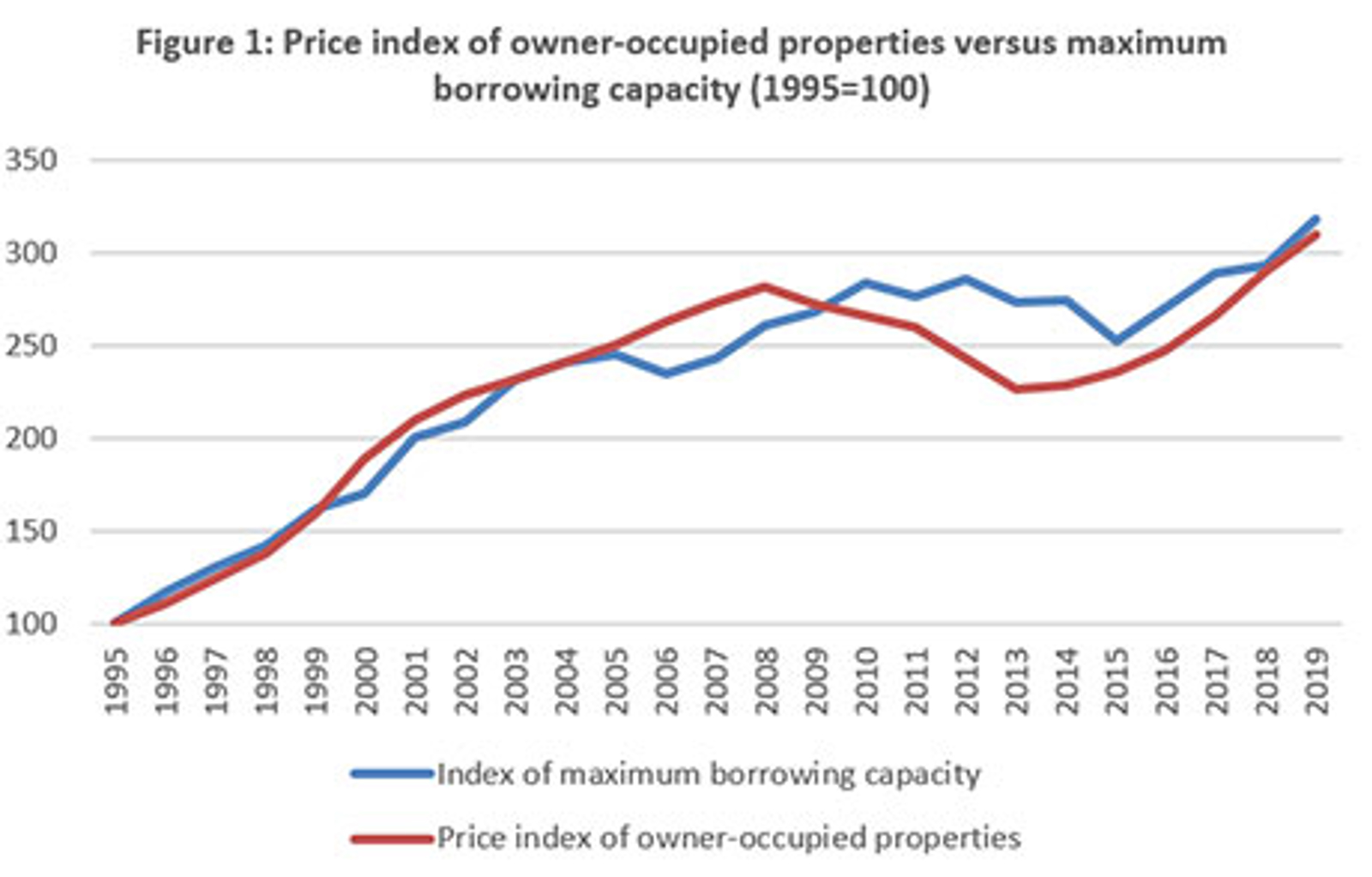

Source: Statistics Netherlands, Nibud, DNB and own calculations. Note: The maximum loan amount is calculated on the basis of Nibud's tables of the financing cost percentages from 1995 to 2019. The maximum mortgage loan amount is then calculated for each year based on average household income in that year and the average interest rate for mortgage loans taken out in that year.

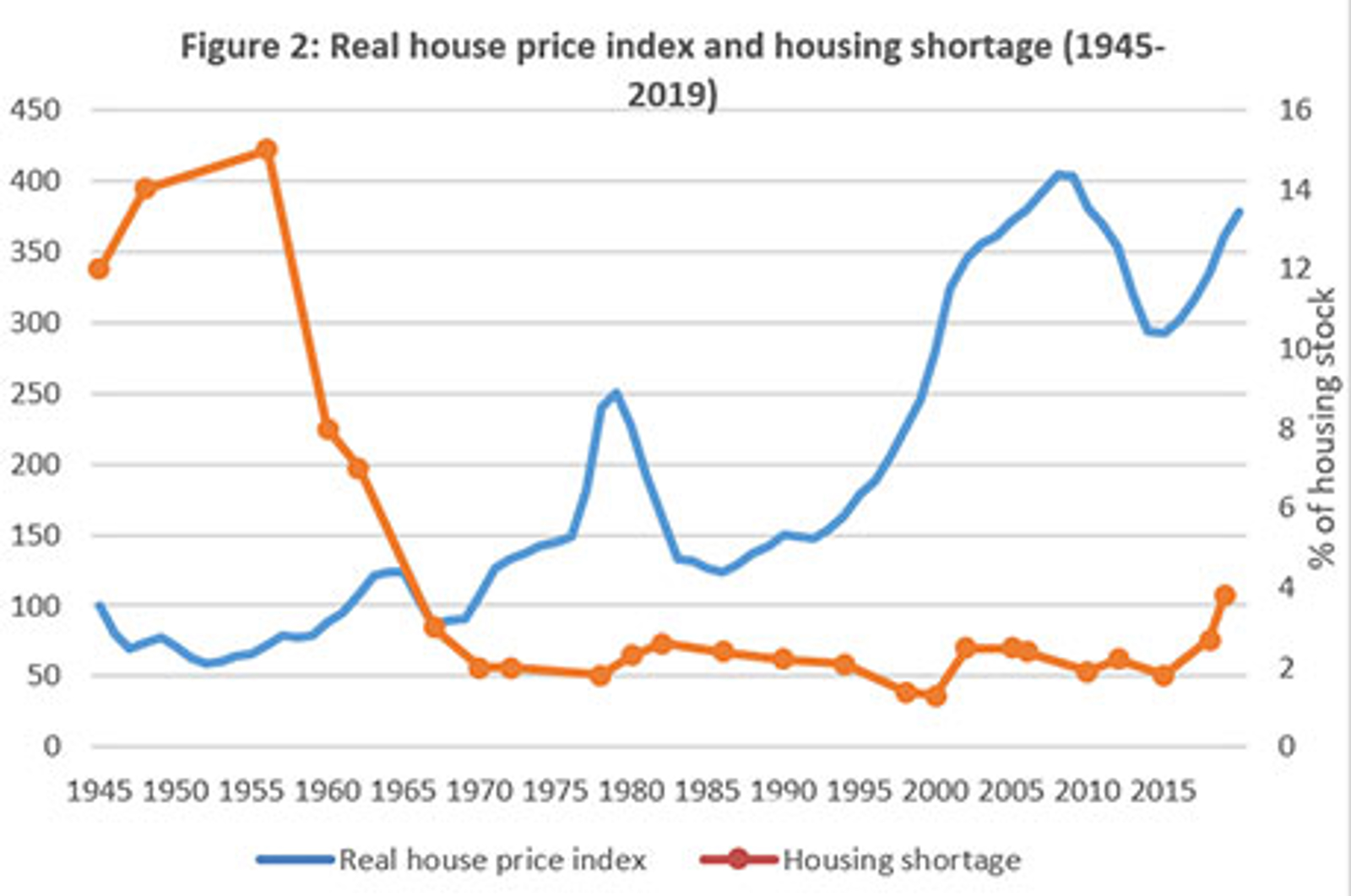

House prices are only related to housing shortages to a limited extent

While price increases in recent years coincide with increasing physical housing shortages, historically no close relation can be observed between house prices and housing shortages. Figure 2 shows the housing shortage since 1945, as a percentage of the total housing stock, and the price level of owner-occupied properties, after inflation adjustment. What immediately strikes the eye is that housing shortages existed throughout this period. Definitions of a housing shortage have changed over time, however. Until recently, they were based mainly on housing preferences of households as inferred from surveys. Currently, the main element in the definition is the discrepancy between the number of households and the number of homes. At present, the shortage amounts to 331,000 homes, or 4.2% of the housing stock. Although the contribution of this housing shortage to high price levels is difficult to measure, empirical estimates (for both countries with housing shortages and countries with surpluses) suggest a relatively small contribution. A 1 percentage point reduction in the current housing shortage – meaning a housing stock increase exceeding the growth in the number of households by 80,000 – could result in a price drop of 1-2%. It should be noted that reducing the housing shortage is not easy in practice, which further limits the options for relieving price increases in this way.