The higher the amount, the more likely we still insert our debit card

The proportion of POS payments for which a debit card was inserted fell by one-fifth, from 10% to 8%. Debit card insertions depend partly on the transaction amount involved. In 2023, for example, for amounts lower than €5, a debit card was inserted into the POS terminal in only 4% of purchases. For amounts between €20 and €50, this was more than twice as high (9%), and for amounts above €50 it was even four times as high (18%). One possible explanation for the relatively high share of debit cards insertions for amounts above €50 is that not so long ago, inserting a card was mandatory for amounts above €50, which is why some people continue to do so habitually.

Especially at petrol stations, payments were often made this way: more than 1 in 4 payments (26%) were made by inserting a debit card. There are two possible explanations for this: payments for fuel are often more than €50, and many unstaffed stations introduced contactless payment not so long ago, so we are not yet used to paying contactless at these locations.

We use cash more often for small amounts

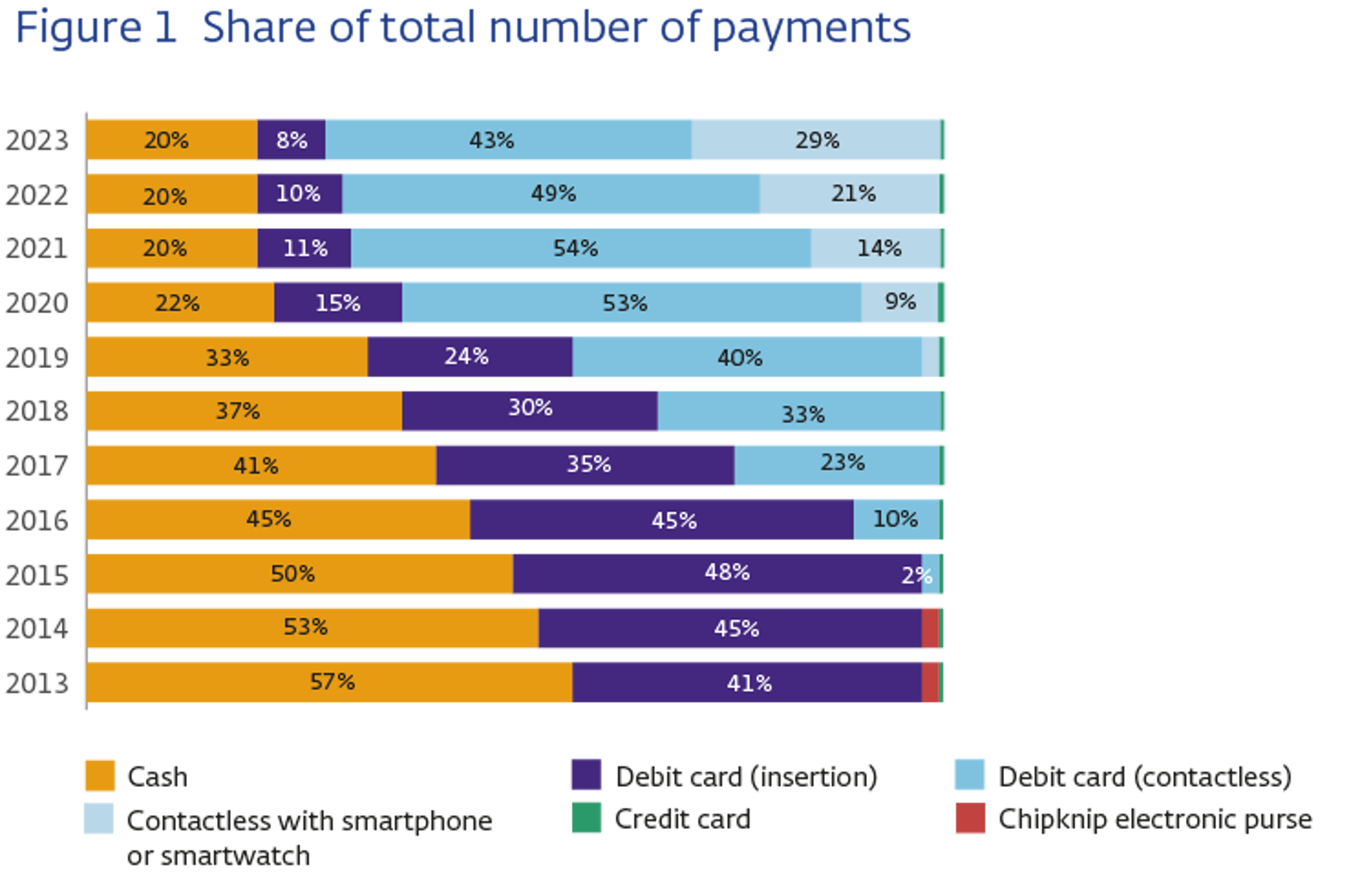

A quarter of the POS payments below €5 were paid with cash (25%). For purchases between €50 and €100, it was almost half this number (13%). We paid 16% of the amounts above €100 with cash, slightly up from 2022. The use of cash has remained stable: for three years now, 2 out of 10 POS purchases have been paid with cash.