweighs that of positive developments. It is not inconceivable that our alternative scenario will materialise, which makes fiscal discipline all the more important. Experience in recent years has shown that the government’s financial buffers have enabled the Netherlands to absorb the shocks caused by the COVID-19 pandemic and the energy crisis.

The budget deficit is expected to increase to 2.9% of GDP in the next two years, and the debt-to-GDP ratio will go up from 2025 onwards. This is partly due to the sharp rise in interest charges and the rising costs related to population ageing, healthcare and climate action.

It is therefore important to limit the deficit to 2% of GDP by the end of the new government term, in line with the advice issued by the Working Group on Fiscal Space. Only then will we maintain the buffers needed to absorb shocks. These buffers will also ensure that the government does not have to make immediate cuts or raise taxes in the event of setbacks, thereby enabling it to pursue more stable policies. Reducing the deficit means a new government will need to make choices. Not everything can be done at the same time.

Take international trade and cooperation into account when making policy choices

In addition to fiscal discipline, European economic cooperation can also help to maintain our economy’s resilience. As a small, open economy, the Netherlands is heavily dependent on international trade in Europe and elsewhere. It is precisely trade and cooperation with our European partners that can protect the Netherlands from fragmentation in global trade.

For more information, please contact Bouke Bergsma by email at bouke.bergsma@dnb.nl or by Telephone at + 31 (0)653 258 400.

DNB Autumn Projections - December 2023

Figures Autumn Projections December 2023

Discover related articles

DNB uses cookies

We use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.