Note: Results based on calculations by DNB using non-public microdata from Statistics Netherlands.

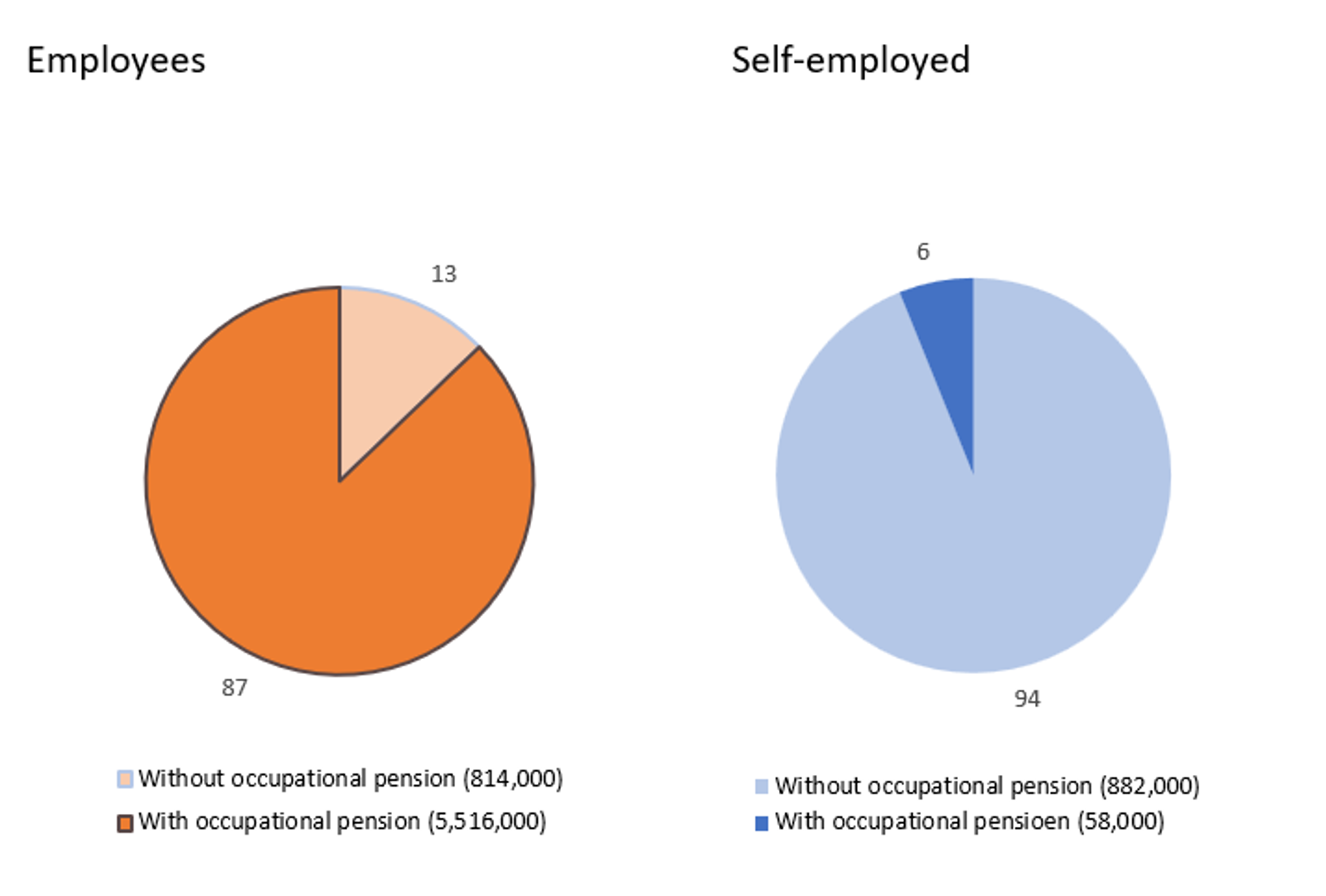

Employees who do not accrue an occupational pension are often under the age of 40, female, and have a migration background. Employees without a fixed employment contract and employees in small companies are less likely to accrue an occupational pension. These characteristics barely changed over the period 2016-2020.

Self-employed persons almost exclusively accrue an occupational pension in sectors for which a compulsory arrangement applies. In all other sectors, they hardly do so. In most sectors, only between 2% and 4% of self-employed persons build up an occupational pension. Self-employed people with a higher income are more likely to participate in these schemes.

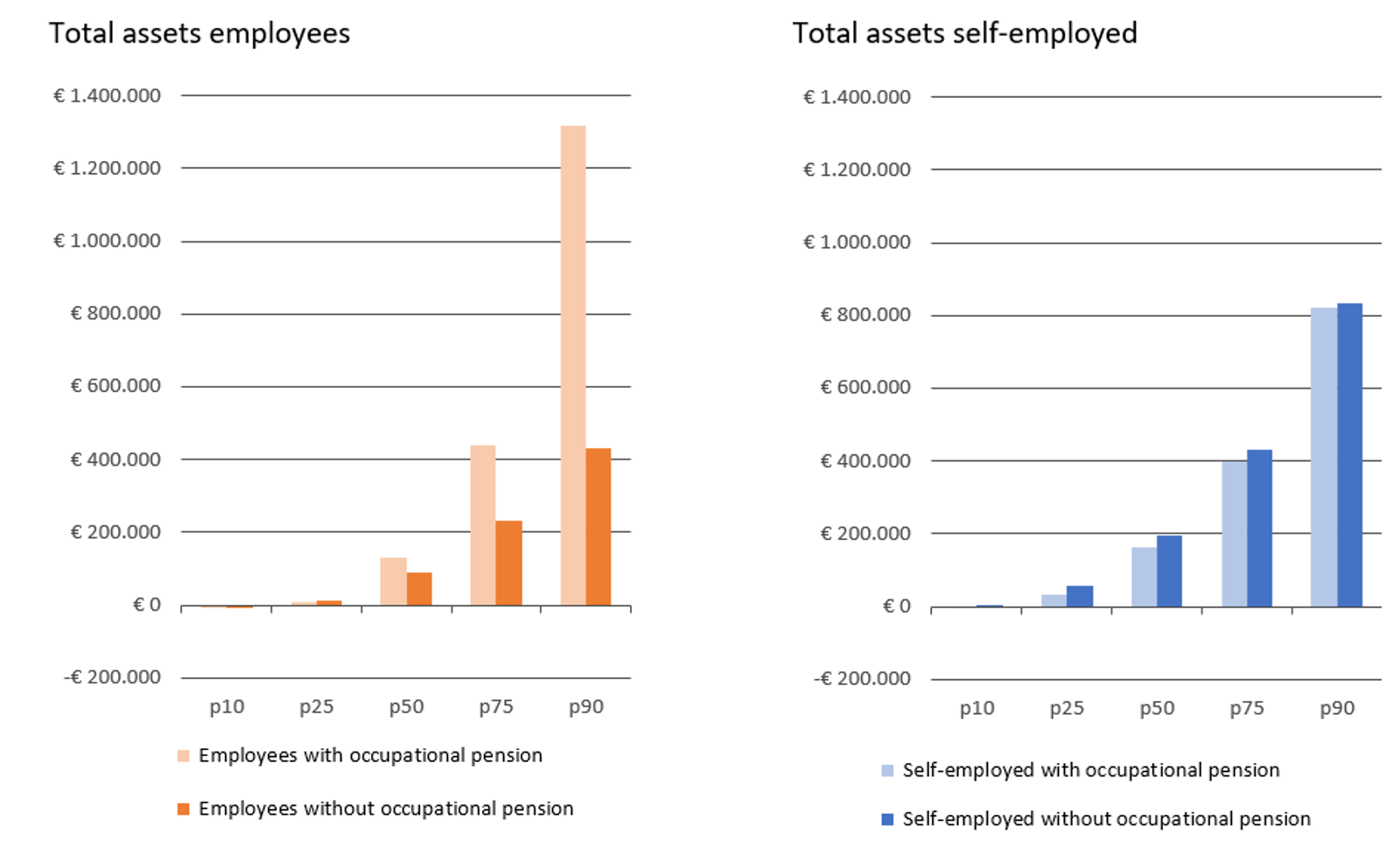

A prolonged period of non-accrual leads to inequality

Most self-employed persons who do not accrue pension entitlements in a given year do not accrue a pension in later years either. An analysis of the period 2016-2020 shows that of the self-employed persons who did not accrue a pension in the first year, 92% were still self-employed with no pension accrual five years later. The group of employees who do not accrue pension is also very consistent.

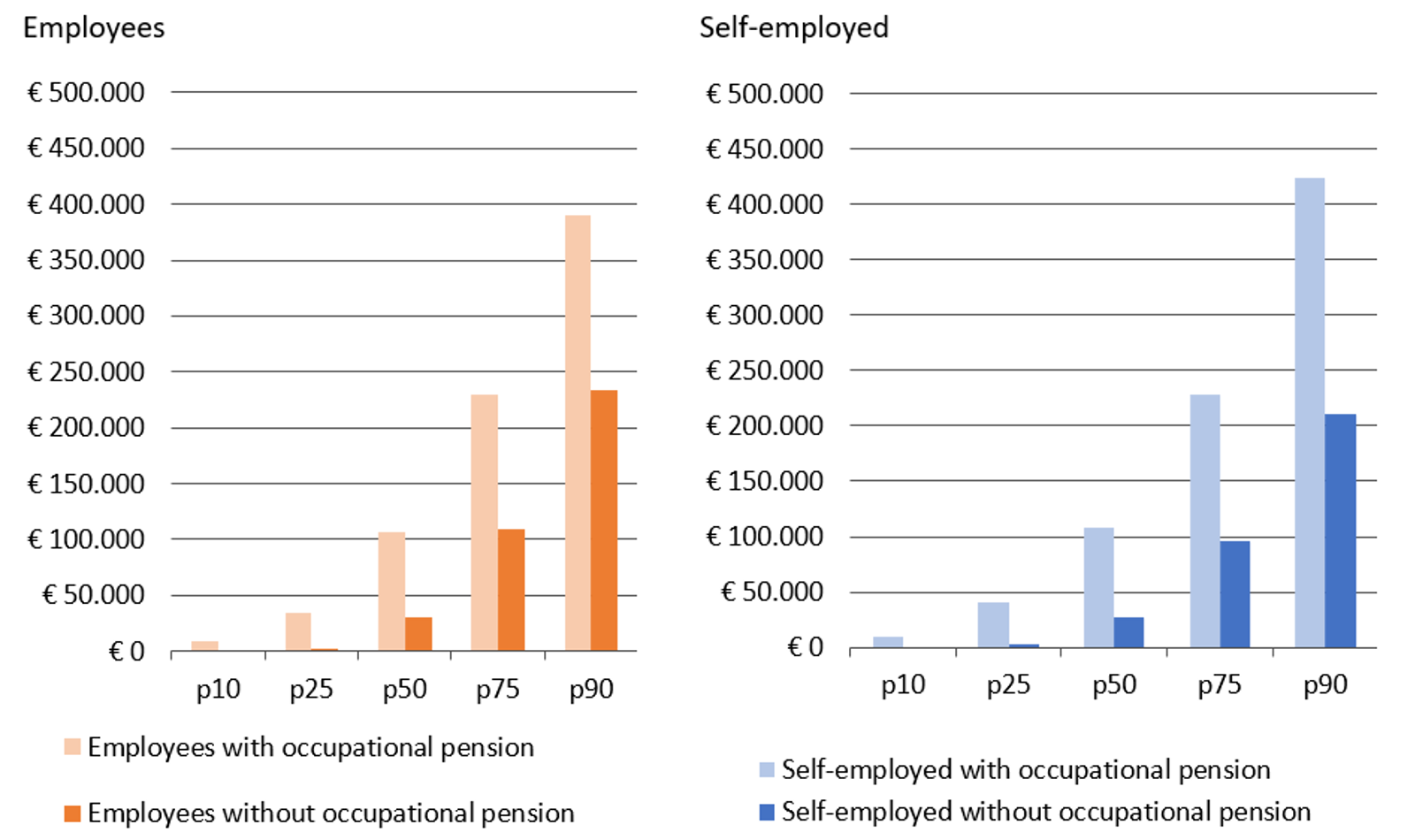

The fact that groups of workers do not compensate for lagging accrual in other years leads to a very unequal distribution of pension entitlements. Figure 2 shows that those contributing in 2020 had a significantly higher future discounted value of entitlements than the groups that did not contribute in that year. The median (50th percentile, p50 in the figure below) worker with occupational pension in 2020 had a discounted value of pension entitlements that is worth around €100,000, while the median worker without occupational pension had only accumulated a quarter of that amount.

Figure 2 - future discounted value of pension entitlements for 10th, 25th, 50th, 75th and 90th percentile, by 1) type of employment and 2) occupational pension status