So, whereas in the aftermath of the previous crisis the emphasis was very much on the banks, we now have some catching up to do when it comes to reducing systemic risk in non-bank financial markets.

So, we know what ails the patient. Now it is time to make a treatment plan to strengthen resilience.

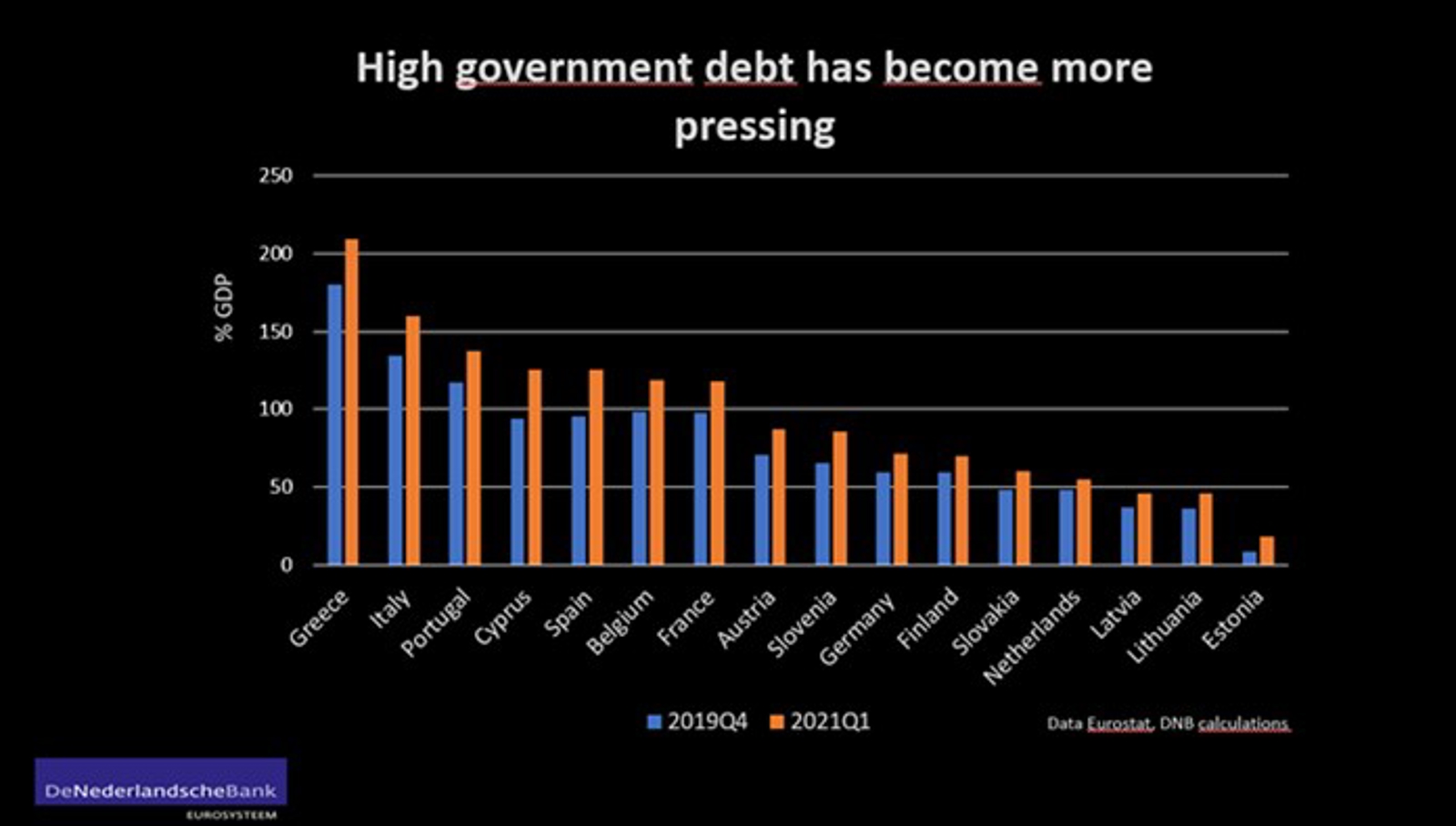

First we treat rising debt and diverging growth in the euro area. I take these two vulnerabilities together because I believe the answer to both problems is the same: to strengthen the structural growth capacity of the euro economies. Higher potential economic growth ultimately generates the capacity to repay debt and it helps to reduce the productivity gap between member states. In other words: the patient needs to become more active.

The question then is: how to strengthen structural economic growth? Here we need two things: economic reform and public investment.

When it comes to economic reform, the key thing here is that all member states must play their part. Weaker economies need to implement reforms that increase their productivity and competitiveness. This is good for exports, for economic growth, for employment, and for public debt. These reforms are more likely to succeed if the stronger economies also do their fair share. For these stronger economies, that means implementing reforms that give households more room to spend, so that they can boost imports and reduce their trade surpluses. This will not only help the weaker economies, but also benefit the stronger ones.

Now when it comes to public investment, not all countries in Europe have the same fiscal space to invest in their economies. Next Generation EU is therefore very important. By relieving national budgets, it enables countries to modernize their economies on a much larger scale than would otherwise have been possible. That includes digitalization and becoming carbon-neutral. It can act as a catalyst for economic reform and private investment. If we succeed in making Next Generation EU work, all countries in the European Union stand to gain.

By reforming and investing we can hopefully stop a further divergence of the European economies and start the process of re-finding our balance.

To support balanced economic growth, we will also have to take a closer look at the Stability and Growth Pact. Policymakers in Europe responded to the Covid crisis by activating the general escape clause. By temporarily lifting all restrictions, governments gained fiscal policy flexibility to do what was needed to support firms and households. That was a wise decision. And we may very well need the general escape clause in the face of another extreme event in the future. But a suspension of all fiscal rules should not be our only tool to achieve a balanced policy mix to deal with economic shocks. To me it showed that the Stability and Growth Pact needs more built-in room for countercyclical fiscal policy. To ensure the rules do not cut short much needed public investment, worsen economic downturns and increase economic divergence between member states. This is even more important in the current low interest rate environment, where, in the vicinity of the effective lower bound, central banks have limited room for maneuver.

Countercyclical fiscal policy is a two-way street: fiscal expansion to support the economy in bad times is only possible if we build buffers in good times. A more countercyclical fiscal framework should therefore have robust and credible rules that ensure national governments keep their debt levels in check. And not only should member states build up buffers in good times. They should also increase potential economic growth that ultimately bolsters debt repayment capacity. So, as we allow for more fiscal flexibility, limiting the level of debt will have to play a bigger role as an anchor for fiscal prudence.

All in all, the Stability and Growth Pact has served an important purpose over the past 20 years and it continues to do so. Therefore we need to review it in the light of the changed economic circumstances.

Time for the shrink, time to balance the mind, time to strengthen the financial system.

At European level, to strengthen the financial system we need to move forward with completing the Banking Union. We need to make significant steps in building the Capital Markets Union. And we should resume the European implementation of the Basel III reforms.

On a global scale, vulnerabilities in parts of the NBFI sector need to be addressed with priority, keeping momentum and ambition in the work underway. Financial institutions, both banks and non-banks, need buffers to absorb losses and liquidity shocks. Regulation needs flexibility in order to allow institutions to use these buffers. And the system needs safety valves, like margining, to prevent too much risk pressure being built up. It is important to advance the comprehensive work program the FSB has developed to enhance the resilience of the NBFI sector while preserving its benefits.

Once, when I was running a marathon I saw another runner with this text on his T-shirt: "Anyone can run a hundred meters, it's the next forty-two thousand and two hundred that count." During the covid-pandemic we ran over hundred meters, but there is still a long way to go. The biggest mistake we can now make is to think the job is done. There are just too many structural threats to the European economy and financial system we need to address. The most important work is not behind us. It’s just ahead of us. So I would say: let’s get to the finish!