Turnaround in the economy

According to the DNB business cycle indicator, the low point of the economic cycle has been reached, after which economic growth will pick up gradually and at a moderate pace this year.

Read more Turnaround in the economyYou are using an outdated browser. DNB.nl works best with:

Published: 22 November 2021

© DNB

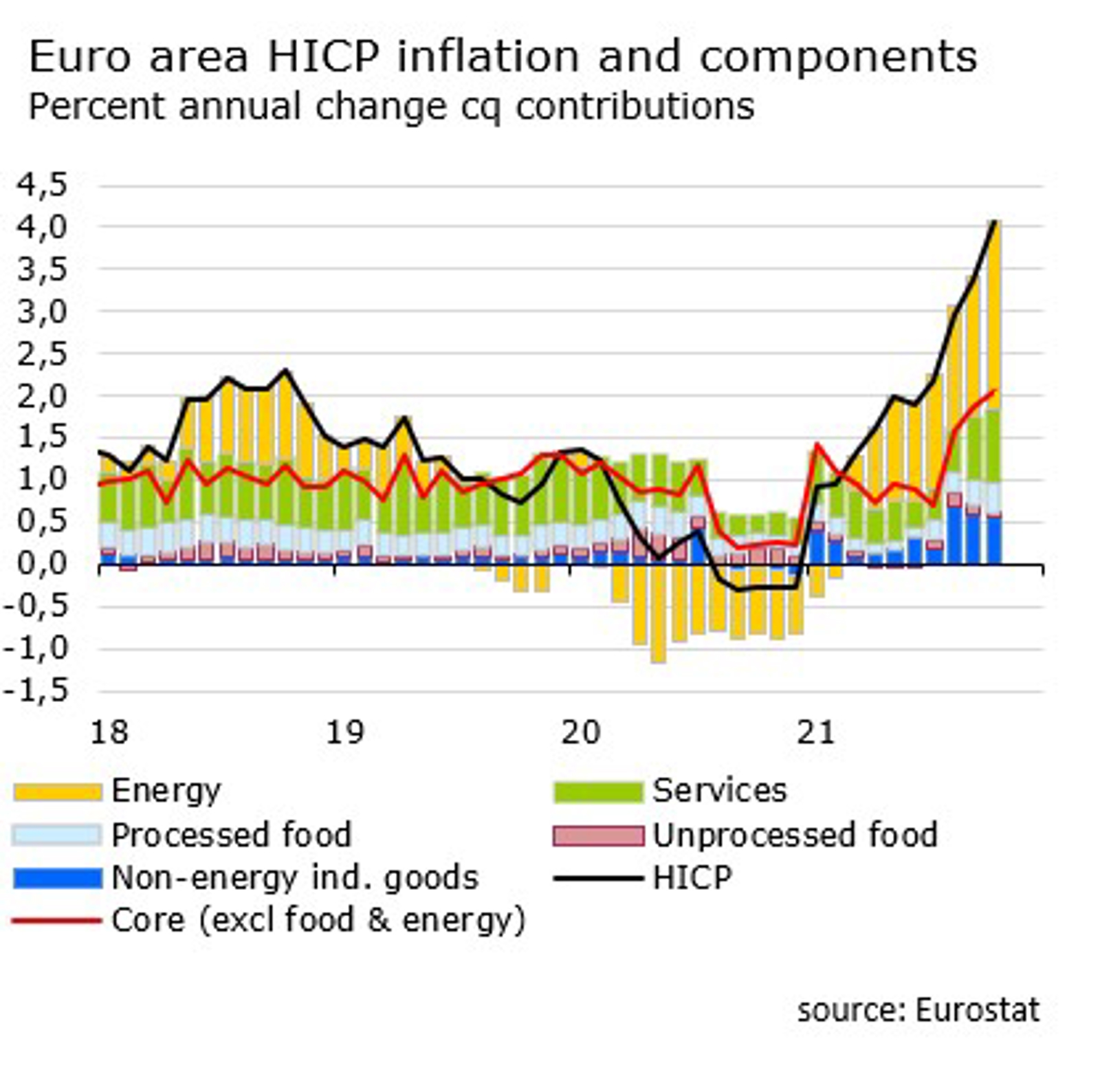

After being subdued for a number of years, euro area inflation has recently increased markedly. This raises two main questions. What are the drivers of this development? To what extent is this increase transitory and what are the risks that inflation may be higher in the future? In a DNB Analysis the factors that have influenced inflation during the pandemic are explained. Whereas the currently high inflation rate is expected to be transitory, the upward risks to inflation have clearly increased. All in all, as the pandemic is not over yet, any evaluation of future inflation is, however, highly uncertain.

In the years before the outbreak of the Covid pandemic, inflation was low and below the ECB’s inflation target of 2%. On average, consumer price inflation since 2011 has been 1.3%, and core inflation 1.1% (that is inflation excluding volatile components such as energy and food). For the ECB’s monetary policy, this has been particularly challenging because policy rates have been at their effective lower bound. The Covid crisis has affected inflation significantly. In the first phase, lockdown measures imposed by governments to contain the pandemic pushed down inflation. In the second phase, starting in the fourth quarter of 2020, the euro area has experienced a strong recovery and a marked increase in inflation.

In recent months, euro area inflation has risen sharply, driven by a combination of factors (see Figure). Some of them are transitory factors, like changes in the German VAT and statistical “base effects” of the pandemic-induced low prices one year ago, and will fade away over the coming months. Other factors – such as consumers releasing their pent-up demand, supply chain bottlenecks, and rising prices for energy and other commodities – are transitory in nature but now appear to persist longer than initially thought. Looking ahead, the outlook for inflation is highly uncertain. The longer the current high inflation persists, the higher the risk that it becomes embedded in the inflation expectations and the behavior of households and firms, thereby generating “second-round effects”.

Some of to the higher inflation is welcome. In general, a modest level of inflation serves to “grease the wheels” of labour and product markets. Inflation has long been below the ECB’s target of 2%. The currently higher short-term inflation could give a boost to longer-term inflation expectations, and help anchoring them around the ECB’s target. This would allow the ECB to phase out some monetary policy measures.

However, temporarily higher inflation could lift inflation expectations. Price increases in particular sectors and in producer prices could then be passed through to increases in core inflation, and a wage-price spiral could be set off. The fact that high inflation is combined with tight labour markets in some parts of the euro area, like Germany and the Netherlands, is strengthening these concerns. To date, signs of these second-round effects are not visible in the euro area. Wage growth has been relatively modest and most measures of inflation expectations indicate that current high inflation is largely transitory. This said, second-round effects are particularly hard to predict in the current environment characterized by a truly unique shock, in terms of both its nature and magnitude, and high uncertainty. It is therefore important to monitor the evolution of inflation and the dynamics of inflation expectations carefully, to avoid an undue overshooting of inflation.

More information

According to the DNB business cycle indicator, the low point of the economic cycle has been reached, after which economic growth will pick up gradually and at a moderate pace this year.

Read more Turnaround in the economy

In the fourth quarter of 2023, foreign multinationals transferred over €300 billion in conduit activities from the Netherlands abroad. These relocations indicate adjustments in business structures, and may be due to the introduction this year of a minimum tax for these international companies.

Read more Conduit activities in the Netherlands declined in fourth quarter of 2023

The Dutch economy is strong and resilient, but not everyone in the Netherlands experiences it that way. Many people are struggling financially or have concerns about their future. The Netherlands should therefore strive for a highly developed and finely tuned economy that works better for everyone.

Read more Towards an economy that works better for everyone

“We see that while the Dutch economy is doing quite well, it is not working well enough for some groups in society.” Klaas Knot said this at the presentation of DNB’s 2023 Annual Report.

Read more Introductory remarks upon the presentation of the 2023 annual reportWe use cookies to optimise the user-friendliness of our website.

Read more about the cookies we use and the data they collect in our cookie notice.