The Minister of Finance previously announced that she would start discussions with stakeholders on the desirability and feasibility of an insurance guarantee scheme in the Netherlands. Similar to a deposit guarantee scheme (DGS) which partially guarantees savings, an IGS guarantees the value of insurance policies up to a certain maximum and aims to keep policies intact. It is, in effect, insurance covering an insurance policy. Unlike many neighbouring countries, the Netherlands does not have an IGS.

An IGS may be designed in a variety of ways. Important choices that must be made are which insurance policies are covered, how an IGS provides protection, what guarantee levels apply, and how the scheme is funded. These choices determine feasibility and affordability

Protecting policyholders

It stands to reason that those policies should be covered, at a minimum, under which policyholders would face financial difficulties if their insurer should fail. These are long-term insurance policies that are important to policyholders in terms of pension accrual, or whose pay-outs are essential for their livelihood, such as life insurance (including group pension insurance), income protection insurance, and funeral insurance. For non-life and health insurance, Dutch law provides other solutions that protect policyholders against large losses in case of insurer failure*.

* These are the Motor Traffic Guarantee Fund (Waarborgfonds motorverkeer) for third-party liability insurance, the settlement system operated by the National Health Care Institute (Zorgverzekeringsfonds) for non-contracted care policies, and the statutory priority status of policyholders who are already entitled to pay-out under their non-life insurance policy.

An IGS can ensure value preservation and continuity of insurance policies in three ways:

- It can provide additional funding to limit curtailment of policyholder’s rights in the event of a sale or open firm bail-in (relaunch) of the failing insurer

- It can supplement pay-outs to policyholders during the remaining terms of existing policies (run-off)

- It can compensate policyholders for their losses following liquidation of the bankrupt insurer.

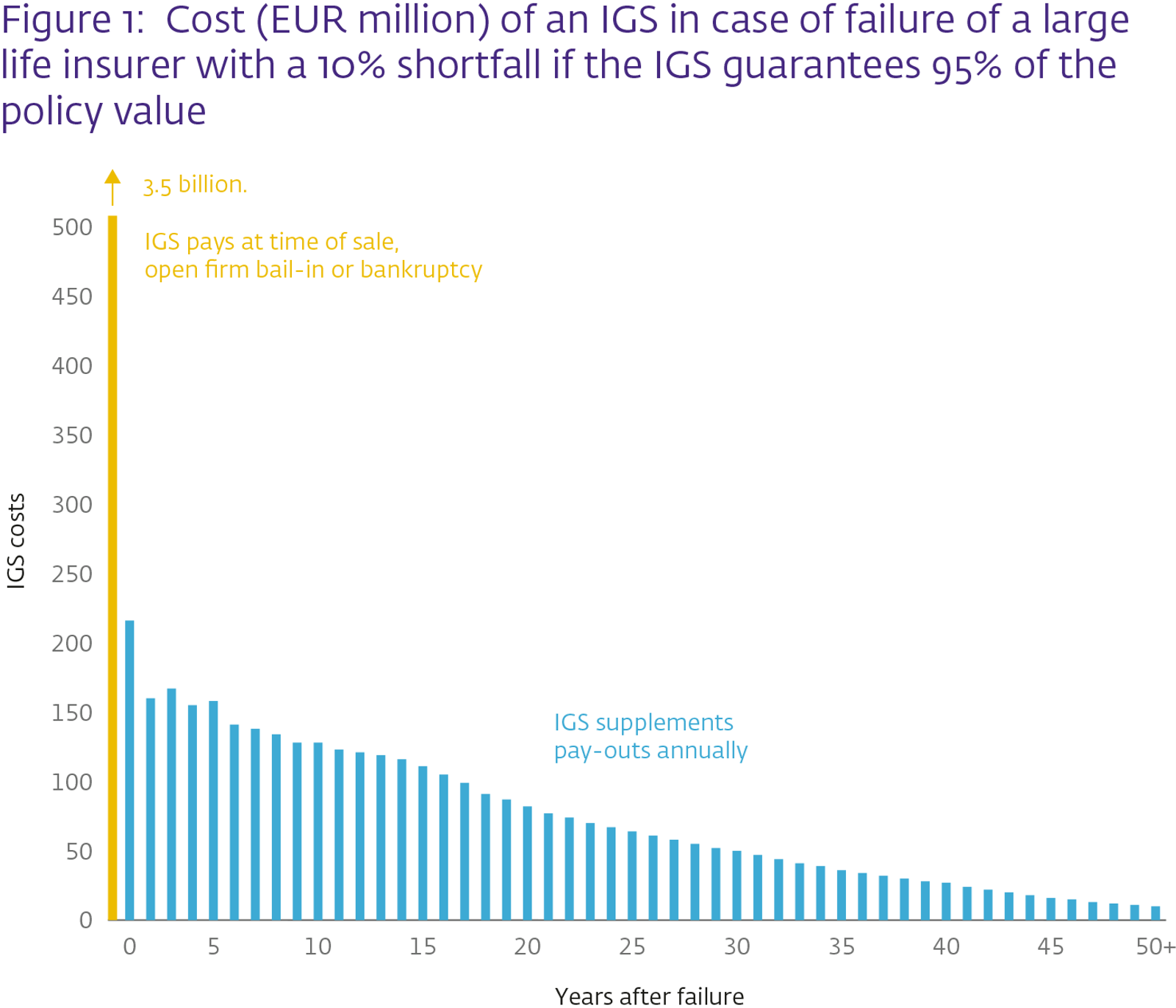

The IGS can be used flexibly and effectively if its funds are made available for these three functions. If an insurer's portfolio is difficult to sell, it can keep its portfolio of insurance policies that subsequently expire over time without selling new policies, which is known as “run-off” in insurance jargon. If the insurer has insufficient funds to make full payments under the remaining policies, the IGS can top these up. In such a case, the IGS pays out smaller amounts over the remaining terms of the expiring policies, rather than a large amount up-front, as is the case in a sale or liquidation in bankruptcy. This makes it easier to guarantee the policies of a large life insurer facing a considerable shortfall, as costs can be spread over longer periods, sometimes even spanning decades (see Figure 1).